Pound Sterling Price News and Forecast: GBP/USD could clear 1.2700 on weak US data

GBP/USD Forecast: Pound Sterling could clear 1.2700 on weak US data

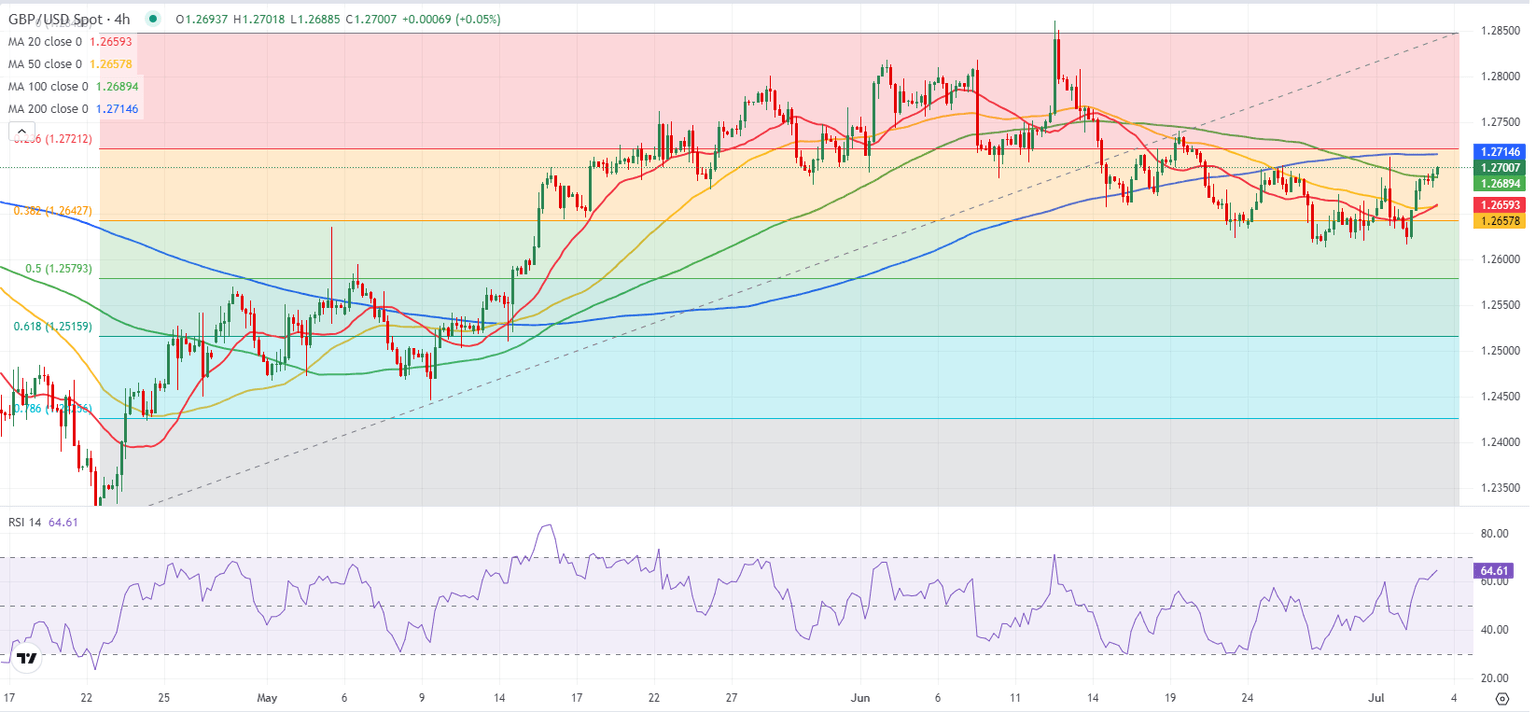

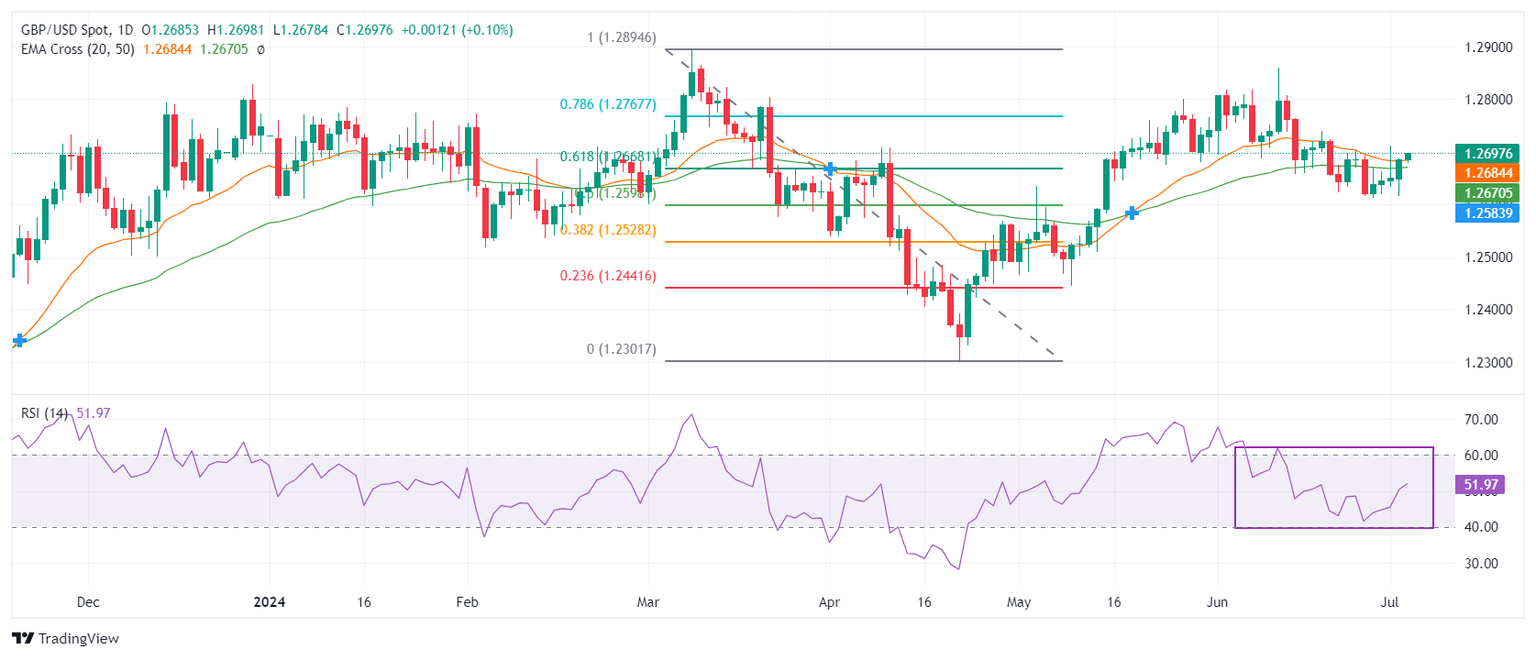

GBP/USD continues to edge higher and trades in positive territory near 1.2700 after posting gains on Tuesday. The pair's technical outlook points to a bullish tilt in the near term as investors await key macroeconomic data releases from the US.

The US Dollar (USD) came under modest selling pressure as the market mood improved during the American trading hours on Federal Reserve Chairman Jerome Powell's comments on the policy outlook on Tuesday. Read more...

Pound Sterling rises to near 1.2700 with focus on US data, UK elections outcome

The Pound Sterling (GBP) extends its upside to near the round-level resistance of 1.2700 in Wednesday’s London session after a sharp recovery from the three-day low of 1.2615 on Tuesday. The GBP/USD pair exhibits strength as the near-term outlook of the US Dollar (USD) has become uncertain after the speech from Federal Reserve (Fed) Chair Jerome Powell at the European Central Bank (ECB) Forum on Central banking on Tuesday prompted optimism on rate cuts.

Powell said recent data suggests that the disinflation process has resumed, though we need more good inflation data before reducing interest rates. Powell added that risks to inflation are more balanced. He also said that an unexpected weakness in the labor market could force them to react on interest rates. Read more...

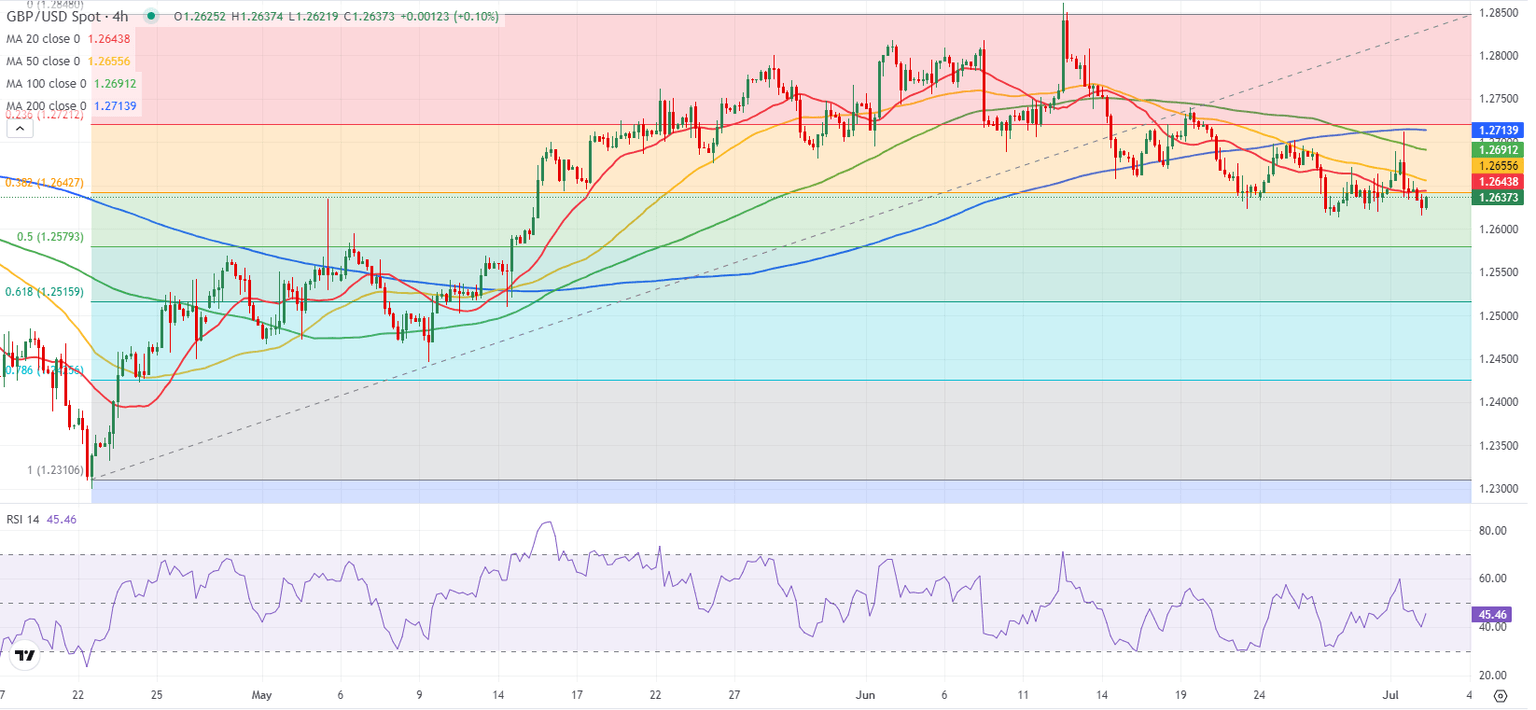

GBP/USD Forecast: Pound Sterling retreats below key technical level ahead of Powell

GBP/USD spike above 1.2700 and touched its highest level since June 20 in the American session on Monday. The pair lost its traction later in the day and closed virtually unchanged at 1.2650. The pair stays on the back foot on Tuesday and trades below the key technical level at 1.2640.

The negative shift seen in risk sentiment helps the US Dollar (USD) find demand on Tuesday and doesn't allow GBP/USD to stage a rebound. Reflecting the souring mood, US stock index futures are down between 0.3% and 0.5%. Read more...

Author

FXStreet Team

FXStreet