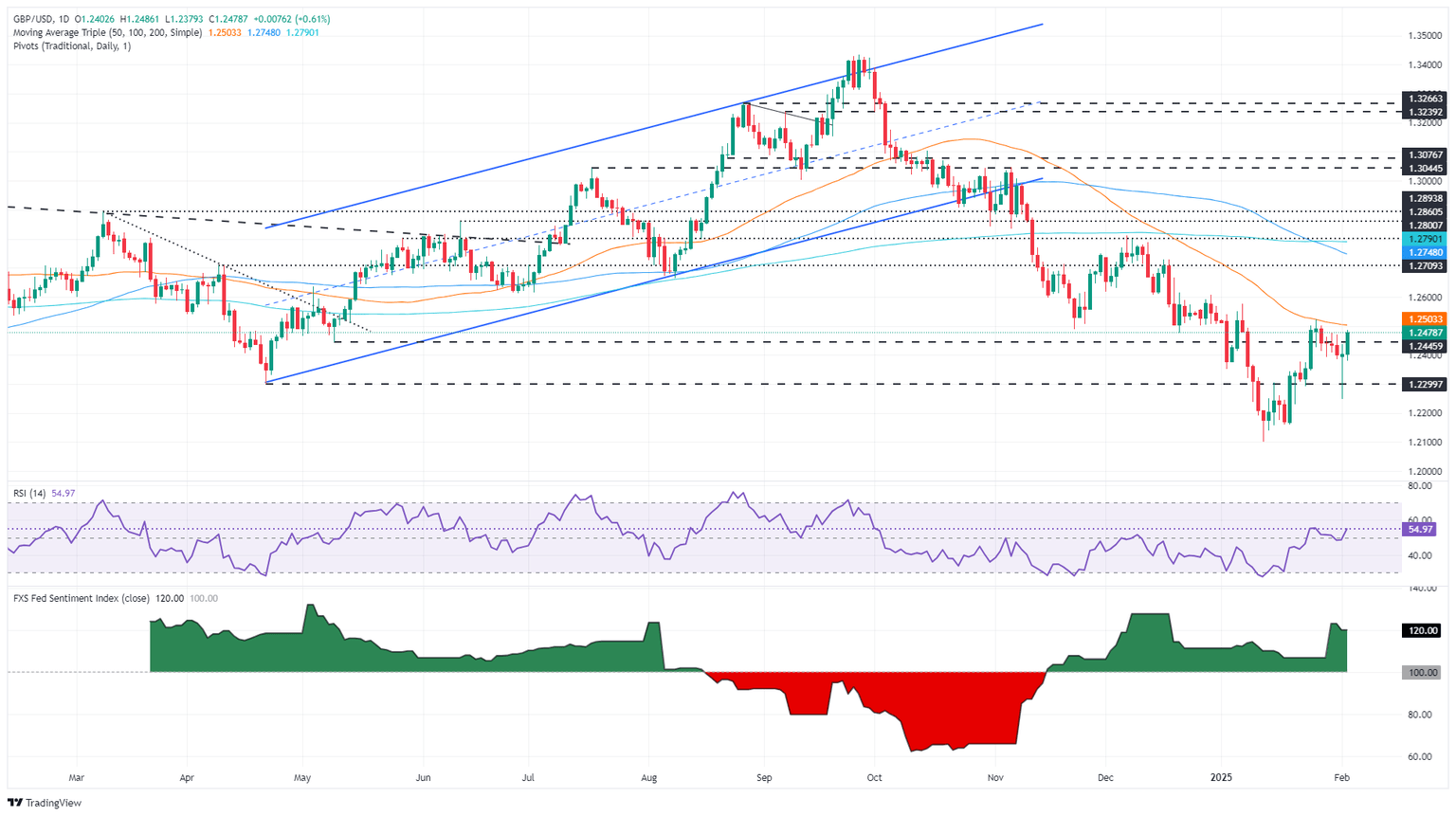

Pound Sterling Price News and Forecast: GBP/USD climbs above 1.2450 amid soft USD

GBP/USD Price Analysis: Climbs above 1.2450 amid soft USD

The Pound Sterling (GBP) post gains versus the US Dollar (USD) for the second straight day after US President Donald Trump tariff threats on Mexico and Canada were delayed, due to negotiations beginning between the parties, aimed to improve fighting against fentanyl traffic and illegal migration. The GBP/USD trades at 1.2476 up 0.62%. Read More...

Pound Sterling recovers against USD as Trump suspends tariffs on North American peers

The Pound Sterling (GBP) rebounds from its intraday low of 1.2380 against the US Dollar (USD) in Tuesday’s European session, but is still 0.2% down to near 1.2430. The GBP/USD pair bounces back as the US Dollar struggles for a firm footing, following United States (US) President Donald Trump’s decision to pause the 25% tariff imposition on Canada and Mexico for 30 days. Read More...

GBP/USD remains above 1.2400, eyes on tariff implementation on China

GBP/USD continues to gain ground for the second successive session, trading around 1.2430 during the Asian hours on Tuesday. The pair improved amid improved risk-on sentiment after US President Donald Trump announced late Monday that he would pause tariffs on Mexico and Canada. Read More...

Author

FXStreet Team

FXStreet