GBP/USD Forecast: BOE may compound the Fed and trigger greater downfall

The Brexit bonanza has proved short-lived – Pound bulls prematurely celebrated Prime Minister Boris Johnson's climbdown before the Federal Reserve sent the safe-haven dollar higher. Now it is the Bank of England's turn to move cable – and potentially tilt it lower.

PM Johnson agreed to compromise with the "rebels" in his Conservative Party by agreeing to more robust parliament oversight over the Internal Markets bill. This legislation – which is set to receive the House of Commons' approval next week – knowingly violated the Brexit accord with the EU. Read More...

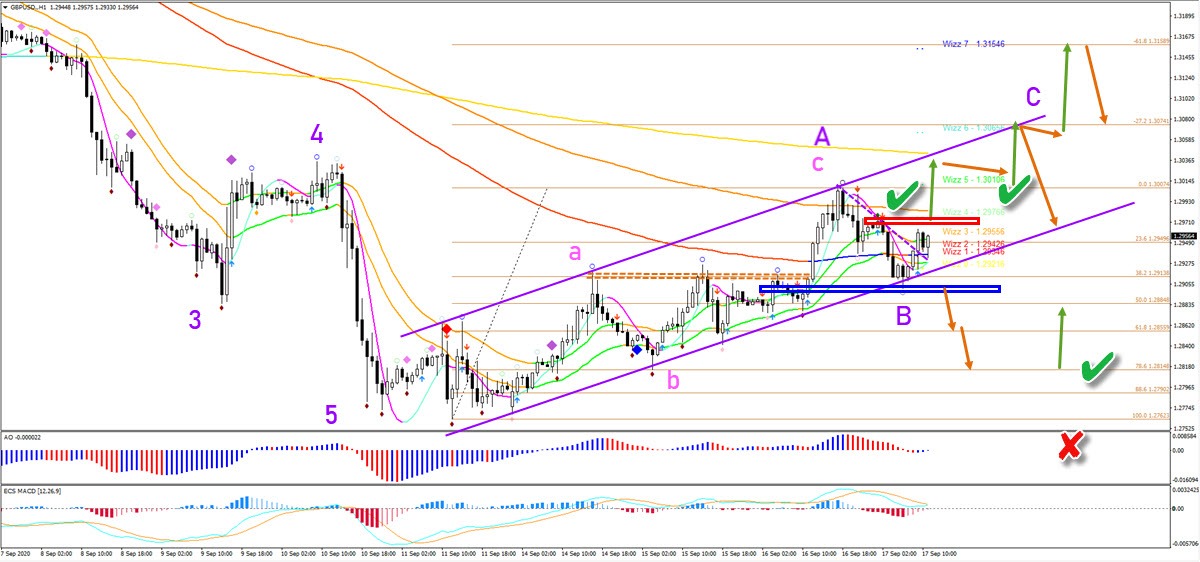

GBP/USD bulls regain control and aim at 1.3040 and 1.3150

The GBP/USD is building a well balanced uptrend channel. The bulls took over control when price broke through the resistance zone (dotted orange) and 144 ema. But can they push price action up higher?

The GBP/USD have the upper hand at the moment. And they are expected to keep it. A break above the resistance Fractal (red box) confirms the uptrend continuation. The main target is the long-term moving average and 38.2% Fibonacci retracement level of the 4 hour chart at 1.3040. Read More...

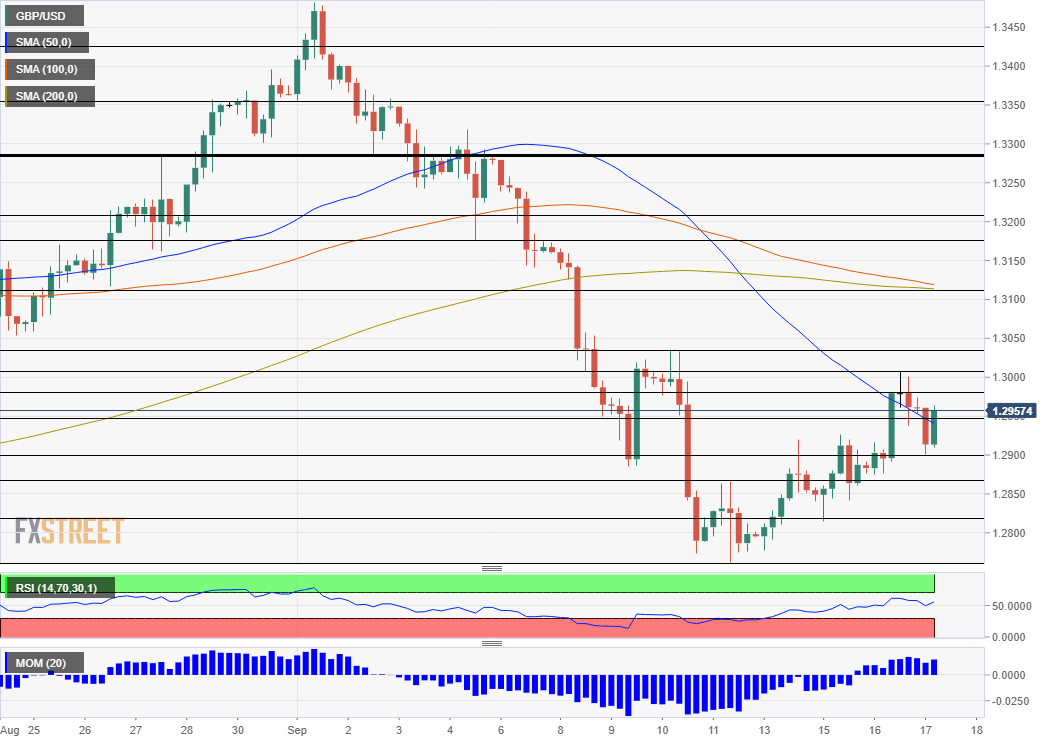

GBP/USD refreshes session tops, still below 1.3000 mark as focus remains on BoE

The GBP/USD pair managed to recover the early lost ground and was last seen trading near the top end of its daily trading range, around the 1.2970-75 region.

The pair witnessed some selling through the first half of the trading action on Thursday and extended the previous day's retracement slide from the key 1.3000 psychological mark, or weekly tops. The US dollar added to the post-FOMC recovery move and got an additional boost from weaker global risk sentiment. This, in turn, was seen as a key factor exerting pressure on the GBP/USD pair. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD flirts with 1.0500 on mixed US PMI readings

The bullish momentum remains unchanged around EUR/USD on Friday as the pair keeps its trade close to the area of multi-week highs around the 1.0500 barrier in the wake of the release of mixed results from the preliminary US Manufacturing and Services PMIs for the current month.

GBP/USD challenges recent peaks near 1.2450

GBP/USD pushes harder and puts the area of recent two-week highs near 1.2450 to the test on the back of the intense sell-off in the Greenback, while the British pound also derives extra strength from earluer auspicious prints from advanced UK Manufacturing and Services PMIs.

Gold keeps the bid bias near its all-time high

Gold prices maintain the bid tone near their record top at the end of the week, helped by the intense weakness around the US Dollar, alleviating concerns surrounding Trump's tariff narrarive, and a somewhat more flexible stance towards China.

Dogelon Mars pumps more than 85%, whales dump 128 billion coins and realize a profit

Dogelon Mars (ELON) price continues its rally on Friday after rallying more than 18% this week. On-chain data shows that ELON whale wallets realized profits during the recent surge. The technical outlook suggests a rally continuation of the dog-theme meme coin, targeting double-digit gains ahead.

ECB and US Fed not yet at finish line

Capital market participants are expecting a series of interest rate cuts this year in both the Eurozone and the US, with two interest rate cuts of 25 basis points each by the US Federal Reserve and four by the European Central Bank (ECB).

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.