GBP/USD Forecast: Ready for the next leg up? It depends on Brexit hopes overcoming Cummings' scandal

Flying further up with free-roaming fish? While Brits are closely following the latest developments around Dominic Cummings – the special adviser at Downing Street who violated the lockdown – an EU concession around fisheries helped propel the pound higher.

Brussels is reportedly ready to relent on its "maximalist approach" on fishing rights. While the industry is minuscule, it carries substantial political weight. The EU's step may help make progress in talks about future relations, once the transition period ends. Read More...

GBP/USD Forecast: Bulls paused near 50% Fibo. amid escalating US-China tensions

The GBP/USD pair caught some aggressive bids and shot to two-week tops on Tuesday. The positive news of a potential COVID-19 vaccine and hopes for a V-shaped recovery for the global economy provided a strong lift to the global risk sentiment. The upbeat market mood was evident from a strong rally in the global equity markets and weighed heavily on the US dollar's perceived safe-haven status.

On the other hand, the British pound got a strong boost from reports that the EU is willing to drop its ‘maximalist’ approach on fisheries in the next round of Brexit negotiations with the UK, starting next week. This marked the first major concession from the bloc, which helped ease concerns about a deadlock in Brexit talks and prompted some short-covering move around the GBP pairs. Read More...

GBP/USD Price Analysis: Finds some support near 38.2% Fibo./descending channel confluence region

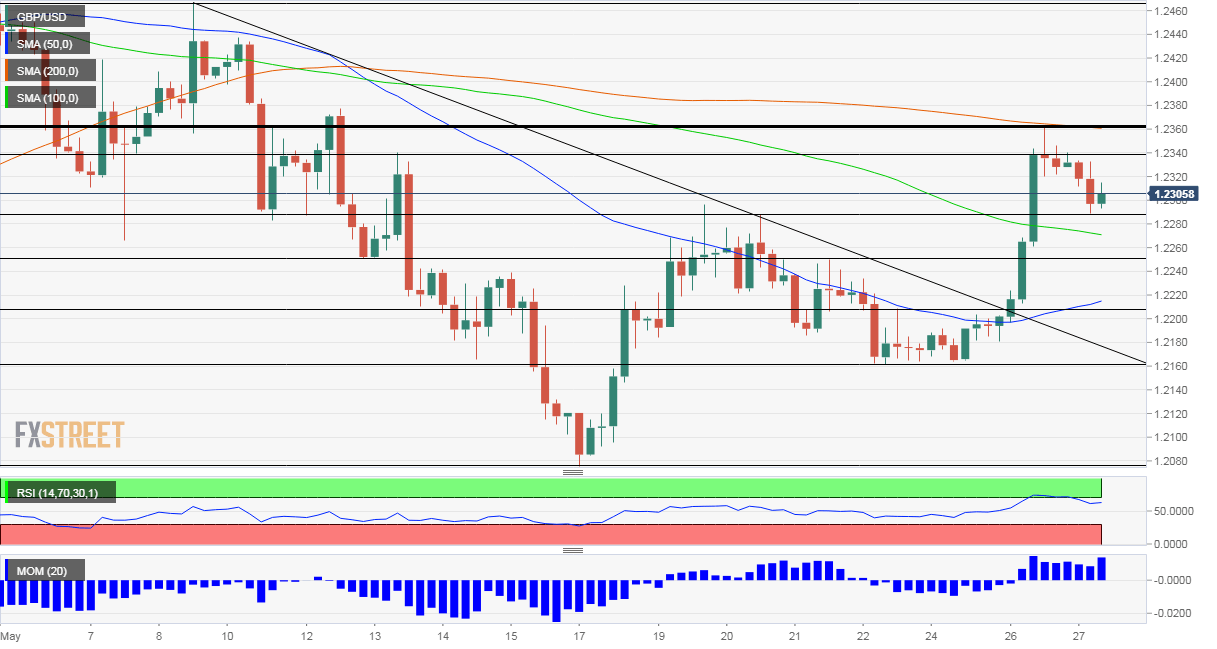

The GBP/USD pair stalled its overnight strong bullish momentum near the 50% Fibonacci level of the 1.2644-1.2076 recent downfall and witnessed a modest pullback on Wednesday. The retracement slide dragged the pair further below the 1.2300 round-figure mark during the early European session, with bears now flirting with 38.2% Fibo. level support.

The mentioned level coincides with the lower end a downward sloping channel on intraday charts. Given the overnight strong upsurge, the channel seemed to constitute towards the formation of a bullish flag chart pattern. The technical set-up supports prospects for the emergence of some dip-buying, warranting some caution for aggressive bearish traders. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers above 1.1000 ahead of ECB policy announcements

EUR/USD is gyrating in a tight range above 1.1000 in Asian trading on Thursday. Traders assess the latest US CPI inflation data, bracing for the ECB policy announcements amid a positive risk sentiment and sustained US Dollar strength.

GBP/USD recovers to 1.3050, US data in focus

GBP/USD is recovering from three-week lows to trade near 1.3050 in the European morning on Thursday. The pair is underpinned by persisting risk flows and a pause in the US CPI-led Dollar rebound. The focus now shifts to the US PPI inflation data.

Gold sellers keep lurking at $2,530, range breakout likely?

Gold price is making a minor recovery attempt early Thursday, as buyers stay hopeful above $2,500. With the US Consumer Price Index data out of the way, the focus now turns toward the US Producers Price Index and Jobless Claims data for fresh trading incentives.

Uniswap price is poised for a rally if it breaks above the ascending triangle pattern

Uniswap price trades inside an ascending triangle pattern; a breakout signals a rally ahead. This bullish move is further supported by UNI’s on-chain data, which shows a negative Exchange Flow Balance and decreasing exchange supply, hinting at a rally ahead.

ECB preview: Another rate cut without new forward guidance

With the latest inflation data out of the eurozone, a rate cut at next week’s European Central Bank meeting has almost become a done deal.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.

-637261574465675086-637261697605720993.png)

-637261641631097124-637261698624379573.png)