Pound Sterling Price News and Forecast: GBP/USD bullish sequence suggests pullback to find support [Video]

![Pound Sterling Price News and Forecast: GBP/USD bullish sequence suggests pullback to find support [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/new-style-twenty-pound-notes-3079195_XtraLarge.jpg)

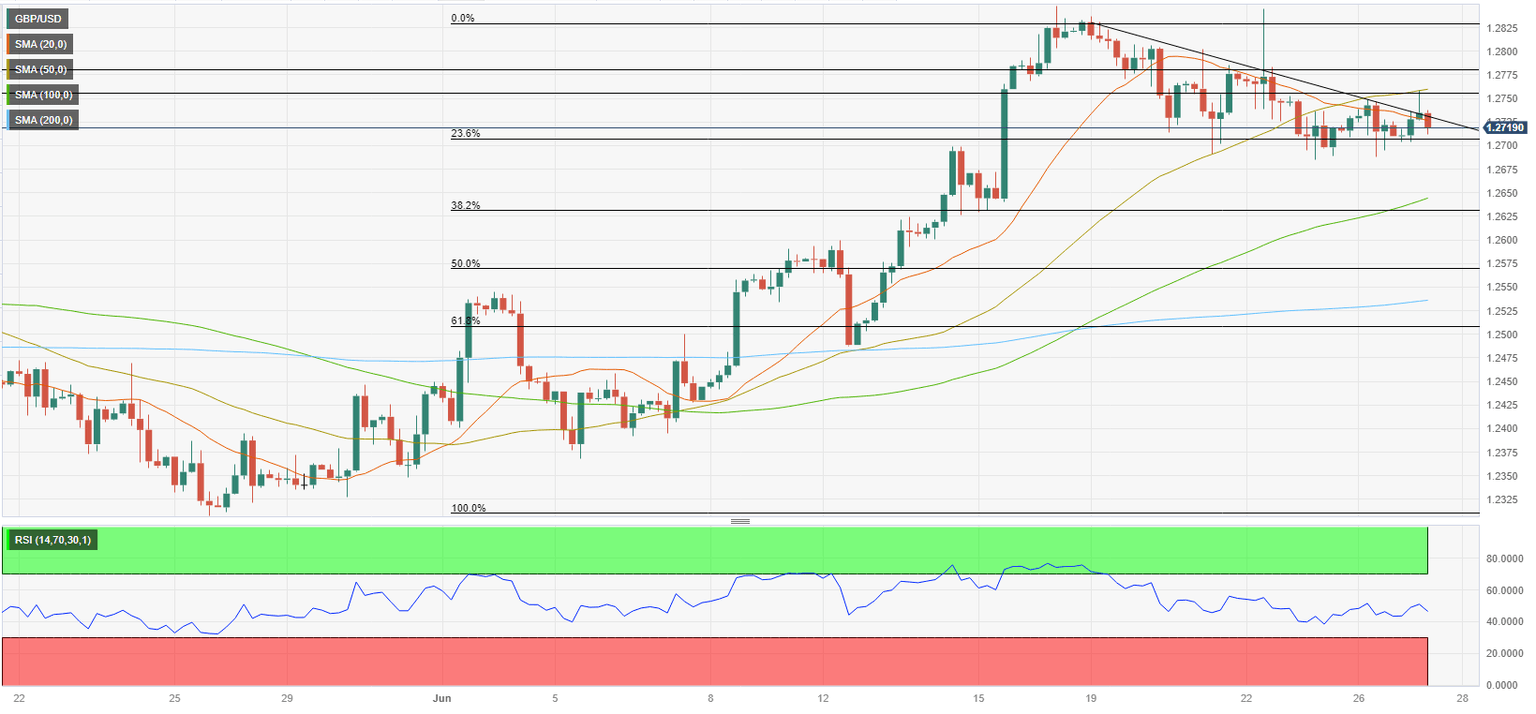

GBP/USD Forecast: Pound Sterling struggles to clear key 1.2750 hurdle

GBP/USD tested 1.2750 for the second straight day on Tuesday but failed to clear this level. Although the positive shift seen in risk sentiment could help the pair limit its losses in the near term, technical selling pressure could gain momentum if 1.2700 support fails.

In the Asian session, investors cheered optimistic comments from Chinese Premier Li Qiang, who said China was on track to grow at a stronger pace in the second quarter than in the first. Li also confirmed that the annual growth target was still 5%. Read more ...

GBP/USD bullish sequence suggests pullback to find support [Video]

GBP/USD shows an incomplete bullish sequence from 9.26.2022 low and 3.8.2023 low favoring further upside. Near term, rally from 5.26.2023 low ended wave 1 at 1.2848 as a 5 waves impulse Elliott Wave structure. Up from 5.26.2023 low, wave ((i)) ended at 1.2545 and pullback in wave ((ii)) ended at 1.2367. Pair then rallied again in wave ((iii)) towards 1.2699, and dips in wave ((iv)) ended at 1.2626. Final leg higher wave ((v)) ended at 1.2848 which completed wave 1. Read more ...

GBP/USD Price Analysis: Volatility contracts above 1.2700 despite cheerful market mood

The GBP/USD pair is trading back and forth in a narrow range of 1.2700-1.2750 in the early London session. The upside in the Cable is restricted as higher inflationary pressures in the United Kingdom have dampened its economic outlook while the downside is supported due to correction in the US Dollar Index (DXY).

The US Dollar Index is hovering near 102.60 as investors are divided about the monetary outlook by the Federal Reserve (Fed). Fed chair Jerome Powell conveyed last week that the central bank will continue tightening interest rates but at a careful pace. Read more ...

Author

FXStreet Team

FXStreet