GBP/USD Forecast: 1.2500 proves to be a tough resistance to crack

GBP/USD has edged slightly lower after having failed to clear 1.2500 for the third straight day on Friday. The near-term technical outlook doesn't yet point to a buildup of bearish momentum. In the second half of the day, risk perception and key macroeconomic data releases from the US could drive the pair's action.

Although the data from the US revealed on Thursday that the economy expanded at an annual rate of 1.1% in the first quarter, compared to the market expectation of 2%, the US Dollar (USD) stayed resilient against its rivals. The significant negative contribution of 2.26 percentage point of the change in private inventories to the GDP showed that the US economy has performed better than what the data suggests. Furthermore, the details of the report showed that consumer activity remained healthy despite strengthening price pressures in Q1. Read more ...

GBP/USD: Brief results and immediate prospects

Today, the dollar is strengthening throughout the currency market. This is partly due, in our opinion, to the fixation of a part of the many short positions on it at the end of the trading week and month. At the same time, the dollar's volatility may accelerate today ahead of the Fed's meeting next week.

Disputes of market participants mainly go around the prospects of its monetary policy. Economists are predicting a 25 basis point hike in the Fed's interest rate to 5.25%, before Fed officials pause because of the risks of increased pressure on the banking sector and the economy as a whole, to move towards monetary easing by the end of the year. Read more ...

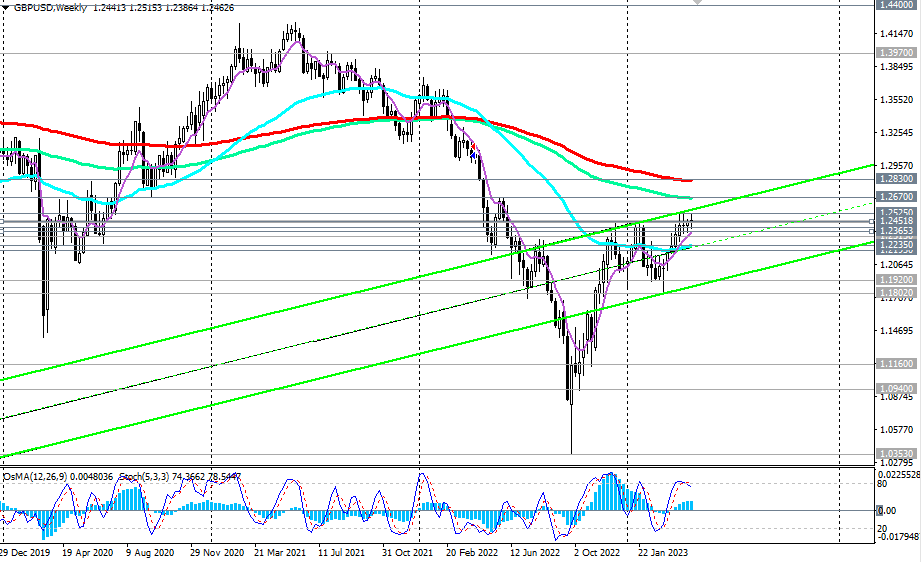

GBP/USD Price Analysis: Gathers strength for a sustainable move above 1.2500

The GBP/USD pair is consolidating near the psychological resistance of 1.2500 in the Asian session. The Cable is gathering strength for a sustained breakout above 1.2500 after a few failed attempts. Rising expectations of more interest rate hikes from the Bank of England (BoE) to arrest double-digit stubborn inflation are fueling fresh blood into the Pound Sterling.

The US Dollar Index (DXY) has regained strength and has jumped above 101.70 as investors are shifting their focus toward the monetary policy decision by the Federal Reserve (Fed), which will be announced next week. Read more ...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.