GBP/USD Forecast: Pound Sterling closes in on key 1.2050 support

GBP/USD turned south in the early European session and dropped below 1.2100 after spending the Asian trading hours in a tight range near 1.2150. The risk-averse market atmosphere and rising US Treasury bond yields help the US Dollar outperform its rivals on Thursday and make it difficult for the pair to shake off the bearish pressure.

The benchmark 10-year US Treasury bond yield extended its weekly rally and climbed to its highest level since 2007 near 5% on Thursday. Later in the day, Federal Reserve Chairman Jerome Powell will speak before the Economic Club of New York. Read more...

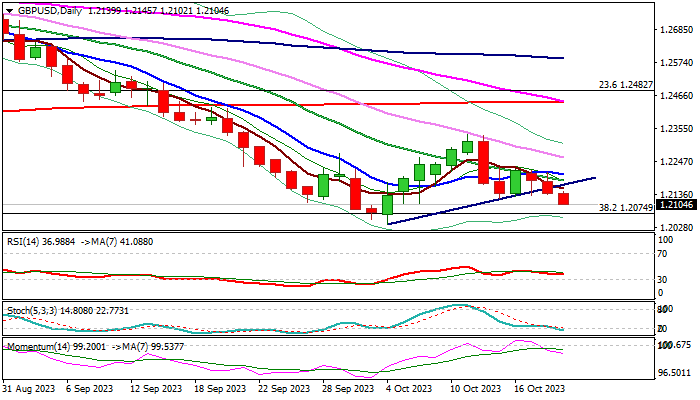

GBP/USD outlook: Break of pivotal supports risks further weakness

Fresh leg lower extends into third straight day, with increasing downside risk seen after break of pivotal supports at 1.2170/22 (trendline support / Oct 13 former higher low). Close below 1.2122 to confirm signal and expose targets and key near-term supports at 1.2037/00 Oct 4 new multi-month low/psychological).

Daily chart studies are bearish, as south-heading 14-d momentum is going deeper into negative territory and moving averages remain in bearish setup, adding to weakening near-term structure, though bears may face headwinds from oversold conditions. Read more...

Pound Sterling falls back as stubbornly high inflation triggers slowdown fears

The Pound Sterling (GBP) strives for a cushion, remaining vulnerable due to persistent inflation fears. The GBP/USD pair struggles for traction as the UK Consumer Price Index (CPI) report for September released on Wednesday showed inflation remains stubborn due to higher Oil prices, services inflation and strong wage growth.

Inflation in the UK is the highest among G7 economies. The decline in inflation towards the 2% target has lost steam, keeping Bank of England(BoE) policymakers on their toes. Meanwhile, market sentiment remains cautious due to persistent fears of Iran’s intervention in the Israel-Palestine conflict. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD loses the grip and challenges 1.0400

A robust, tariff-driven upswing in the US Dollar is now driving EUR/USD to deepen its daily losses, closing in on the key support at 1.0400 the figure ahead of scheduled speeches from Federal Reserve officials and President Trump.

GBP/USD keeps its offered bias around 1.2630 on USD buying

Following the lead of other risk-sensitive currencies, GBP/USD is giving way to renewed buying pressure on the Greenback, keeping the trade around 1.2630 ahead of remarks from Fed policymakers and President Trump.

Gold flirts with two-week lows around $2,880

Gold prices resume their downtrend and revisit two-week lows in the sub-$2,880 zone per ounce troy following the improved tone in the US Dollar, higher yields and further tariff narrative.

Bitcoin recovers above $85,000 while institutional investors offload their holdings

Bitcoin (BTC) recovers slightly and trades around $86,000 at the time of writing on Thursday after falling nearly 15% at one point this week. US President Donald Trump’s ongoing tariff news and falling institutional demand fueled the BTC’s correction.

February inflation: Sharp drop expected in France, stability in the rest of the Eurozone

Inflation has probably eased in February, particularly in France due to the marked cut in the regulated electricity price. However, this overall movement masks divergent trends. Although disinflation is becoming more widespread, prices continue to rise rapidly in services, in France as well as elsewhere in the Eurozone.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.