GBP/USD Forecast: Bulls could turn hesitant if 1.2700 support fails

GBP/USD touched its highest level in five months above 1.2800 in the previous week but erased its gains ahead of the New Year holiday to close the week virtually unchanged. Early Tuesday, the pair trades modestly higher on the day at around 1.2750 as trading conditions are yet to normalize.

GBP/USD rose nearly 1% in December. Although the US Dollar (USD) weakened against its major rivals, it managed to limit its losses against Pound Sterling. Softer-than-forecast inflation data from the UK and concerning growth figures caused investors to second-guess the timing of the Bank of England's (BoE) policy pivot in 2024. Read more...

GBP/USD begins 2024 in a muted tone

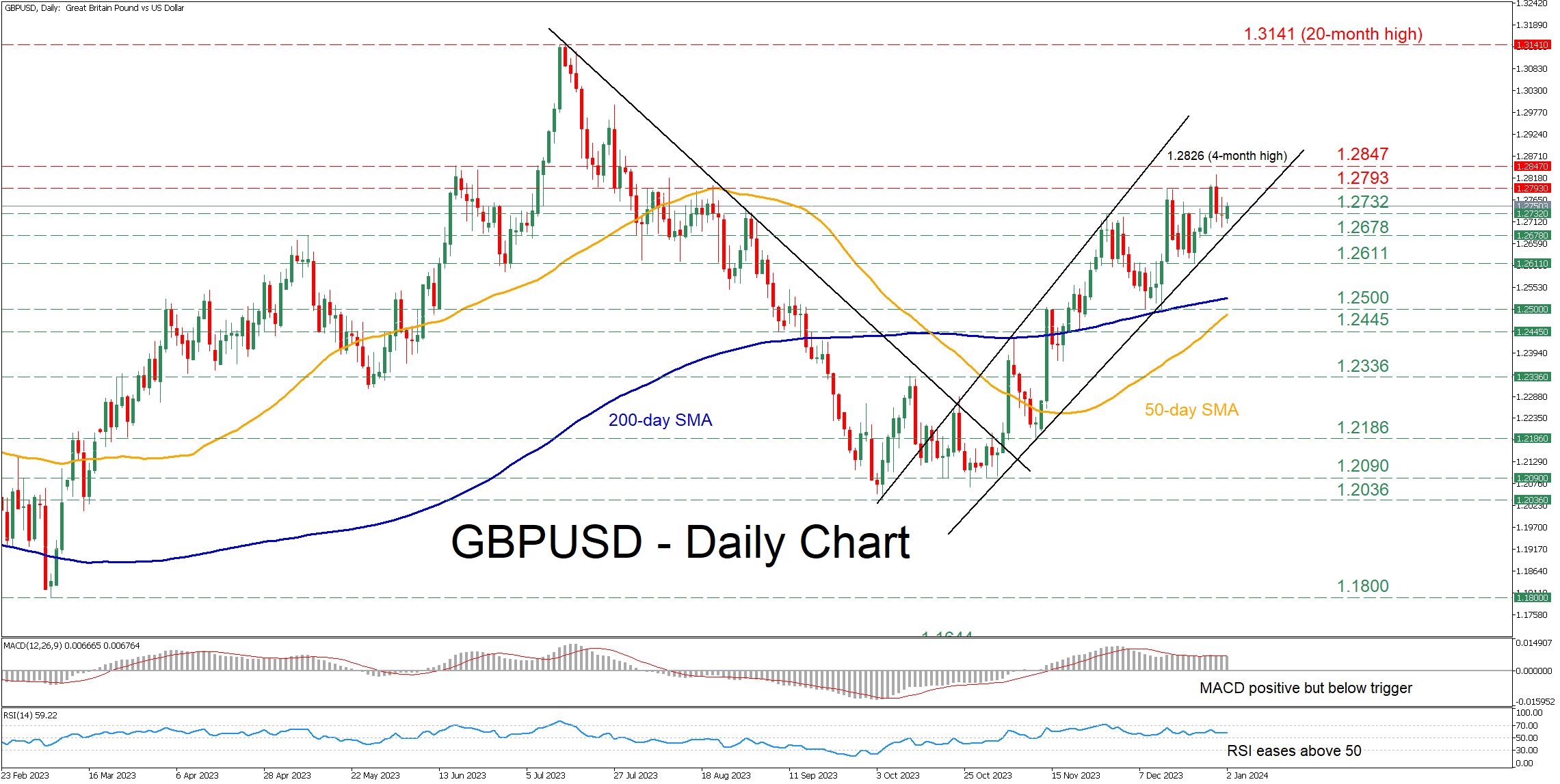

GBPUSD had been forming a profound structure of higher highs following its break above a crucial descending trendline in early November. Although the pair’s rally has temporarily paused at the four-month peak of 1.2826, the impending completion of a golden cross between the 50- and 200-day simple moving averages (SMAs) could infuse upside pressures.

Given that the short-term oscillators are providing cautiously positive signals, the bulls could attempt to erase the latest weakness and conquer the December resistance of 1.2793. A violation of that hurdle could open the door for the four-month peak of 1.2826. Failing to halt there, the pair might advance towards the June high of 1.2847. Read more...

Pound Sterling turns subdued after downbeat UK factory data

The Pound Sterling (GBP) faces nominal sell-off after the release of the weaker-than-projected S&P Global Manufacturing PMI for December. The factory data remained lower at 46.2 than expectations and the former reading of 46.4. The economic data below the 50.0 threshold indicates contraction in economic activities. The Manufacturing PMI remains below the 50.0 threshold for the 17-month in a row.

S&P Global commented that “UK manufacturing output contracted at an increased rate at the end of 2023. The demand backdrop also remains frosty, with new orders sinking further as conditions remain tough in both the domestic market and in key export markets, notably the EU. The downturn has hit manufacturers' confidence, which dipped to its lowest level in a year, and encouraged renewed cost caution with further cutbacks to stock levels, purchasing and employment. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Fed set to cut rates again, dot plot to drive USD action – LIVE

The Federal Reserve (Fed) is widely expected to cut the policy rate by 25 bps after the last meeting of 2024. Underlying details of the dot plot could provide important clues about the policy outlook and drive the US Dollar's valuation.

EUR/USD extends slide below 1.0500 ahead of Fed rate call

EUR/USD extends slide below 1.0500 amid a nervous wait-and-see stance. The pair's further upside remains capped as traders stay cautious and refrain from placing fresh bets ahead of the Federal Reserve's highly-anticipated policy announcements.

Gold near weekly lows ahead of Fed

Gold is practically flat near $2,650 on Wednesday after bouncing up from a one-week low it set on Tuesday. The precious metal remains on the defensive as the market braces for the outcome of the last Federal Reserve’s (Fed) meeting of the year.

GBP/USD holds above 1.2700 after UK inflation data

GBP/USD enters a consolidation phase above 1.2700 following the earlier decline. The data from the UK showed that the annual CPI inflation rose to 2.6% in November from 2.3%, as expected. Investors gear up for the Fed's monetary policy decisions.

Sticky UK services inflation to come lower in 2025

Services inflation is stuck at 5% and will stay around there for the next few months. But further progress, helped by more benign annual rises in index-linked prices in April, should see ‘core services’ inflation fall materially in the spring.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.