GBP/USD outlook: Bears resume after a brief consolidation

Cable fell further at the beginning of the week, after larger bears paused for consolidation on Friday. Current bets show 60% chance of BoE rate cut at Thursday’s policy meeting, which continues to weigh on sterling.

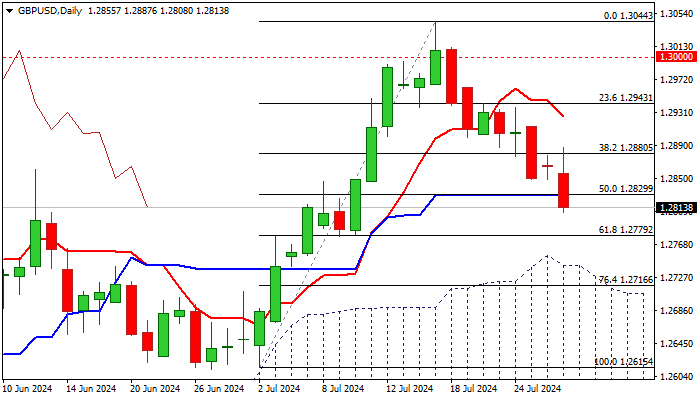

Technical picture on daily chart weakened further after Monday’s acceleration broke below 1.2830 pivot (50% retracement of 1.2615/1.3044 / daily Kijun-sen) with daily close below here to confirm fresh negative signal. Read more...

GBP/USD Forecast: Bearish pressure builds up as focus shifts to Fed and BoE meetings

After posting losses for the second consecutive week, GBP/USD stays under pressure early Monday and trades in negative territory below 1.2850. The pair's near-term technical outlook points to a buildup of bearish momentum.

The Federal Reserve (Fed) and the Bank of England (BoE) will announce monetary policy decisions later in the week. Growing expectations for a BoE rate cut this Thursday make it difficult for Pound Sterling to find demand. According to Reuters, UK interest rate futures point to a 58% chance of a 25 basis points (bps) BoE rate cut on August 1, up from nearly 50% on Friday. Read more...

GBP/USD Weekly Forecast: Fed-BoE policy divergence could trigger next directional move in Pound Sterling

The Pound Sterling (GBP) stretched its corrective downside from yearly highs against the US Dollar (USD), sending GBP/USD back under 1.2900 – the lowest level in over a week.

GBP/USD maintained its corrective downside mode during the past week, despite a broadly rangebound US Dollar. Divergent monetary policy outlooks between the US Federal Reserve (Fed) and the Bank of England (BoE) also failed to offer the much-needed lift to the Pound Sterling, as the sentiment around the higher-yielding currency was dented by resurfacing concerns over China’s economic slowdown. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD closes in on 1.0800 as US Dollar recovery continues

EUR/USD stays under bearish pressure on Monday and falls toward 1.0800. The US Dollar preserves its strength at the beginning of the week and doesn't allow the pair to stage a rebound as markets adopt a cautious stance ahead of this week's key macroeconomic events.

GBP/USD stays below 1.2850 in cautious start to week

GBP/USD struggles to gain traction and trades in the red below 1.2850. Investors adopt a cautious stance ahead of the Federal Reserve's and the Bank of England's policy meetings this week, making it difficult for the pair to turn north.

Gold struggles to hold above $2,400

Gold started the week on a bullish note as markets reacted to escalating tensions in the Middle East. After rising above $2,400, however, XAU/USD retreated below this level, pressured by the renewed US Dollar strength ahead of this week's critical events.

Ripple update: What to expect from XRP and Ripple lawsuit this week

Ripple (XRP) extended gains by nearly 2% early on Sunday. XRP sustained above the psychological price level of $0.60 amidst the optimism of Donald Trump’s speech at the Bitcoin conference, and BTC’s recent gains.

Seven fundamentals for the week: Fed, NFP, geopolitics and lots of data promise an explosive week Premium

Time for a summer holiday? Not yet, as this week promises to be super hot in financial markets. Three central bank decisions and US jobs data – which is growing in importance as inflation fades – provide a jam-packed schedule.