Pound Sterling Price News and Forecast: GBP/USD bears move in for the kill, testing key support structure

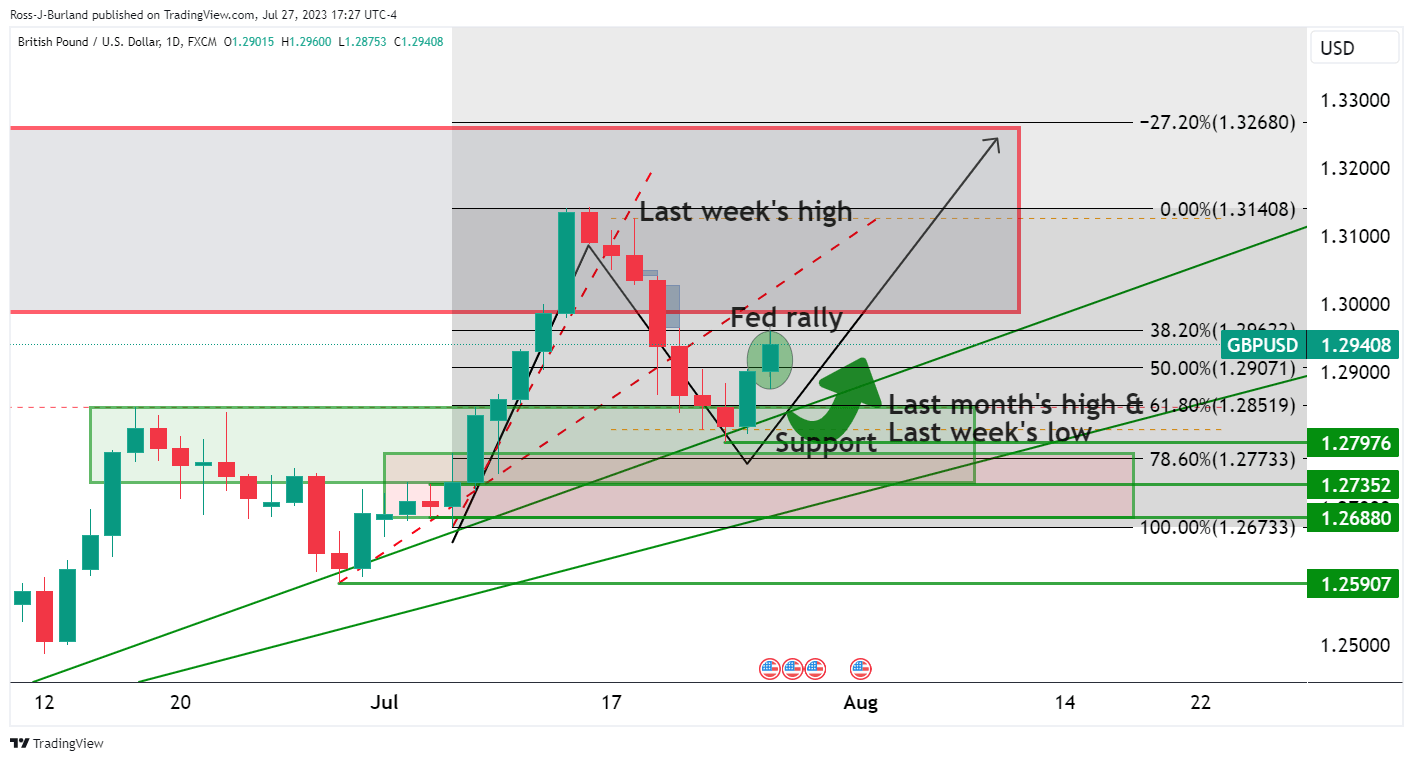

GBP/USD Price Analysis: Bears move in for the kill, testing key support structure

GBP/USD followed EUR/USD lower on strong US data and the European Central Babk's dovish 25bp hike. The pair dropped from 1.2995 to a low of 1.2781 while the markets reduce more hawkish Bank of England rate expectations for the August 3 interest rate meeting. This leaves the technical structure complicated and two-fold for Cable as the following illustrates. Read more...

Pound Sterling enters bearish passage as recession woes elevate

The Pound Sterling (GBP) turns weak amid deepening fears of a recession in the United Kingdom economy corner aggressive policy tightening by the Bank of England (BoE). Earlier, the GBP/USD pair faced pressure but overall sentiment for Pound Sterling is bullish as more interest-rate hikes from the UK central bank cannot be ruled out in order to bring inflation back to target. United Kingdom’s Treasury Advisers showed concerns about economic growth due to the aggressive policy tightening by the central bank, which has elevated the burden on firms. Moreover, the UK’s housing sector is facing the wrath of higher borrowing costs and demand for property from first-time home buyers has dropped sharply. Read more...

GBP/USD Forecast: Pound Sterling could extend uptrend on a weak US GDP reading

GBP/USD gathered bullish momentum and advanced to a weekly high near 1.3000 during the European trading hours on Thursday. The risk-positive market atmosphere provides an additional boost to the pair ahead of the Gross Domestic Product (GDP) data releases from the US.

The US Dollar (USD) stays under persistent selling pressure as markets see a strong chance that the Federal Reserve may have reached its terminal rate with a 25 basis points rate hike on Wednesday. FOMC Chairman Jerome Powell's hesitancy to confirm the need for additional rate increases and his acknowledgement of policy being restrictive in the post-meeting press conference triggered a USD selloff late Wednesday. In the European session, S&P 500 Futures and Nasdaq Futures are up 0.6% and 1.2%, respectively, highlighting the upbeat market mood. Read more...

Author

FXStreet Team

FXStreet