GBP/USD outlook: Bulls loosen grip ahead of key US data

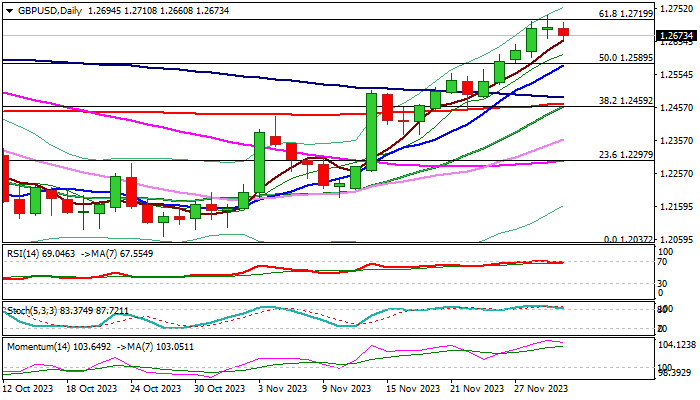

Cable eases from new three-month high in European trading on Thursday, as daily Doji candle on Wednesday signaled indecision and overbought daily studies prompted a partial profit-taking. Failure to register a daily close above 1.2719 Fibo barrier (61.8% of 1.3141/1.2037) and subsequent weakness add to initial signals of bull trap and increases risk of pullback.

Initial support lays at 1.2655 (5DMA), followed by rising 10DMA (1.2581) which should ideally contain dips to keep larger bulls intact, with deeper correction to expose pivotal supports at 1.2466/58 (converging 200 and 20DMA’s / broken Fibo 38.2%). Read more...

GBP/USD attracts some buyers near 1.2700, US PCE data looms

The GBP/USD pair attracts some buyers below the 1.2700 psychological mark during the early Asian session on Thursday. That being said, the softer US Dollar (USD) offers some support to the major pair. At press time, GBP/USD is trading near 1.2695, up 0.02% on the day.

The US Bureau of Economic Analysis (BEA) revealed on Thursday that the US economy grew to 5.2% in the third quarter (Q3) from the previous reading of 4.9%, above the market consensus of 5.0%. Federal Reserve (Fed) Governor Michelle Bowman said he sought to keep alive the possibility of more rate hikes, raising concerns about the longevity of inflationary pressure. Read more...

GBP/USD grapples to extend gains near 1.2700, US PCE Price Index eyed

GBP/USD struggles to continue its winning streak that began on November 23, treading water around 1.2700 during the Asian session on Thursday. However, the GBP/USD pair marked a three-month high at 1.2733 on Wednesday on a softer US Dollar (USD).

Bank of England (BoE) Governor Andrew Bailey asserted that the central bank is committed to taking necessary measures to bring inflation down to its 2.0% target. He emphasized that despite efforts, the BoE has not observed sufficient progress to be confident in achieving this goal. This hawkish remark might have provided upward support for the Pound Sterling (GBP). Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD bounces off lows near 1.0820, Dollar loses traction

EUR/USD attempts some recovery following lows near 1.0820 as the US Dollar chalks up another strong day. In the meantime, persistent tariff jitters and disappointing February US Producer Price data are keeping the pair on the back foot.

Gold pushes higher, retargets its all-time high

Gold is on a roll, surpassing the $2,950 mark per troy ounce amid the continuation of the upside impulse so far this week. Escalating trade tensions have heightened fears of an economic downturn, creating a risk-averse atmosphere that continues to make the precious metal an attractive safe haven.

GBP/USD succumbs to USD gains, remains near 1.2940

Persistent buying pressure in the Greenback is weighing on risk sentiment, motivating GBP/USD to gyrate around the 1.2940 region and erase its two-day rally for now.

Metaverse narrative stalls as price action fades, but on-chain data signals continuing accumulation

Metaverse tokens are cryptocurrencies associated with virtual worlds, digital economies, and immersive online experiences. Tokens like Sandbox, Decentraland, and Axie Infinity, three of the most prominent assets during the Metaverse boom of 2021, continue to face correction since they topped in early December.

Brexit revisited: Why closer UK-EU ties won’t lessen Britain’s squeezed public finances

The UK government desperately needs higher economic growth as it grapples with spending cuts and potential tax rises later this year. A reset of UK-EU economic ties would help, and sweeping changes are becoming more likely.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.