GBP/USD Price Forecast 2024: Will politics and policy spoil the Pound Sterling party?

Setting out to analyze the GBP/USD price outlook for 2024, there are plenty of unknowns and looming uncertainties that make it difficult to convincingly predict the course of the Pound Sterling against the US Dollar (USD) in the year ahead. On both sides of the Atlantic, increased odds of a recession, a dovish pivot in the monetary policies and general elections are foreseen as the key factors driving the GBP/USD price action next year, barring any unprecedented geopolitical risks.

GBP/USD witnessed a rollercoaster ride in 2023 but the Pound Sterling managed to preserve the recovery gains seen in the first half of the year to a 15-month high of 1.3142. Meanwhile, the US Dollar failed to sustain the turnaround, helping GBP/USD gain over 5.0% on the year. However, it remains to be seen whether the British Pound will maintain its upswing against the Greenback, as we head into 2024. Read more...

GBP/USD attempts to recoup some losses [Video]

GBPUSD climbed to a new four-month high in the previous week, but it reversed lower again, falling beneath the 61.8% Fibonacci retracement level of the down leg from 1.3140 to 1.2035 at 1.2720.

The next major support level for traders to have in mind is the 20-day simple moving average (SMA) at 1.2615, with the technical oscillators confirming another bearish wave. The MACD oscillator is falling beneath its trigger line in the positive territory, while the RSI is flattening above the 50 level. Read more...

GBP/USD Forecast: Pound Sterling could struggle to extend rebound ahead of UK inflation data

After closing the second consecutive trading day in negative territory on Monday, GBP/USD found a foothold early Tuesday and stabilized above 1.2650. Ahead of the UK November inflation data on Wednesday, the pair could have a hard time gathering recovery momentum.

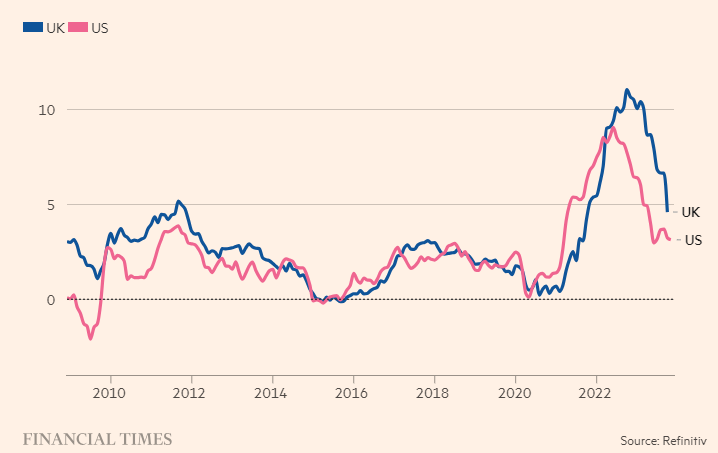

Despite the modest improvement seen in risk mood in the second half of the day on Monday, GBP/USD failed to gain traction as investors remained reluctant to increase Pound Sterling longs. Annual inflation in the UK, as measured by the change in the Consumer Price Index (CPI) is forecast to decline to 4.4% in November from 4.6% in October. Read more

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD recovers above 1.0300, markets await comments from Fed officials

EUR/USD gains traction and trades above 1.0300 on Thursday despite mixed German Industrial Production and Eurozone Retail Sales data. Retreating US bond yields limits the USD's gains and allows the pair to hold its ground as market focus shifts to Fedspeak.

GBP/USD rebounds from multi-month lows, trades above 1.2300

GBP/USD erases a portion of its daily gains and trades above 1.2300 after setting a 14-month-low below 1.2250. The pair recovers as the UK gilt yields correct lower after surging to multi-year highs on a two-day gilt selloff. Markets keep a close eye on comments from central bank officials.

Gold climbs to new multi-week high above $2,670

Gold extends its weekly recovery and trades at its highest level since mid-December above $2,670. The benchmark 10-year US Treasury bond yield corrects lower from the multi-month high it touched above 4.7% on Wednesday, helping XAU/USD stretch higher.

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot Exchange Traded Funds recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.