Pound Sterling Price News and Forecast: GBP/USD

GBP/USD Weekly Forecast: Pound Sterling weakens as BoE August rate cut hangs in the balance

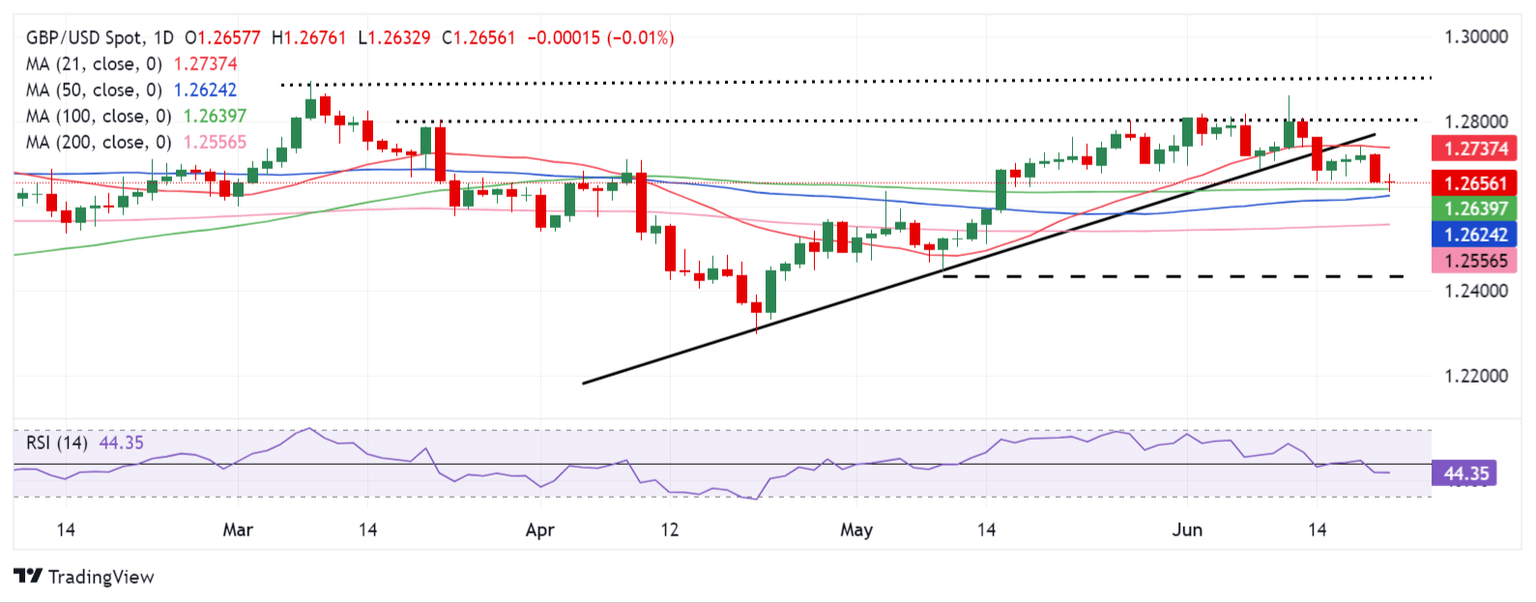

The Pound Sterling (GBP) extended its losing streak against the US Dollar (USD) into the third straight week, knocking off GBP/USD to a fresh monthly low below 1.2650.

GBP/USD witnessed good two-way business in the past week, staging a modest recovery in the first half of the week before surrendering to sellers following Thursday's Bank of England (BoE) policy announcements. Read more...

GBP/USD bears flirt with 100-day SMA, retain control near the lowest level since mid-May

The GBP/USD pair kicks off the new week on a subdued note and remains well within the striking distance of its lowest level since mid-May touched on Friday. Spot prices currently trade around the 1.2635 area, with bears awaiting a sustained break and acceptance below the 100-day Simple Moving Average (SMA) before positioning for an extension of the recent pullback from a multi-month peak.

The British Pound (GBP) continues to be undermined by the Bank of England's (BoE) dovish pause last week, which lifted bets for an interest rate cut at the August monetary policy meeting. Adding to this, the flash UK PMIs released on Friday showed that private sector business activity expanded in June at its slowest rate since last November. This, along with some follow-through US Dollar (USD) buying, turns out to be another factor weighing on the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet