Pound Sterling Price News and Forecast: GBP uptrend pauses ahead of key data releases

GBP/USD Forecast: Pound Sterling uptrend pauses ahead of key data releases

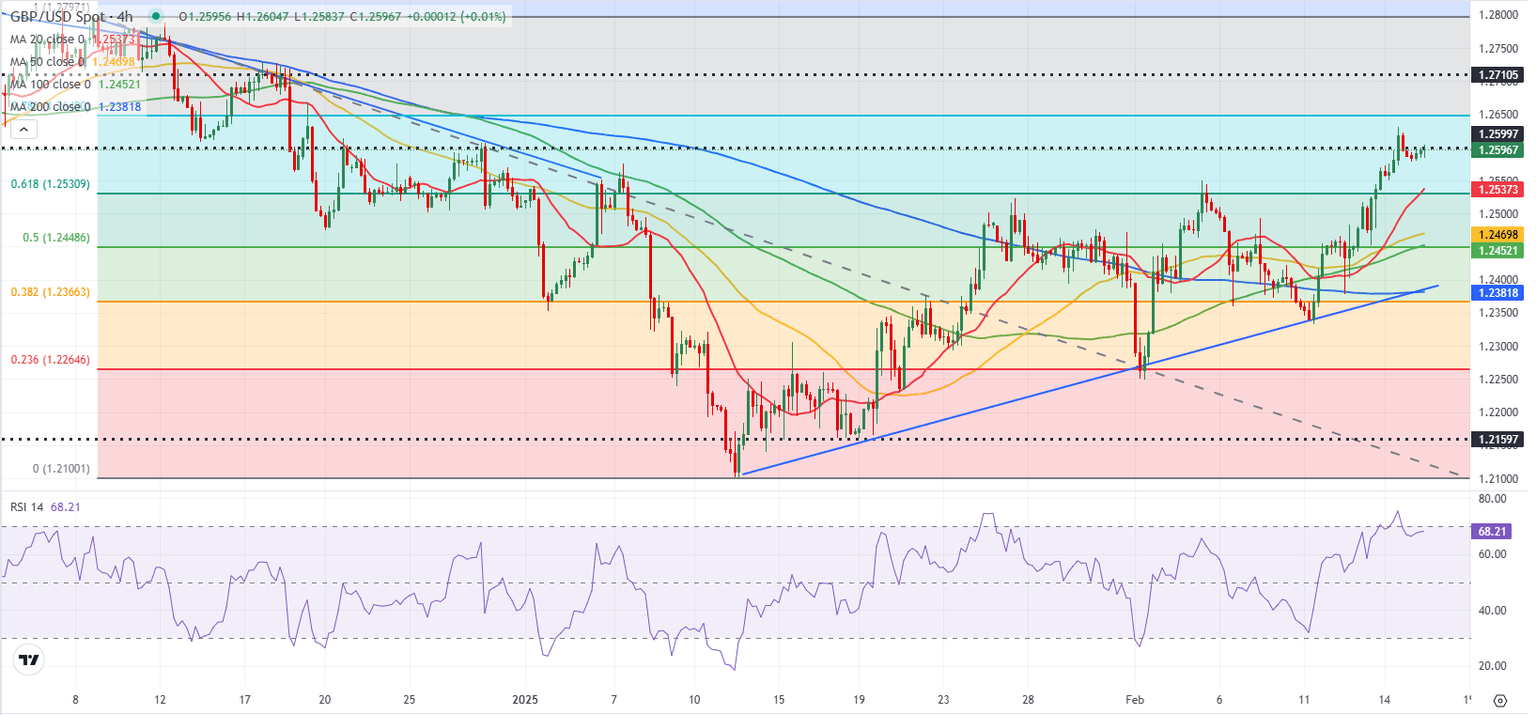

GBP/USD stays in a consolidation phase near 1.2600 after gaining 1.5% in the previous week. The pair could have a hard time finding direction in the short term, with investors opting to wait for key macroeconomic data releases from the UK.

The risk-positive market atmosphere caused the US Dollar (USD) to weaken against its major rivals last week. Easing fears over US President Donald Trump's tariff policy triggering trade wars allowed risk flows to dominate the market action. Reflecting the broad-based selling pressure surrounding the USD, the USD Index fell more than 1% on a weekly basis. Read more...

GBP/USD Weekly Outlook: Pound Sterling looks north ahead of UK employment, inflation test

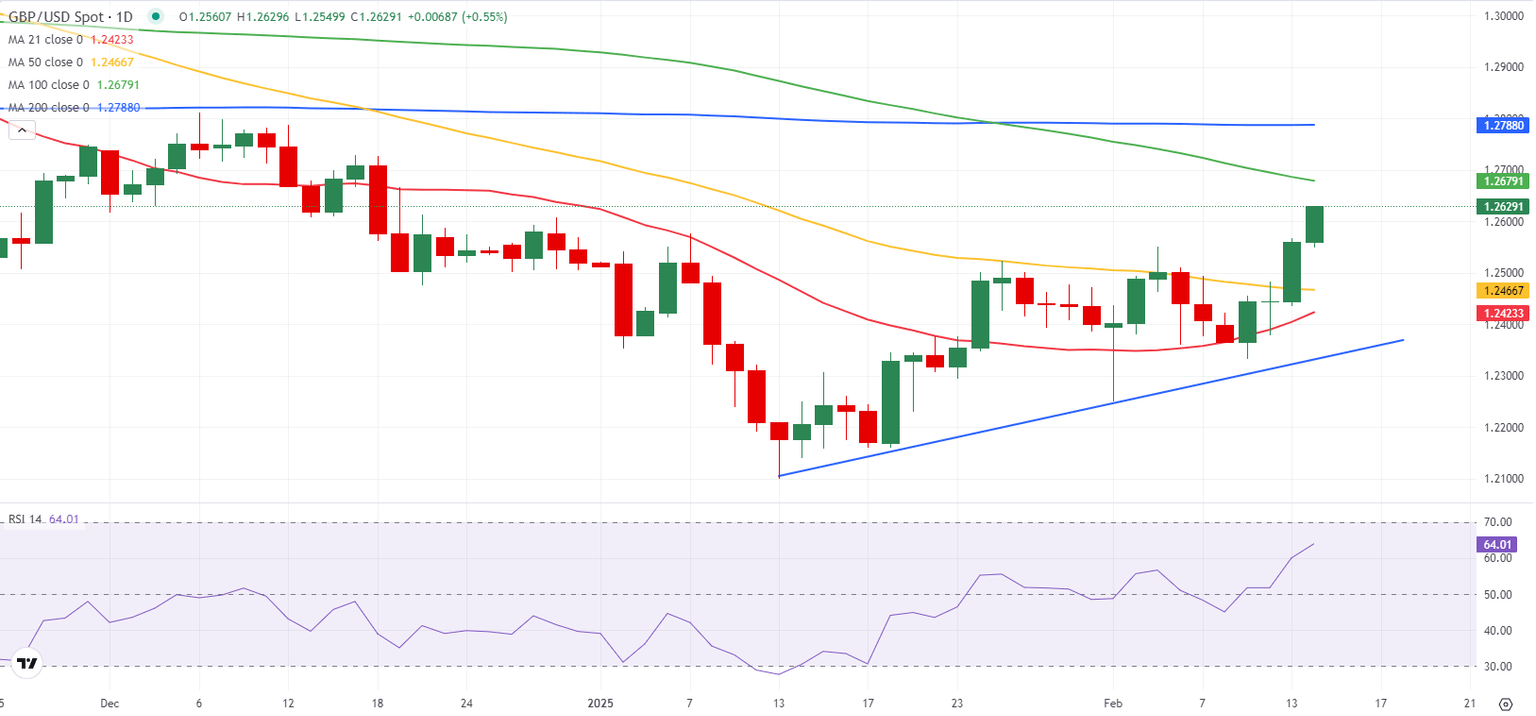

The Pound Sterling (GBP) extended the recovery from 14-month troughs against the US Dollar (USD) as the GBP/USD pair reclaimed the 1.2500 threshold.

The primary catalyst behind the GBP/USD pair’s ongoing upswing was the sustained correction in the US Dollar across its major currency rivals. US President Donald Trump’s reciprocal tariffs plan and dovish US Federal Reserve (Fed) expectations exerted downside pressure on the Greenback, even though Fed Chairman, Jerome Powell, stuck to his hawkish rhetoric in his Congressional testimonies. Read more...

Author

FXStreet Team

FXStreet