Pound Sterling Price News and Forecast: GBP stays below key level as focus shifts to FOMC Minutes

GBP/USD Forecast: Pound Sterling stays below key level as focus shifts to FOMC Minutes

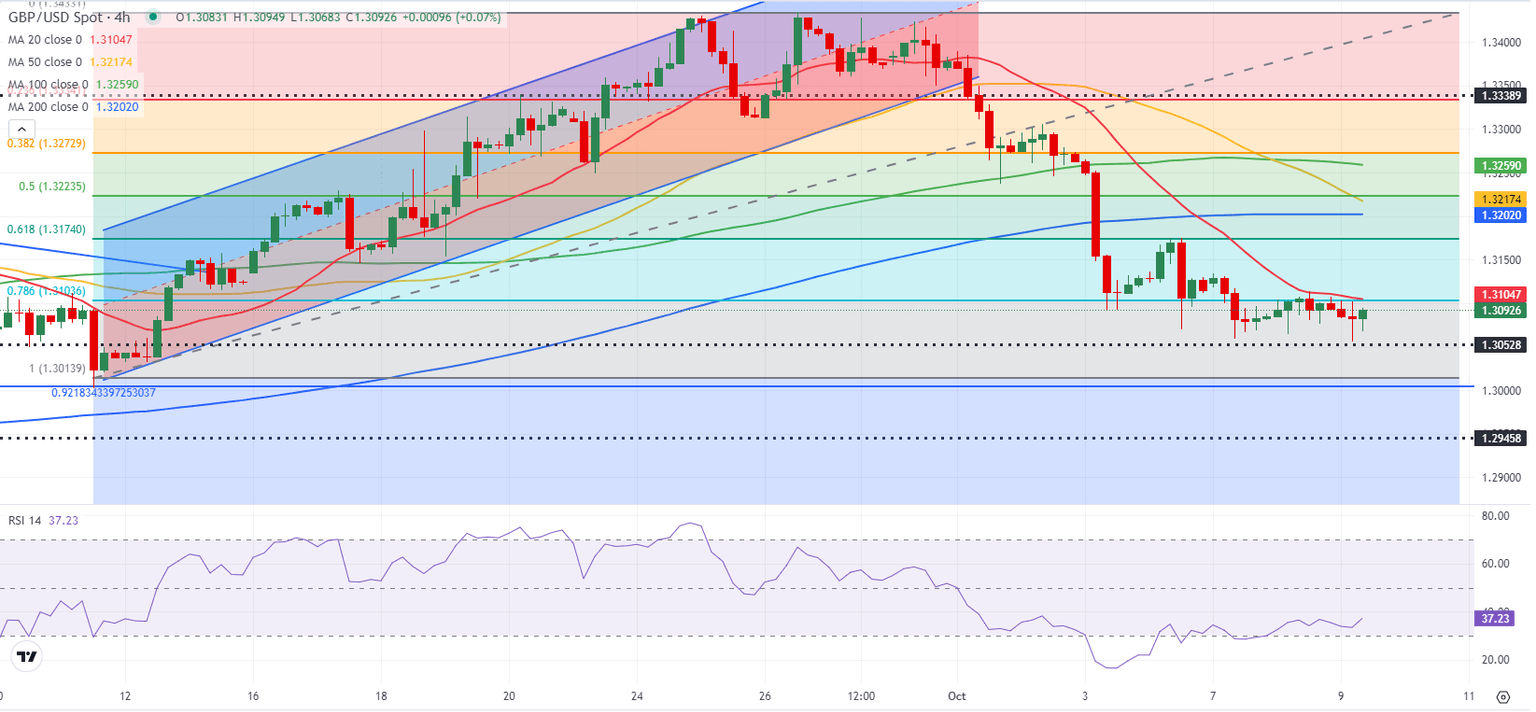

GBP/USD managed to post small gains on Tuesday but failed to reclaim 1.3100. The pair stays relatively quiet in the European session on Wednesday as investors wait for the Federal Reserve (Fed) to publish the minutes of the September policy meeting.

The recovery seen in Wall Street's main indexes made it difficult for the US Dollar (USD) to gather strength during the American trading hours on Tuesday, allowing GBP/USD to cling to modest daily gains. Read more...

GBP/USD trades cautiously below 1.3100 with FOMC minutes on the horizon

The GBP/USD pair trades with caution below the crucial resistance of 1.3100 in Wednesday’s London session. The Cable remains under pressure as the US Dollar (USD) extends its upside, with traders pricing out another Federal Reserve (Fed) 50 basis points (bps) interest rate cut in November.

The market sentiment remains risk-averse amid escalating tensions between Israel and Iran. S&P 500 futures have posted some losses in European trading hours. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, strives to rally further above 102.70. Read more...

Author

FXStreet Team

FXStreet