GBP/USD Forecast: Pound Sterling buyers regain control ahead of US data

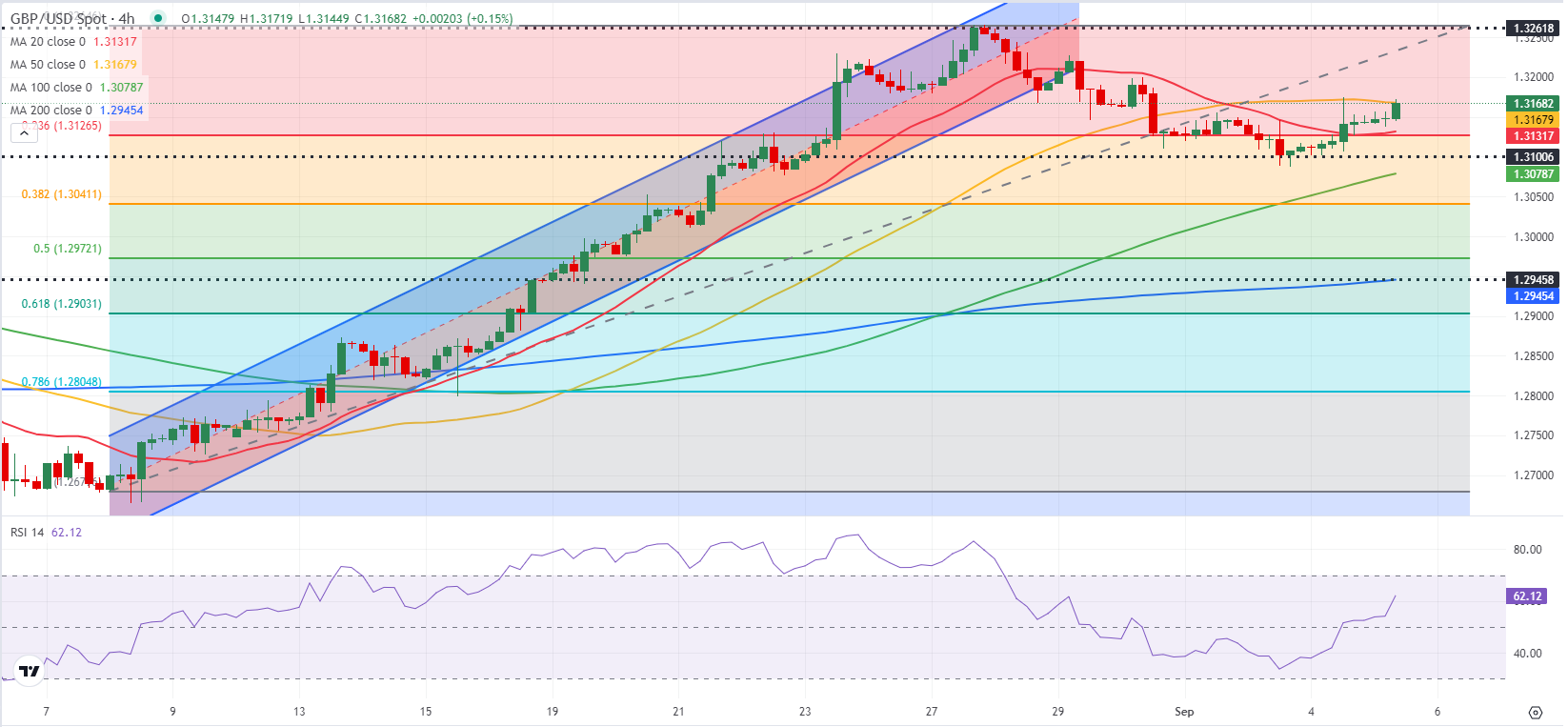

GBP/USD holds its ground and trades in positive territory above 1.3150 after closing higher on Wednesday. Investors await August ADP Employment Change data from the US.

The renewed US Dollar (USD) weakness helped GBP/USD gain traction during the American trading hours on Wednesday. The US Bureau of Labor Statistics reported that JOLTS Job Openings declined to 7.67 million in July from 7.9 million in June. As this reading missed the market expectation of 8.1 million by a wide margin, the immediate reaction caused the USD to weaken against its rivals. Read more...

GBP/USD Elliott Wave technical analysis [Video]

The GBPUSD daily chart analysis shows that the British Pound to US Dollar currency pair is currently trending in an impulsive manner. The market follows an impulsive wave structure, indicating a strong directional movement consistent with the prevailing trend. The specific structure under analysis is gray wave 1, part of a larger wave sequence.

At this stage, the market is positioned in orange wave 3, which represents a crucial phase in the ongoing wave cycle. After the completion of orange wave 2 of 3, gray wave 1 of 3 has begun. This indicates that the market is progressing through the early stage of this wave, which typically results in significant price movements. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays vulnerable near 1.0600 ahead of US inflation data

EUR/USD remains under pressure near 1.0600 in European trading on Wednesday. The pair faces headwinds from the recent US Dollar upsurge, Germany's political instability and a cautiou market mood, as traders look to US CPI data and Fedspeak for fresh directives.

GBP/USD trades with caution near 1.2750, awaits BoE Mann, US CPI

GBP/USD trades with caution near 1.2750 in the European session on Wednesday, holding its losing streak. Traders turn risk-averse and refrain from placing fresh bets on the pair ahead of BoE policymaker Mann's speech and US CPI data.

Gold price trims a part of modest recovery, focus remains on US CPI

Gold price (XAU/USD) trims a part of modest intraday recovery gains, albeit it manages to hold above the $2,600 mark heading into the European session on Wednesday. Traders now look forward to the crucial US consumer inflation figures for a fresh impetus.

US CPI data preview: Inflation expected to rebound for first time in seven months

The US Consumer Price Index is set to rise 2.6% YoY in October, faster than September’s 2.4% increase. Annual core CPI inflation is expected to remain at 3.3% in October. The inflation data could significantly impact the market’s pricing of the Fed’s interest rate outlook and the US Dollar value.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.