Pound Sterling weakens against US Dollar after Trump threatens to tariff BRICS

- The Pound Sterling falls on Monday against the US Dollar after Donald Trump threatened BRICS with 100% tariffs, supporting the Greenback.

- Trump said he would impose tariffs if the trading group tried to replace the US Dollar with their own reserve currency.

- Technically, GBP/USD remains in an uptrend, within which it is undergoing a correction.

The Pound Sterling (GBP) pulls back on Monday after more invective from President-elect Donald Trump bolsters the US Dollar (USD).

In a post on social media, Trump railed against the BRICS trading bloc’s plans to replace the US Dollar with their own currency. If the emerging-market trading bloc goes ahead, warned Trump, he would hit them with 100% tariffs.

The GBP/USD pair bounces briefly, however, following the release of UK house price data that showed dwellings’ prices rose more than expected in November, as this provided support to the Pound Sterling.

Pound Sterling pulls back after Trump throws BRICS

The GBP/USD pair is trading lower on Monday after rising quite strongly in the previous week, when it clocked gains of 1.71%.

The pair is falling after Donald Trump threatened to impose 100% tariffs on the BRICS trading bloc of nations, which includes Brazil, Russia, India, China, South Africa, Egypt, Iran, the United Arab Emirates and Ethiopia. Trump said he would impose the tariffs if the group goes ahead with plans to replace the US Dollar as their main medium of exchange.

“The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER,” Trump posted on Truth Social on Saturday afternoon. “We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy,” he added.

Pound Sterling gets bump from UK house prices

GBP/USD recovered some lost ground after the release of Nationwide Housing Prices early on Monday showed a rise of 3.7% YoY in November, beating estimates of 2.4% and the previous month’s 2.4% YoY rise.

On a seasonally-adjusted monthly basis, Nationwide House Prices rose 1.2% – well above the 0.2% expected and 0.1% previous estimate.

UK Money and Lending data out on Friday, meanwhile, showed a fall in Consumer Credit in October. Mortgage Approvals, however, unexpectedly rose.

The overall takeaway, according to economists at advisory service Capital Economics, was that the data suggested “downside risks” to UK economic growth in Q4.

“October’s money and lending figures suggest that Budget worries prompted households to become more cautious with their borrowing and saving,” said Capital in a note. “Today’s data release adds a bit further downside risk to our Q4 GDP growth forecast of +0.4% q/q,” it added.

GBP/USD and outlook for interest rates

In terms of the outlook for interest rates – a major driver of currency valuations – the Pound Sterling and the US Dollar are well-matched.

Both the Bank of England (BoE) and the US Federal Reserve (Fed) are seen as likely to cut interest rates at their December policy meetings as inflation in both countries eases.

The swaps market is pricing a probability of around 60% that the BoE will cut interest rates by 0.25% at their December meeting, according to Brown Brothers Harriman (BBH). The US futures market, meanwhile, is pricing in around a 67% probability of a same-sized cut at their December meeting, according to the CME FedWatch tool.

This could limit volatility for GBP/USD as lower interest rates would be bearish for both currencies since they reduce foreign capital inflows.

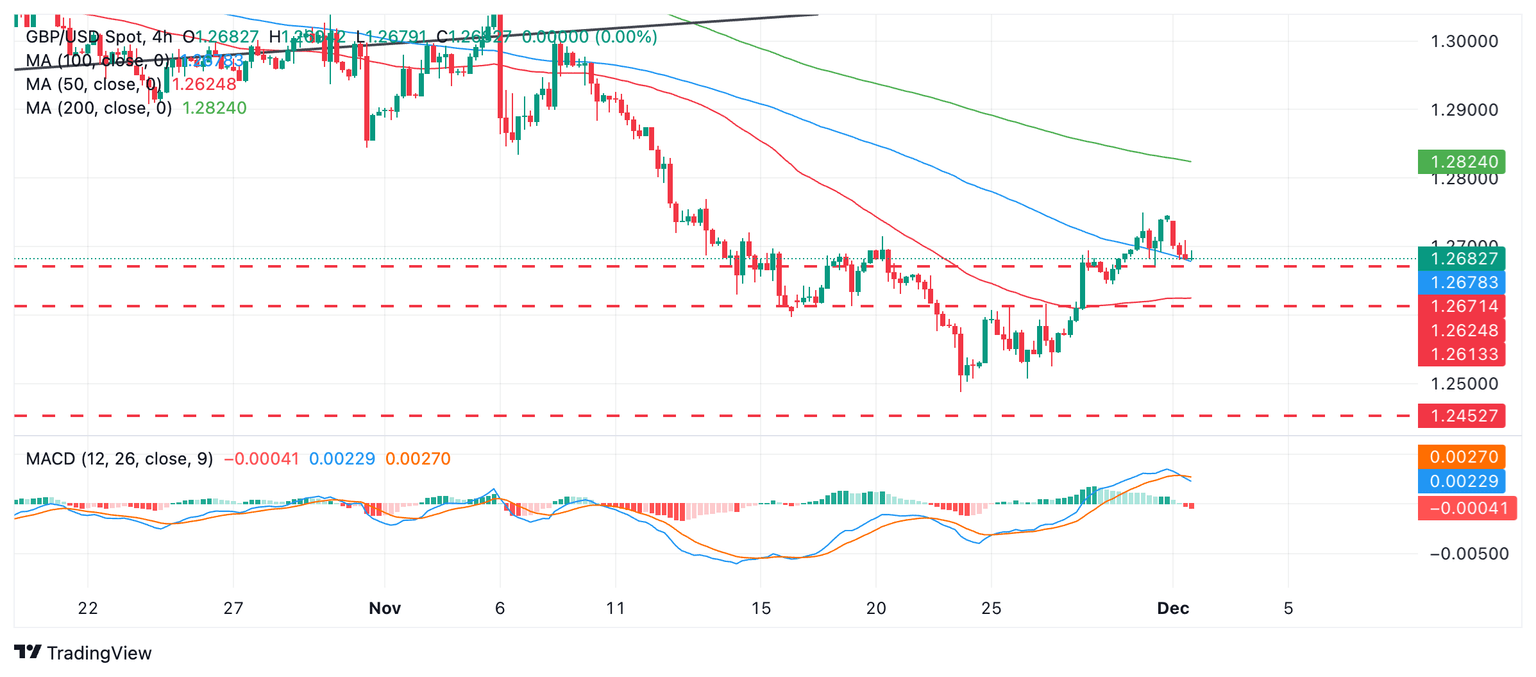

Technical Analysis: GBP/USD pulls back within uptrend

GBP/USD remains within a short-term uptrend, which is still intact despite Monday’s losses. Since it is a principle of technical analysis that “the trend is your friend” the odds continue to favor an extension of this trend higher.

GBP/USD 4-hour Chart

A break above 1.2750 would probably activate the next upside target at around 1.2824, where the (green) 200-period Simple Moving Average (SMA) is situated.

A continuation lower, however, could take the pair down to support at 1.2671, the mid-November lows.

The blue Moving Average Convergence Divergence (MACD) indicator has crossed below its red signal line, suggesting more weakness to come.

The medium-term trend is still bearish, indicating a risk to the downside, whilst the longer-term trend – it could be argued – is still probably bullish, further complicating the picture.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.