Pound Sterling looks to extend recovery as key support holds [Video]

![Pound Sterling looks to extend recovery as key support holds [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-157771037_XtraLarge.jpg)

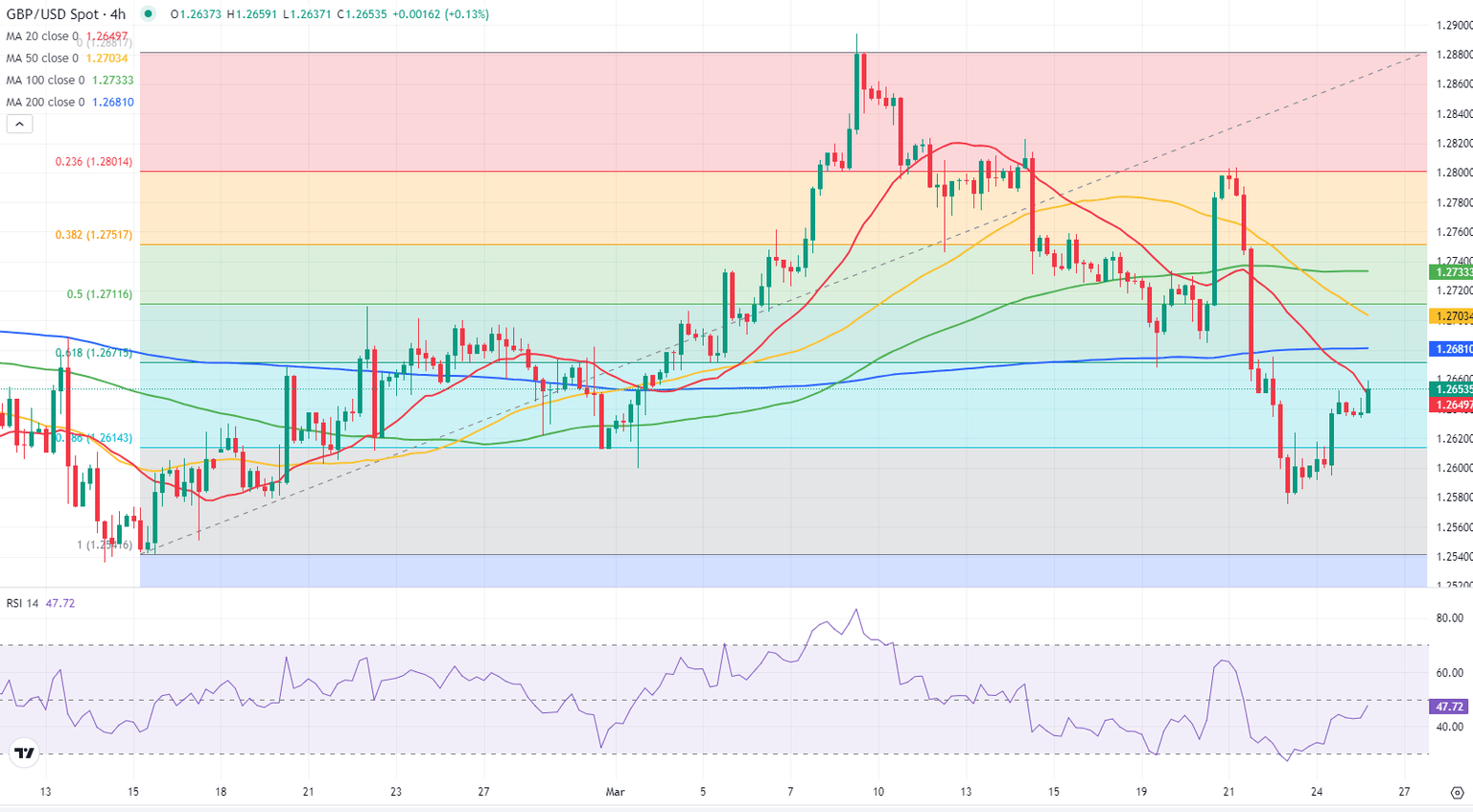

GBP/USD outlook: Bulls gaining traction after a double rejection at 200DMA

Cable remains constructive in early Tuesday’s trading, after it was lifted by better than expected UK data on Monday and fading expectations for BOE rate cut in May.

Fresh recovery was also underpinned by a double downside rejection at 200DMA (1.2591) on Fri/Mon however, bearishly aligned daily studies (momentum indicator is in the negative territory and 10/20/55 DMA’s in bearish setup) keep in play risk of potential recovery stall. Read more...

GBP/USD bounces off 200-day SMA [Video]

GBP/USD rebounded off the 200-day simple moving average (SMA), which coincides with the 1.2595 support level and the medium-term ascending trend line. The market has still been developing within a consolidation area since November 21, despite the break to the upside that it had on March 8, which seems to be a failed signal. Read more...

GBP/USD Forecast: Pound Sterling looks to extend recovery as key support holds

After testing 1.2600 at the beginning of the week, GBP/USD reversed its direction and closed in positive territory on Monday. The pair clings to small gains near 1.2650 in the early European morning on Tuesday.

In the absence of high-tier data releases and fundamental drivers, the US Dollar (USD) struggled to build on the previous week's gains. After rising nearly 1% in a two-day span ahead of the weekend, the USD Index lost 0.2% on Monday. Read more...

Author

FXStreet Team

FXStreet

-638470428472395843.png&w=1536&q=95)