Pound Sterling refreshes three-week high at 1.3250 as UK inflation ticks up

- The Pound Sterling jumps to near 1.3250 against the US Dollar as UK core inflation rose faster than expected in August.

- UK core CPI grew by 3.6%, while the headline inflation was stable at 2.2% as expected.

- The Fed seems prepared to announce its first interest-rate cut in more than four years.

The Pound Sterling (GBP) gains against its major peers in Wednesday’s North American session as the United Kingdom (UK) inflation data for August came in hotter than expected. The Office for National Statistics (ONS) reported that the core Consumer Price Index (CPI) – which excludes volatile items such as food, energy, oil, and tobacco – rose by 3.6%, more than the 3.5% estimated and accelerating from 3.3% in July.

Services inflation, a closely watched indicator by Bank of England (BoE) officials, rose sharply to 5.6% from 5.2% in July. This acceleration in inflation could force traders to pare back bets supporting one more interest rate cut by the Bank of England (BoE) in the remainder of the year.

Headline inflation, meanwhile, rose by 0.3% and 2.2% on a monthly and annual basis, respectively, meeting analysts' expectations.

Going forward, investors will focus on the BoE’s monetary policy announcement on Thursday. Before inflation data came out, markets were already expecting the BoE to leave interest rates unchanged at 5%. With August data signaling that inflation remains stubborn, market expectations for rates remaining at their current levels by the year-end may increase.

Daily digest market movers: Pound Sterling surges ahead of Fed-BoE policy decision

- The Pound Sterling surges to near 1.3250 against the US Dollar (US) in Wednesday's New York session after the release of the hot UK inflation data for August. The GBP/USD pair reclaims the immediate resistance of 1.3200, however, it is expected to face sheer volatility as the Federal Reserve’s (Fed) monetary policy decision will be announced at 18:00 GMT.

- According to the CME FedWatch tool, the central bank is certain to start reducing interest rates. This will be the first interest rate cut decision by the Fed in over four years. However, the debate is over the pace by which key borrowing rates will be reduced. 30-day Federal Funds Futures pricing data shows that the probability of the central bank cutting rates by 50 basis points (bps) to 4.75%-5.00% is at 65%, while the rest favors a 25-bps rate cut.

- The Fed will pivot to policy normalization as the latest commentaries from officials indicated that the central bank is more concerned about deteriorating labor demand rather than inflation.

- Apart from the Fed’s policy decision, investors will also focus on the Fed’s dot plot, economic projections, and the press conference of Fed Chair Jerome Powell after the interest rate decision. The Fed dot plot indicates the collective forecast for the federal fund rate by all policymakers in the medium and long term.

- On the economic data front, the United States (US) monthly Building Permits and Housing Starts came in higher than expected in August. Building Permits and Housing Starts came in at 1.475 million and 1.356 million respectively.

Technical Analysis: Pound Sterling rises further to near 1.3200

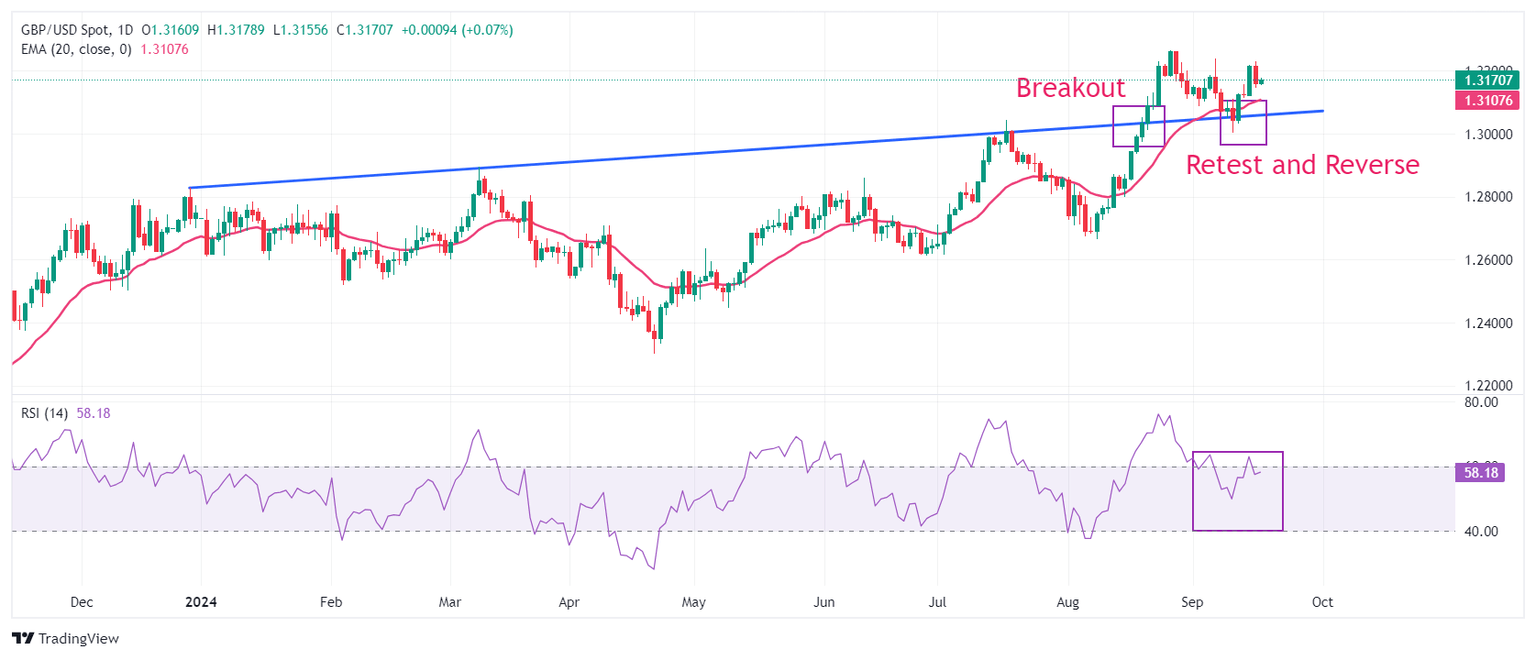

The Pound Sterling rises above 1.3200 against the US Dollar in European trading hours. The near-term outlook of the GBP/USD pair remains firm as it holds above the 20-day Exponential Moving Average (EMA) near 1.3100. Earlier, the Cable strengthened after recovering from a corrective move to near the trendline plotted from the December 28, 2023, high of 1.2828, from where it delivered a sharp increase after a breakout on August 21.

The 14-day Relative Strength Index (RSI) stands around 60.00. A fresh round of bullish momentum could occur if the oscillator sustains around this level.

Looking up, the Cable will face resistance near the August 27 high of 1.3266 and the psychological level of 1.3500. On the downside, the psychological level of 1.3000 emerges as crucial support.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Sep 18, 2024 18:00

Frequency: Irregular

Consensus: 5.25%

Previous: 5.5%

Source: Federal Reserve

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.