Pound Sterling recovery stalls amid firm speculation for early BoE rate cuts

- The Pound Sterling struggles to hold recovery, driven by the upbeat preliminary S&P Global/CIPS PMI report for April.

- Investors speculate that the BoE will shift to rate cuts in the June or August meeting.

- BoE Haskel wants to see more slack in labor demand to gain confidence that inflation will sustainably return to the 2% target.

The Pound Sterling (GBP) turns sideways around 1.2450 against the US Dollar (USD) in Wednesday’s early American session after bouncing back strongly from a five-month low at around 1.2300. The GBP/USD pair struggles for a direction as the US Dollar consolidates after a steep correction on Tuesday. The US Dollar Index (DXY), which measures the US Dollar’s value against six major currencies, attempts to establish a firm footing near 105.70. Also, uncertainty over the BoE's rate-cut timing has paused recovery in the Pound Sterling.

On Tuesday, the USD came under pressure after S&P Global surprisingly reported weak preliminary US PMI numbers for April. The Manufacturing PMI dropped below the 50.0 threshold, signalling a contraction in the sector, and the Services PMI fell sharply to 50.9.

In the same session, the Pound Sterling delivered a sharp upside move after the S&P Global/CIPS reported a strong United Kingdom preliminary PMI report for April. Surprisingly, the Services PMI jumped to 54.9 from the prior reading of 53.1. Investors had forecasted the Services PMI to drop slightly to 53.0. On the contrary, the preliminary Manufacturing PMI surprisingly dropped below the 50.0 threshold that separates expansion from contraction after being in the expansion territory since January. The factory PMI fell sharply to 48.7 from expectations and the prior reading of 50.3.

The agency also showed that new business volumes increased across the private sector as a whole in April. “The rate of growth was the strongest since May 2023, but the expansion was centred on the service economy as manufacturers saw a moderate downturn in order books.”

Strong new business volumes usually indicate an upbeat consumer spending outlook, which could boost inflationary pressures and allow the Bank of England (BoE) to delay interest-rate cuts. The scenario bodes well for the Pound Sterling.

Daily digest market movers: Pound Sterling struggles to extend recovery

- The Pound Sterling struggles to extend recovery above 1.2450 as firm expectations for early rate cuts by the Bank of England offset the impact of the upbeat S&P Global/CIPS PMI report.

- While a rate cut is expected by the BoE is expected before the Federal Reserve (Fed), traders remain split between June and August policy meetings as the start of the easing cycle. "It is between June and August, we are leaning slightly towards August on the basis that one of the key things the Bank is looking at is services inflation," said James Smith, economist at ING Financial Markets. "If services inflation is a little bit stickier, I think that tilts the balance a little bit further towards August over June, but it's a pretty close call to be honest."

- Also, distinct commentaries from BoE policymakers keep the timing of the BoE’s first interest rate cut uncertain. Last week, BoE deputy governor Dave Ramsden said inflation could decline faster than the pace projected by the central bank in its latest forecasts. Ramsden remains confident that inflation will return to the 2% target in May and will remain there for the next three years.

- On the contrary, BoE policymaker Jonathan Haskel is worried about inflation remaining persistent due to tight labor market conditions. Haskel said, "The labour market is central to the inflation aspect." He added that he wants to see the job market easing further to be confident about inflation returning to the 2% target, reported Reuters.

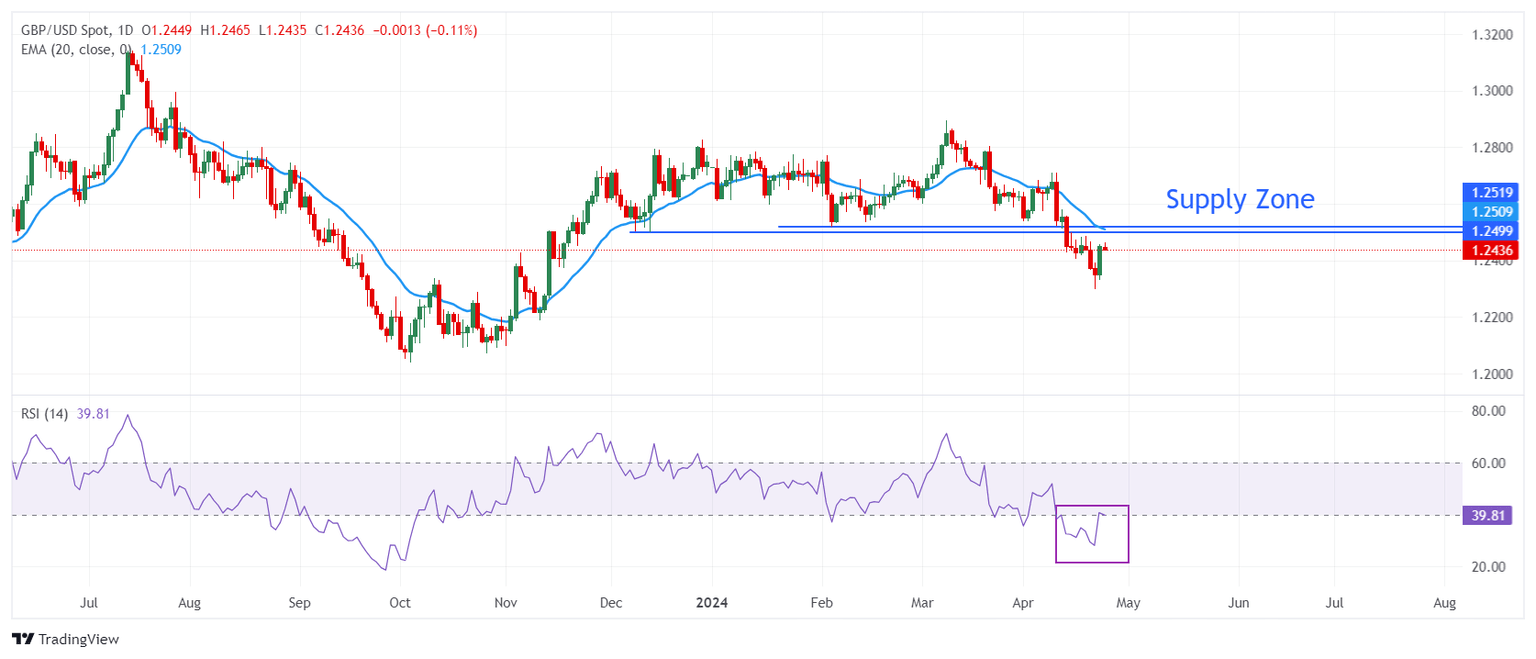

Technical Analysis: Pound Sterling recovery stalls near 1.2450

The Pound Sterling recovers sharply from a five-month low of 1.2300 against the US Dollar. The GBP/USD pair moved higher to 1.2450 on Tuesday and remains at around this level at the time of writing. The upside is limited near the supply zone, placed in a tight range of 1.2500-1.2520. The near-term outlook of the Cable remains weak as the 20-day Exponential Moving Average (EMA) at 1.2509 is declining.

The 14-period Relative Strength Index (RSI) rebounds to 40.00, which could act as a ceiling ahead. The speculation for a bullish reversal could emerge if the momentum oscillator decisively breaks above 40.00.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.