Pound Sterling advances slightly above 1.2700, UK inflation comes under spotlight

- The Pound Sterling holds strength near 1.2700 as investors turn risk-averse on firm Fed rate-cut hopes.

- April’s UK headline inflation is expected to return to near 2%.

- This week, investors will focus on the UK inflation for April and the FOMC minutes.

The Pound Sterling (GBP) trades close to an almost two-month high around 1.2700 in Monday’s American session. The GBP/USD pair strengthens as the US Dollar (USD) struggles for a firm recovery as financial markets remain confident that the Federal Reserve (Fed) will start lowering interest rates from the September meeting.

Investor confidence in Fed rate cuts has strengthened due to a decline in the United States Consumer Price Index (CPI) data and easing labor market conditions as suggested by recent Employment and Initial Jobless Claims data.

In spite of unsupportive economic indicators, Fed policymakers remain leaning towards a restrictive interest rate stance as a one-time decline in inflation is insufficient to build confidence that price pressures will sustainably return to the desired rate of 2%. In the New York session, Federal Reserve Vice Chair for Supervision Michael Barr said, "Q1 inflation was disappointing, did not provide the confidence needed to ease monetary policy". Barr advised allowing more time for a tight policy stance to do its job.

Going forward, investors will focus on the Federal Open Market Committee (FOMC) minutes, which will be published on Wednesday. The FOMC minutes are expected to show that policymakers emphasized keeping interest rates restrictive for a longer period.

Daily digest market movers: Pound Sterling exhibits firm-footing ahead of UK CPI

- The Pound Sterling exhibits strength near the round-level resistance of 1.2700 against the US Dollar. The GBP/USD pair remains upbeat as the appeal for risk-perceived assets has improved amid firm speculation that the Federal Reserve will start reducing interest rates from the September meeting. S&P 500 futures have posted decent gains in the European session.

- This week, the strength of the Pound Sterling will be tested on the grounds of the United Kingdom (UK) inflation data for April, which will be published on Wednesday. The UK Office for National Statistics (ONS) is expected to show that annual headline CPI declined to 2.1% in April from the prior reading of 3.2%. The core CPI, which excludes volatile items such as food and energy prices, is estimated to have softened to 3.7% in April from 4.2% a motnh earlier.

- The expected decline in inflationary pressures will boost expectations of rate cuts by the Bank of England (BoE). Investors expect that the BoE will start reducing interest rates from the June meeting. Market speculation for ECB rate cuts in June has strengthened as BoE Deputy Governor Ben Broadbent sees rate cuts likely in the summer. Broadbent added that rates will be less restrictive at some point.

- The scenario would be unfavorable for the Pound Sterling as policymakers will cut interest rates for the first time since March 2020. Historically, higher interest rates by the nation’s central bank reduce liquidity inflows into the economy, which strengthens the currency’s appeal.

- Before the inflation data is released, investors will focus on the commentary from BoE Governor Andrew Bailey on the interest rate outlook, which is scheduled for Tuesday.

Technical Analysis: Pound Sterling remains firm near 1.2700

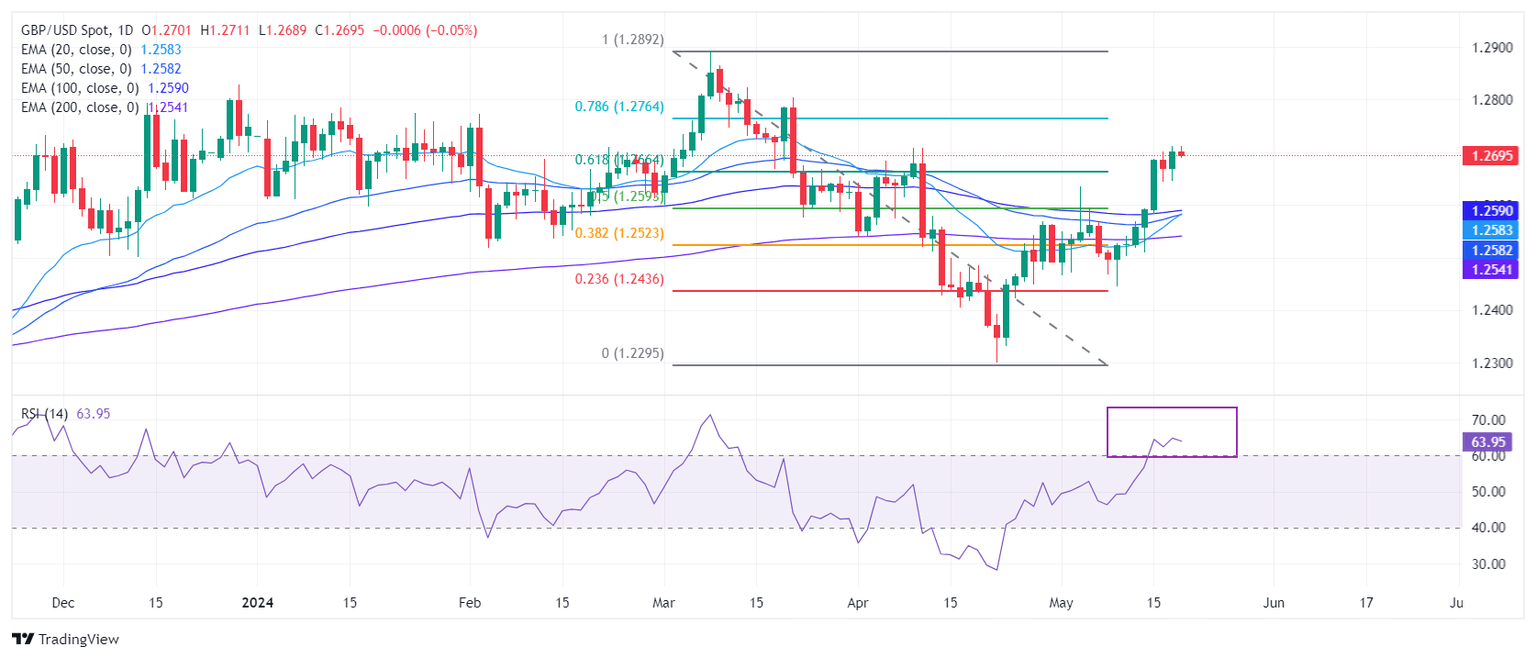

The Pound Sterling advances to an almost two-month high near 1.2700. The GBP/USD pair is expected to remain in the bullish trajectory as all short-to-long-term Exponential Moving Averages (EMAs) are sloping higher, suggesting a strong uptrend. The Cable has retraced 61.8% of losses from March’s high of around 1.2900.

The 14-period Relative Strength Index (RSI) has shifted into the bullish range of 60.00-80.00, suggesting that the momentum has leaned toward the upside.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.