Pound Sterling extends sell-off following BoE meeting

- The Pound Sterling prints red bars on traders’ screens after the Bank of England meeting.

- The BoE leaves interest rates unchanged and keeps the same 7-2 split in voting.

- The language of the accompany statement and minutes tilts marginally dovish weighing on GBP.

- Recent inflation data was mixed despite the headline rate hitting the BoE’s 2.0% target.

The Pound Sterling (GBP) trades over a quarter of a percent lower on Thursday in the 1.2670s against the US Dollar (USD), after the Bank of England (BoE) policy meeting, a key event for GBP pairs.

Pound Sterling weakens after BoE decision

The Pound Sterling continues falling after the BoE publishes its policy decision on Thursday. The BoE, which sets interest rates in the UK, left its policy intererst rate unchanged at 5.25% at the meeting. The decision was agreed by a vote of 7 for a hold, and 2 for a cut, the same as the previous meeting.

The accompanying statement, however, said the decision was "finely balanced" suggesting there might have been a fair risk of the BoE cutting rates instead.

The BoE mentioned the August decision and how new information "affects the assessment that the risks from inflation persistence are receding", which was a hint the bank could be planning to cut interest rates in August, according to Yohay Elam, Product Manager at FXStreet.

Higher interest rates tend to appreciate the Pound by attracting more foreign capital inflows; the opposite is true of lower interest rates. The decisions of the BoE, therefore, heavily impact the Pound.

Downside for the Pound Sterling is likely to remain capped, however, by the BoE's inflation forecast for H2 which it sees rising up to 2.5% YoY.

The decison was in line with the market consensus which was for no rate cuts and a 7-2 split in the voting, with 2 favoring a cut. It is very rare for the BoE to change interest rates during an election campaign. BoE Governor Andrew Bailey himself said a rate cut at the meeting could be “neither ruled out nor a fait accompli”.

Despite UK Consumer Price Index (CPI) inflation data showing a fall to the BoE’s 2.0% target in May, higher inflation in other pockets of the economy continue to keep policymakers wary of cutting, with markets not pricing in a first rate cut until August.

“Over in the UK, there was another important milestone yesterday, as CPI inflation fell exactly in line with the Bank of England’s target, reaching +2.0% in May as expected,” says Jim Reid, Global Head of Macro Research at Deutsche Bank. “However, some of the details of the report were less favorable, as core CPI was higher at +3.5%, while services inflation surprised on the upside at +5.7% (vs. +5.5% expected), and that’s one of the stickier categories. As a result, investors dialed back the chance that the Bank of England would cut rates by the August meeting, with the chance falling from 52% to 34% by the close.”

On Thursday morning, Swiss Franc traders were handed some volatility to play with after the Swiss National Bank (SNB) decided to cut interest rates for the second time in a row to 1.25%. The decision, however, was widely expected, with two-thirds of economists polled by Reuters prior to the event saying they thought the SNB would cut. Still, the SNB decision does not particularly serve as an accurate barometer of what to expect from the BoE.

Technical Analysis: Pound Sterling lacks direction after breakdown runs out of steam

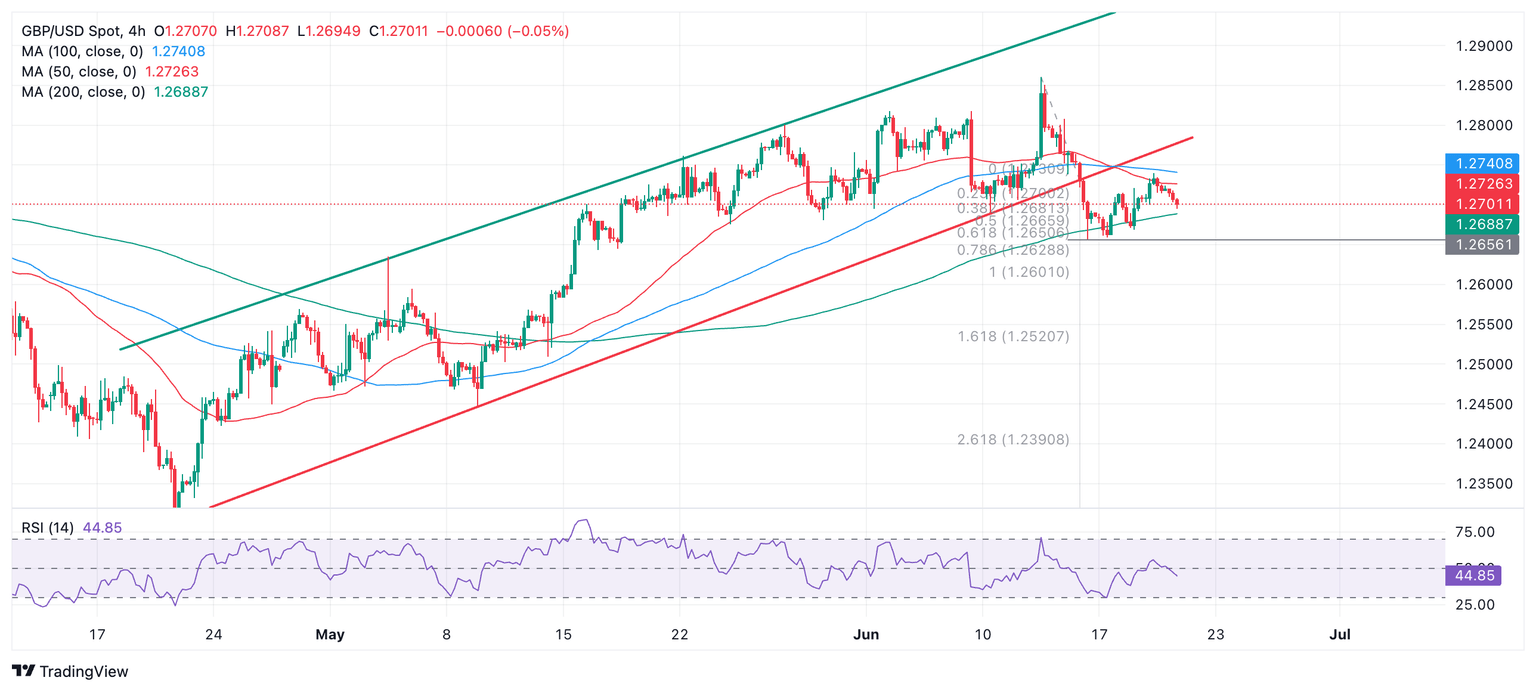

GBP/USD is pulling back after breaking below the (red) lower trendline of a rising channel. From a technical perspective, the trend in the short-term is unclear and the pair could either break lower or just as well recover.

GBP/USD Daily Chart

The sharp decline which saw GBP/USD break out of the bottom of the channel could be a sign the short-term trend is reversing. However, the lack of follow-through lower after the break cautions traders against getting too bearish.

A break below the 1.2657 level (June 14 low) would provide more evidence of a change to a more bearish short-term trend, with an initial target coming in at 1.2601, the extension of the height of the move prior to the break below the channel, extrapolated lower.

On the other hand, a break above the 100 Simple Moving Average (SMA) at 1.2740 could indicate the resumption of the prior uptrending bias, with a target at the underside of the channel at circa 1.2775.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.