Pound Sterling declines despite US PPI grows moderately

- The Pound Sterling retreats as its outlook remains weak amid higher UK gilt yields.

- Investors await the UK-US CPI data for December on Wednesday.

- The Fed is expected to cut interest rates only once this year.

The Pound Sterling (GBP) surrenders its intraday gains and turns negative against the US Dollar (USD) in Tuesday’s North American session. The GBP/USD declines to near 1.2160 even though the United States (US) Producer Price Index (PPI) report showed that the producer inflation grew at a slower-than-expected pace in December. A gradual-than-projected growth in producer inflation has weighed on the US Dollar by forcing the US Dollar Index (DXY) to surrender intraday gains and flattens near 109.50.

The report showed that the annual headline PPI rose by 3.3%, faster than November's reading of 3.0% but slower than estimates of 3.4%. The core PPI - which excludes volatile food and energy items - grew by 3.5% against 3.4% in November. Economists expected the core PPI to have accelerated to 3.8%. Month-on-month headline PPI rose moderately by 0.2%, while the core PPI remained flat.

However, the broader outlook of the Greenback remains strong amid firm expectations that the Federal Reserve (Fed) will deliver less interest rate cuts this year.

Strategists at Barclays have revised down their expectations for the number of interest rate cuts by the Fed this year. The bank expects the Fed to deliver only one cut this year, compared to two previously, based on stronger-than-expected US labor market data and persistent inflation expectations.

Meanwhile, investors await the US CPI data for December, which will be released on Wednesday. Year-on-year headline inflation is expected to have accelerated to 2.8% from 2.7% in November, with core reading growing steadily by 3.3%.

Signs of stubborn price pressures could accelerate expectations that the Fed will avoid cutting interest rates this year. However, a slowdown in inflationary pressures is unlikely to boost the Fed’s dovish bets, as investors expect incoming policies under Trump’s administration, such as immigration controls, tax cuts, and tariff hikes, to fuel the growth rate.

Daily digest market movers: Pound Sterling falls back as higher UK gilt yields keep downside bias unabated

- The Pound Sterling resumes its downside journey in Tuesday's European session due to rising yields on the United Kingdom (UK) gilts. The 30-year UK gilt yields have risen to near 5.47%, the highest since 1998, due to multiple tailwinds, such as higher uncertainty about incoming trade policies under the administration of United States (US) President-elect Donald Trump, persistent inflationary pressures and slower growth expectations in Britain.

- A healthy rise in UK gilt yields has resulted in a discomforting situation for UK Chancellor of the Exchequer Rachel Reeves, who was already facing backlash from employers for raising their contribution to National Insurance (NI) and leaving little fiscal headroom if the situation turns upside down.

- Market participants expect the UK government to turn to foreign financing to fund routine spending to avoid rising domestic borrowing costs. However, the British finance ministry maintains its non-negotiable promise to rely on borrowing only for investment, not for addressing day-to-day spending.

- Meanwhile, investors shift their focus to the UK Consumer Price Index (CPI) data for December, which will be released on Wednesday. Investors will pay close attention to the UK inflation data as it will drive market expectations for the Bank of England’s (BoE) likely interest rate action in the February policy meeting.

- Analysts at UBS expect the BoE to cut interest rates next month, with more reductions remaining in the pipeline later this year. UBS said that higher borrowing costs, which are flowing into the real economy, are “tightening financial conditions”. The Swiss bank added, “Inflationary pressures are present but fading, so a cut in February, with more later this year, remains the base case.”

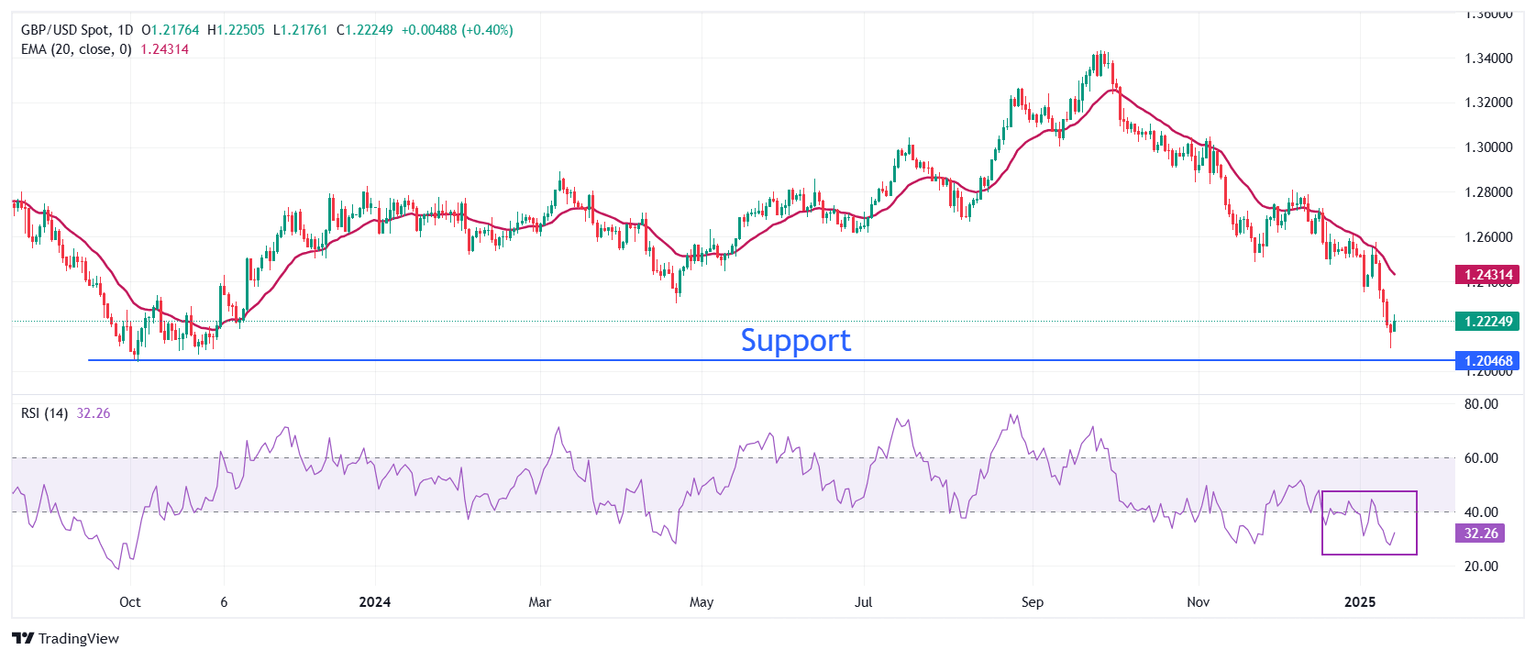

Technical Analysis: Pound Sterling weakens as 20-day EMA declines

The Pound Sterling gives up intraday gains and falls below 1.2200 against the US Dollar in Tuesday’s North American session. Earlier, the GBP/USD pair rebounded after refreshing its more-than-a-year low to near 1.2100 on Monday. The outlook for Cable remains weak as the vertically declining 20-day Exponential Moving Average (EMA) near 1.2430 suggests that the near-term trend is extremely bearish.

The 14-day Relative Strength Index (RSI) rebounds slightly after diving below 30.00 as the momentum oscillator turned oversold. However, the broader scenario remains bearish until it recovers inside the 20.00-40.00 range.

Looking down, the pair is expected to find support near the October 2023 low of 1.2050. On the upside, the 20-day EMA will act as key resistance.

Economic Indicator

Producer Price Index ex Food & Energy (MoM)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Tue Jan 14, 2025 13:30

Frequency: Monthly

Actual: 0%

Consensus: 0.3%

Previous: 0.2%

Source: US Bureau of Labor Statistics

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.