Pound Sterling bounces back strongly despite BoE signals rate-cut ahead

- The Pound Sterling finds support near 1.2620 against the US Dollar.

- UK’s economic outlook appears to be uncertain ahead of UK elections.

- The BoE is expected to start lowering interest rates in August.

The Pound Sterling (GBP) gains ground against the US Dollar (USD) and trades around 1.2680 in Monday’s early New York session after facing a sharp sell-off last week. The GBP/USD pair rebounds as the upside move in the US Dollar Index (DXY), which tracks the Greenback’s value against six major peers, appears to have paused and struggles to extend upside above the immediate resistance of 106.00.

However, the near-term outlook of the US Dollar has strengthened after the preliminary S&P Global Purchasing Managers Index (PMI) report for June showed that activities in the manufacturing and the service sector surprisingly expanded at a faster pace than expected. The report showed that the Composite PMI surprisingly jumped to 51.7. Investors expected the PMI data to decline to 51.0 from the prior release of 51.3.

The report also lifted the mood of Federal Reserve (Fed) policymakers as it said, “Selling price inflation has meanwhile cooled again after ticking higher in May, down to one of the lowest levels seen over the past four years. Historical comparisons indicate that the latest decline brings the survey’s price gauge into line with the Fed’s 2% inflation target.”

Daily digest market movers: Pound Sterling adds significant gains against US Dollar

- The Pound Sterling performs strongly against its major peers, except the Euro, even though financial markets expect that the Bank of England (BoE) will start reducing interest rates from the August meeting. Market speculation for the BoE to begin lowering its key borrowing rates in August was boosted by a slightly dovish monetary policy statement commentary on the interest rate outlook.

- In the monetary policy statement, policymakers said the decision to hold interest rates at 5.25% was “finely balanced”, which investors took it as a signal that rate cuts are around the corner.

- Market expectations for BoE rate cuts have also strengthened as annual headline inflation has returned to the desired rate of 2%. In the press conference after the June meeting, BoE Governor Andrew Bailey acknowledged, “It’s good news that inflation has returned to our 2% target.” And “officials want to be sure that inflation should stay low which is why we have decided to leave interest rates unchanged.

- Though price pressures have returned to 2%, officials worry about the risks of persistent service inflation. In May, service inflation decelerated at a slower pace to 5.7% from the prior release of 5.9%. Investors expected the underlying inflation to have declined to 5.5%.

- Meanwhile, investors have become concerned over the United Kingdom’s (UK) economic outlook after the preliminary S&P Global/CIPS PMI report showed that the overall activity unexpectedly slowed in the service sector in June. However, the Manufacturing PMI expanded at a faster pace than estimates and the former release. "The slowdown in part reflects uncertainty around the business environment in the lead-up to the general election, with many firms seeing a hiatus in decision-making pending clarity on various policies," the report said.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.42% | -0.28% | -0.22% | -0.13% | -0.17% | -0.18% | -0.08% | |

| EUR | 0.42% | 0.16% | 0.27% | 0.34% | 0.27% | 0.29% | 0.42% | |

| GBP | 0.28% | -0.16% | 0.06% | 0.17% | 0.11% | 0.13% | 0.26% | |

| JPY | 0.22% | -0.27% | -0.06% | 0.09% | 0.08% | 0.08% | 0.14% | |

| CAD | 0.13% | -0.34% | -0.17% | -0.09% | -0.03% | -0.04% | 0.08% | |

| AUD | 0.17% | -0.27% | -0.11% | -0.08% | 0.03% | 0.02% | 0.15% | |

| NZD | 0.18% | -0.29% | -0.13% | -0.08% | 0.04% | -0.02% | 0.12% | |

| CHF | 0.08% | -0.42% | -0.26% | -0.14% | -0.08% | -0.15% | -0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling slides below 61.8% Fibo retracement support

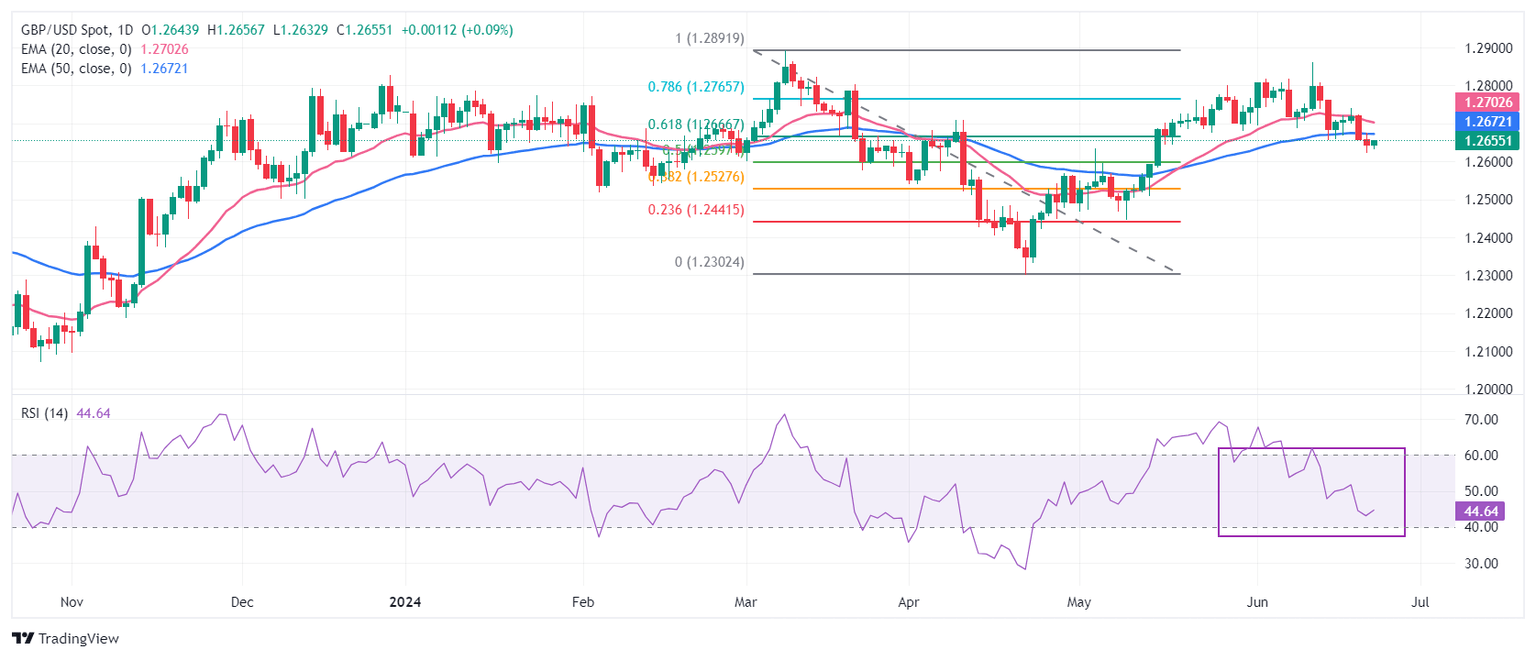

The Pound Sterling finds temporary support near 1.2620 against the US Dollar. However, the near-term appeal is uncertain as the GBP/USD pair has slipped below the 20-day and 50-day Exponential Moving Averages (EMAs), which trade around 1.2700 and 1.2670, respectively.

The Cable also declines below the 61.8% Fibonacci retracement support at 1.2667, plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300.

The 14-day Relative Strength Index (RSI) falls back into the 40.00-60.00 range, indicating that the upside momentum has faded.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.