Pound Sterling plunges against US Dollar on Fed’s hawkish outlook

- The Pound Sterling declines to 1.2660 against the USD as the Fed signals only one rate cut this year.

- Fed policymakers said they want to see inflation declining for months before considering rate cuts.

- UK’s steady wage growth has raised concerns of persistent inflation in the services sector.

The Pound Sterling (GBP) weakens further to near 1.2660 against the US Dollar (USD) in Friday’s American session as the latter rallies. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, extends its upside to 105.75. The USD Index rises for a second consecutive day, as the hawkish stance of the Federal Reserve (Fed) on the interest rate outlook has outweighed the impact of the soft United States (US) Consumer Price Index (CPI) and Producer Price Index (PPI) reports for May.

The US PPI report, released on Thursday, showed that the monthly headline PPI declined by 0.2% due to weak gasoline prices, and the core producer inflation, which excludes volatile food and energy prices, was flat.

Cooler consumer and producer inflation reports suggest that the core Personal Consumption Expenditure Price Index (PCE) reading, which is the Fed’s preferred inflation measure, would also exhibit softening inflationary pressures. This has boosted expectations of early rate cuts by the Fed. 30-day Fed Funds futures pricing data shows that traders see a 65% chance that there will be a rate-cut decision in September, according to the CME FedWatch Tool. The probability has significantly increased from the 50.5% recorded a week ago.

On Wednesday, the Fed signaled only one rate cut this year against a prior projection of three after leaving interest rates unchanged in the range of 5.25%-5.50%. Policymakers scaled back a number of rate cuts in the latest projections amid concerns that progress in the disinflation progress has slowed. In the press conference after the interest rate decision, Fed Chair Jerome Powell said the soft inflation report for May is encouraging but also that officials want to see price pressures decline for months to build confidence for rate cuts. Powell added that policymakers would respond quickly to rate cuts if labor market conditions start easing.

Meanwhile, investors have got a fresh outlook on interest rates from Cleveland Fed Bank President Loretta Mester in an interview with CNBC after the blackout period. Mester said inflation has resumed its journey towards the 2% target after stalling. However, inflation needs to soften further from here for them to consider rate cuts.

Daily digest market movers: Pound Sterling slides further amid uncertainty ahead of BoE's policy decision

- The Pound Sterling exhibits a weak performance against North American and other European currencies but is upbeat against most Asia-Pacific peers in Friday’s London session. The near-term outlook of the GBP is expected to remain uncertain as investors shift focus to the Bank of England’s (BoE) monetary policy meeting, which is scheduled for Thursday.

- The BoE is widely anticipated to keep interest rates steady at 5.25%. Therefore, investors will majorly focus on the number of policymakers who will vote in favor of a rate-cut decision. In the May meeting, BoE Deputy Governor Dave Ramsden joined policymaker Swati Dhingra and voted for lowering interest rates by 25 basis points (bps) to 5.0%. In the press conference, BoE Governor Andrew Bailey acknowledged significant progress in inflation declining to 2% but remarked, “We are not yet at a point where we can cut the base rate," EuroNews reported.

- Currently, financial markets are split between August or September meetings regarding when the BoE could start reducing interest rates. Before the BoE outcome, investors will focus on the CPI report for May, which will be published on Wednesday. UK headline inflation appears to be on course to return to the desired rate of 2%. However, service inflation that is driven by wage growth continues to be a major concern for policymakers.

- The latest UK Employment report showed that Average Earnings, which is a wage inflation measure, grew steadily in the three months ending April. The pace at which wages are growing is significantly higher than what is needed to bring inflation down to BoE’s target.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| GBP | USD | EUR | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | -0.77% | -0.19% | -0.60% | -0.52% | -0.20% | -0.02% | -1.05% | |

| USD | 0.77% | 0.57% | 0.16% | 0.24% | 0.58% | 0.79% | -0.29% | |

| EUR | 0.19% | -0.57% | -0.39% | -0.35% | 0.00% | 0.21% | -0.85% | |

| JPY | 0.60% | -0.16% | 0.39% | 0.07% | 0.41% | 0.61% | -0.43% | |

| CAD | 0.52% | -0.24% | 0.35% | -0.07% | 0.35% | 0.54% | -0.52% | |

| AUD | 0.20% | -0.58% | 0.00% | -0.41% | -0.35% | 0.21% | -0.87% | |

| NZD | 0.02% | -0.79% | -0.21% | -0.61% | -0.54% | -0.21% | -1.05% | |

| CHF | 1.05% | 0.29% | 0.85% | 0.43% | 0.52% | 0.87% | 1.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling drops to near 61.8% Fibo support

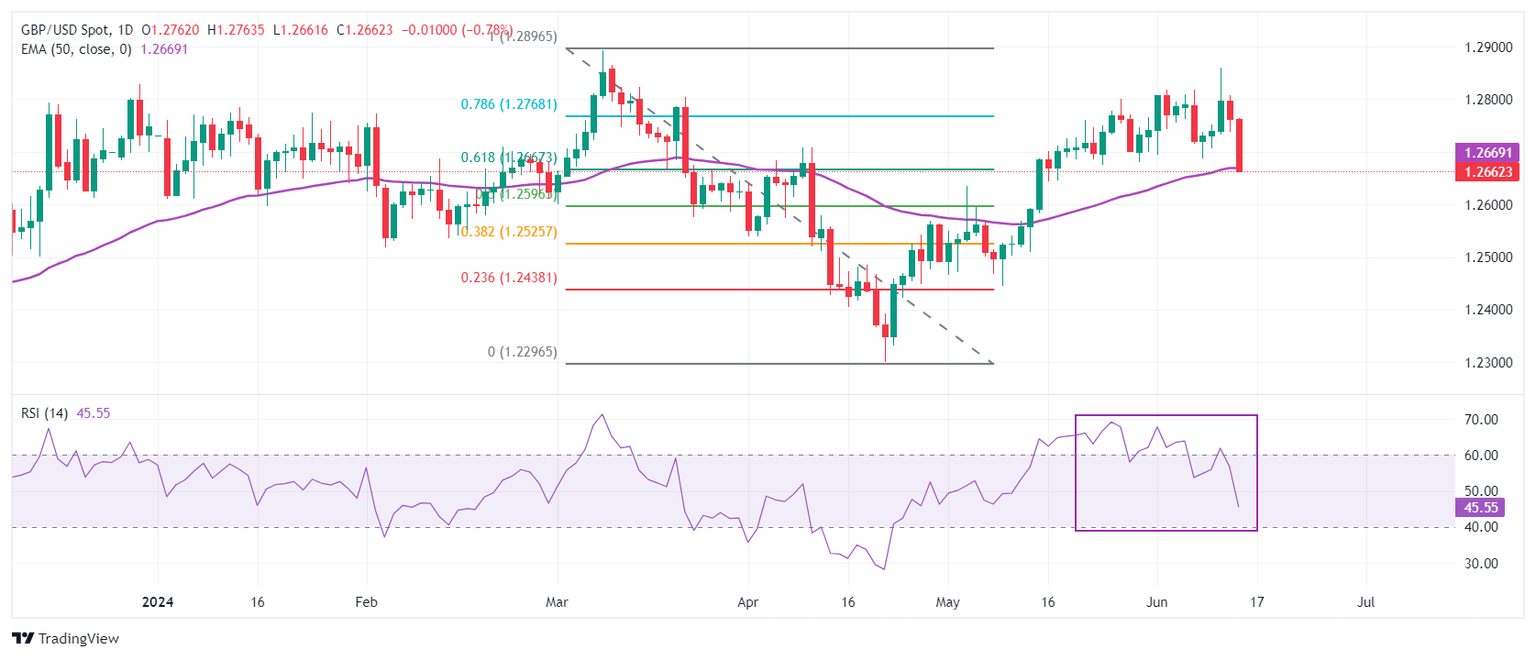

The Pound Sterling falls to a three-week low near 1.2660 against the US Dollar. The GBP/USD pair faces selling pressure while attempting to establish above the 78.6% Fibonacci retracement support (plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300) at 1.2770 and has now declined to near 61.8% Fibo support at 1.2667.

The Cable has declined to near the 50-day Exponential Moving Average (EMA), which trades around 1.2730, suggesting that near-term outlook is uncertain

The 14-period Relative Strength Index (RSI) falls back into the 40.00-60.00 range, indicating that the upside momentum has faded.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Next release: Thu Jun 20, 2024 11:00

Frequency: Irregular

Consensus: 5.25%

Previous: 5.25%

Source: Bank of England

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.