Pound Sterling recovers losses as weak US Retail Sales improve market sentiment

- Pound Sterling recovers as weak US Retail Sales improve market mood.

- The UK economy is in a technical recession after contracting in the last quarter of 2023.

- The BoE may consider aggressive rate cuts due to easing inflation, slowing wage growth, and poor economic outlook.

The Pound Sterling (GBP) rebounds from the day's low as downbeat United States Retail Sales data for January has improved market sentiment. The US Census Bureau has reported that Retail Sales contracted significantly by 0.8% against the consensus of a moderate decline of 0.1%. In December, the economic data was expanded by 0.6%. The US Dollar Index (DXY) falls vertically to 104.30

In the European session, the Pound Sterling faced pressure as the United Kingdom Office for National Statistics (ONS) showed that the economy was in a technical recession in the second half of 2023. The preliminary Q4 Gross Domestic Product (GDP) data contracted by 0.3% after registering a de-growth of 0.1% in the July-September quarter. This means the UK economy has contracted for the second straight quarter in a row – the definition of a technical recession. The data could also ignite expectations of early rate cuts by the Bank of England (BoE), which may be keen to introduce growth-stimulating policies.

The broader appeal for the Pound Sterling is downbeat as most economic indicators, apart from the economic contraction, point to aggressive rate cuts by the BoE to avoid further contraction. The Pound Sterling tends to face foreign outflows when expectations for the BoE turning dovish escalate.

The consumer price inflation remained steady in January while investors forecasted it to accelerate further. Also, BoE Governor Andrew Bailey sees price pressures taming to the required target by Spring.

While wage growth and service inflation are still skewed to the upside, they are unfavorable for achieving the 2% inflation target. However, a moderate decline in wage growth momentum is visible.

Daily Digest Market Movers: Pound Sterling rebounds while US Dollar plummets

- Pound Sterling recovers against the US Dollar after the release of the downbeat US Retail Sales data.

- The US Retail Sales were down by 0.8% amid lower receipts at gasoline stations and weak automobile sales.

- However, weak Retail Sales data has failed to lift up expectations of Federal reserve (Fed) rate-cut in May policy meeting.

- On the United Kingdom front, the ONS has reported that the economy contracted by 0.3% in the last quarter of 2023. Investors anticipated a deceleration in growth by 0.1%.

- The UK GDP also contracted in the third quarter of 2023, indicating the economy meets the criteria for a technical recession.

- This has escalated hopes of early rate cuts by the Bank of England as the economy desperately needs the stimulus provided by lower borrowing costs.

- This week, the expectations for an early unwinding of the restrictive policy stance by the Bank of England were already prompted by a steep slowdown in wage growth and steady annual inflation figures.

- Meanwhile, the inflation outlook softened on Wednesday after BoE Governor Andrew Bailey said inflation will come down to the target by spring.

- Andrew Bailey warned that wage growth and service inflation are still too high to be consistent with the central bank’s target of 2%.

- Bailey mentioned that policymakers would support rate cuts only after getting evidence that wage growth is receding.

- The monthly Manufacturing Production for December rose steadily by 0.8% MoM, while investors anticipated a stagnant performance. On an annual basis, the economic data grew at a higher pace of 2.3% against expectations of 0.6% and the prior reading of 1.9%.

- Monthly Industrial Production was up by 0.6% against 0.5% growth in November. Investors anticipated a decline of 0.1%. Surprisingly, the annual factory data rose by 0.6% while investors forecasted a contraction of 0.1%.

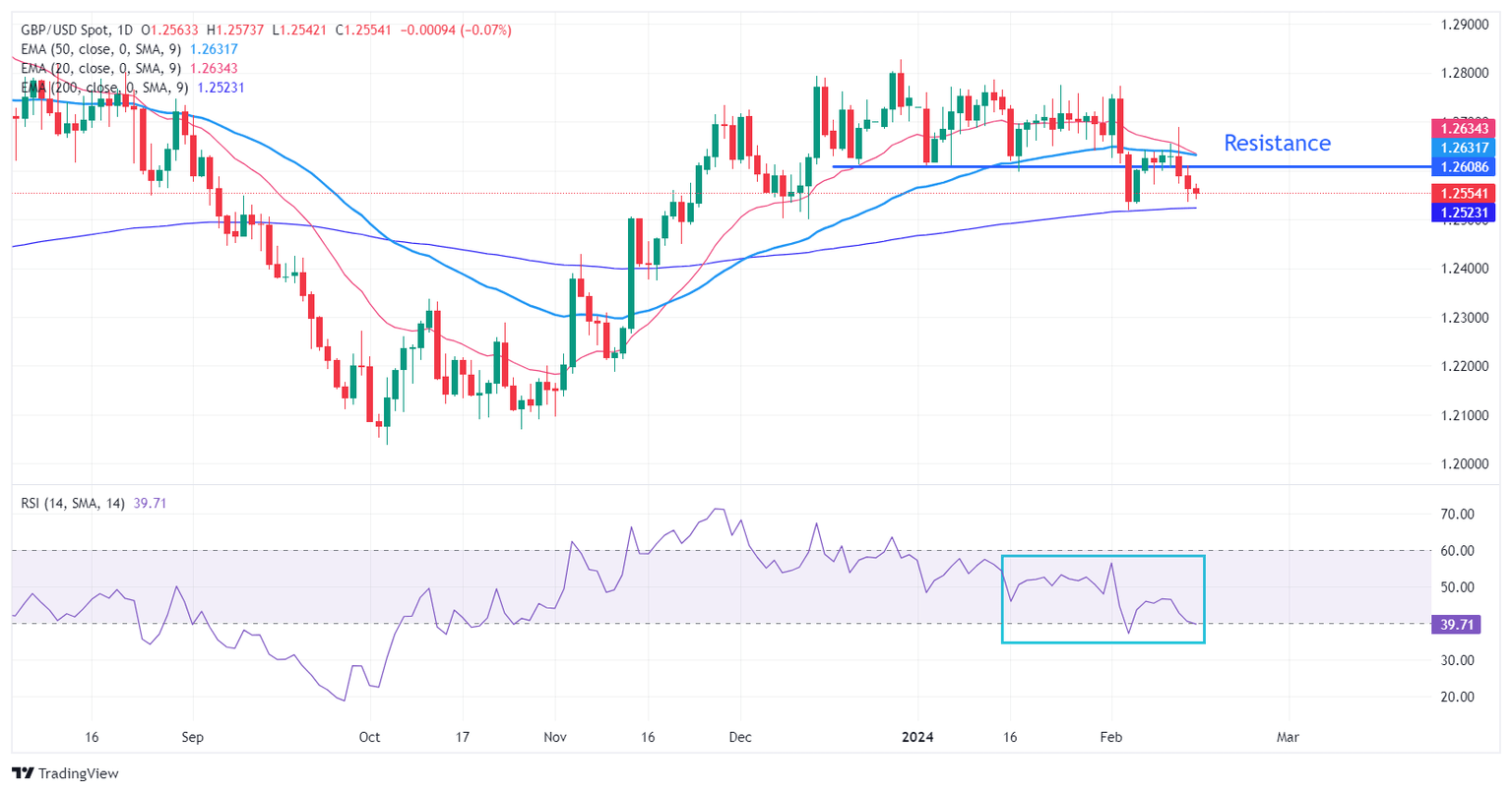

Technical Analysis: Pound Sterling finds interim support near 1.2540

Pound Sterling rebounds to day's high near 1.2570 against the US Dollar, however, the broader appeal is still bearish. The GBP/USD pair is expected to resume its downside journey toward the 200-day Exponential Moving Average (EMA), which trades around 1.2520. More downside seems likely as the 20 and 50-day EMAs are on the verge of delivering a bearish crossover.

The 14-period Relative Strength Index (RSI) struggles to hold above 40.00. Failing to hold the same would trigger a bearish momentum.

Pound Sterling FAQs

What is the Pound Sterling?

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

How do the decisions of the Bank of England impact on the Pound Sterling?

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

How does economic data influence the value of the Pound?

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

How does the Trade Balance impact the Pound?

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.