Pound Sterling clings to gains above 1.2700 despite weak preliminary UK PMI

- The Pound Sterling trades close to a two-month high near 1.2750 as BoE rate-cut prospects fade for June fade.

- A slower-than-expected decline in the UK inflation weakens the BoE rate-cut case for June.

- The US Dollar weakens as investors already priced in hawkish communication from FOMC minutes.

The Pound Sterling (GBP) holds strength above 1.2700 in Thursday’s New York session. The GBP/USD pair strengthens as traders pare bets that were leaned towards the Bank of England (BoE) shifting to policy normalization in the June meeting after remaining hawkish for more than two years on interest rates. The expectations favoring the BoE that it will start reducing interest rates from the June meeting diminished after the Consumer Price Index (CPI) report for April showed that inflation softened at a slower pace than expected.

According to the CPI report, annual headline and core inflation declined to 2.3% and 3.9%, respectively. The inflation measure that dashed hopes of BoE rate cuts in June is the service price index, which declined modestly to 5.9% from the prior reading of 6.0%. UK’s stubborn service inflation has remained a major barrier in the progress of disinflation, which is driven by wage growth.

Meanwhile, investors turned uncertain towards the United Kingdom's (UK) economic outlook after the release of the weak preliminary PMI data for May. The S&P Global/CIPS PMI report shows that the Composite PMI dropped at a faster pace to a two-month low at 52.8 from the estimates of 54.0 and the prior reading of 54.1. The sharp decline in the Composite PMI was driven by weak Services PMI, which fell to a six-month low at 52.9 from the consensus of 54.7 and the former reading of 55.0. The Manufacturing PMI rose above the 50.0 threshold that separates expansion from contraction and grew strongly to 51.3. Economists forecasted that the factory PMI would have increased to 49.5 from 49.1 in April.

Daily digest market movers: Pound Sterling strengthens on multiple tailwinds

- The Pound Sterling exhibits strength against the US Dollar as investors expect that rate cuts from the BoE will be delayed due to a slower-than-expected decline in the UK inflation for April. Before the June meeting, the BoE will be having one more employment and inflation data, which could strengthen the case of a rate cut if it comes in line with the central bank’s forecasts.

- Sterling is expected to remain in action on Friday, too, as the UK Office for National Statistics (ONS) will report the Retail Sales data for April. The Retail Sales data represents household spending, which provides significant cues about the inflation outlook. On a month-on-month basis, Retail Sales are estimated to have declined by 0.4% after remaining stagnant last month. Annually, Retail Sales are expected to have contracted by 0.2% against a growth of 0.8% in March.

- On the other side of the Atlantic, the US Dollar fails to hold gains, which were induced by fears that progress in the United States inflation declining towards the 2% target has stalled. The Federal Open Market Committee (FOMC) minutes for the May meeting, released on Wednesday, suggested that the confidence needed for them to consider rate cuts has been dented due to disappointment from recent inflation data.

- Meanwhile, the US Department of Labor has reported that Initial Jobless Claims were lower-than-expected in the week ending May 17. Weekly jobless claims were 215K against the consensus of 220K. For the last two weeks, the number of individuals claiming jobless benefits has remained more than expected, which has indicated that the labor market strength is easing.

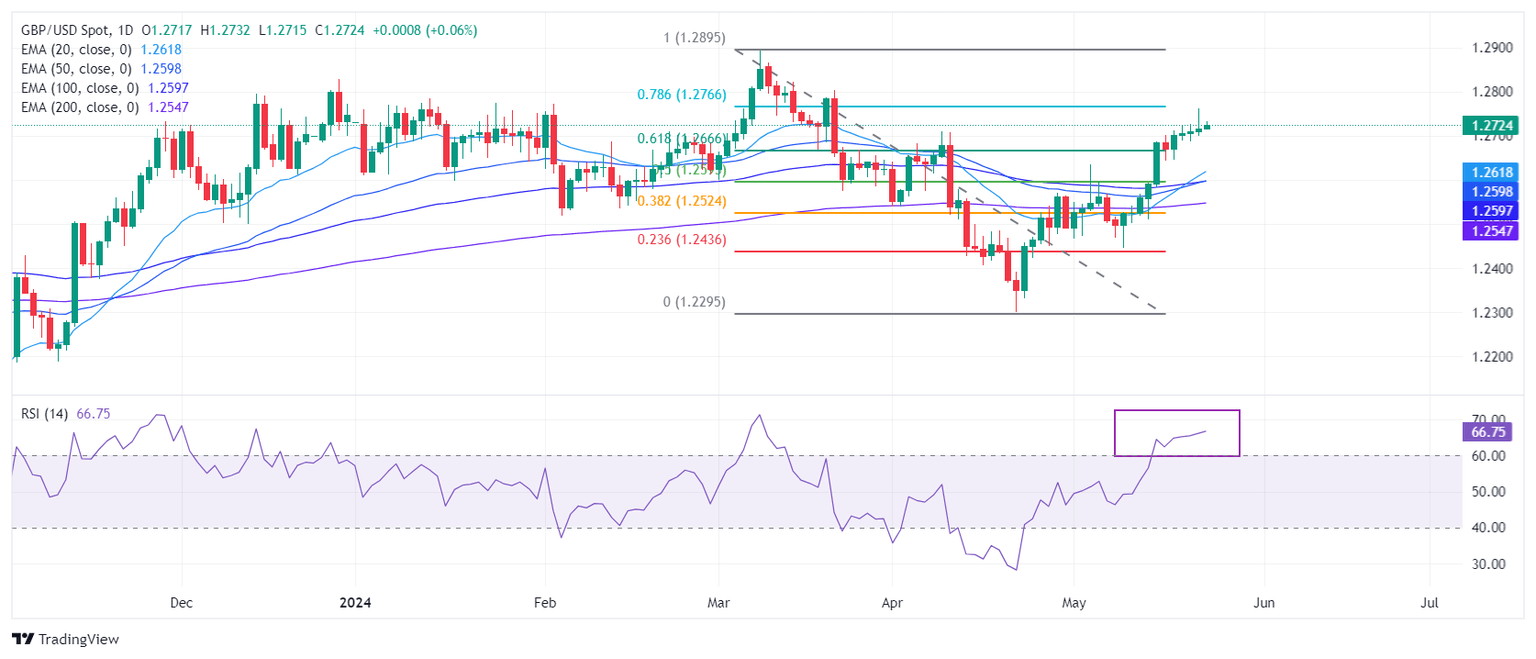

Technical Analysis: Pound Sterling remains firm above 1.2700

The Pound Sterling extends its winning spell for the fifth trading session on Thursday due to weak UK Services PMI data for May. Though, the GBP/USD pair is still comfortably stabilized above the 61.8% Fibonacci retracement (plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300) at 1.2667.

The Cable is expected to remain in the bullish trajectory as all short-to-long-term Exponential Moving Averages (EMAs) are sloping higher, suggesting a strong uptrend.

The 14-period Relative Strength Index (RSI) has shifted into the bullish range of 60.00-80.00, suggesting that the momentum has leaned toward the upside.

Economic Indicator

Core Consumer Price Index (YoY)

The United Kingdom (UK) Core Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. The YoY reading compares prices in the reference month to a year earlier. Core CPI excludes the volatile components of food, energy, alcohol and tobacco. The Core CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Last release: Wed May 22, 2024 06:00

Frequency: Monthly

Actual: 3.9%

Consensus: 3.6%

Previous: 4.2%

Source: Office for National Statistics

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.