Pound Sterling bounces back as steady UK wage growth diminish BoE rate-cut bets

- The Pound Sterling rebounds to 1.2750 as steady UK wage growth undermines BoE rate-cut bets for the August meeting.

- UK Average Earnings Excluding bonuses rose steadily by 6%.

- Investors see the Fed arguing to maintain a restrictive framework for longer.

The Pound Sterling (GBP) revives intraday losses and recovers to 1.2740 in Tuesday’s New York session. The GBP/USD pair rebounds despite poor United Kingdom (UK) Employment data for three months through April and a firm US Dollar (USD) amid expectations that the Federal Reserve (Fed) will delay interest-rate cuts.

The UK Office for National Statistics (ONS) reported that the labor market recorded a drawdown for the fourth time in a row. Employment fell by 140,000 workers in the three months to April, less than the 177,000 decline in employment seen in the January-March period. The ILO Unemployment Rate rose to 4.4%, higher than the expected 4.3%, which is the highest reading in more than two years. The labor market data indicates that firms struggle to bear the consequences of the Bank of England's (BoE) higher interest rates.

However, the negative impact of poor labor demand on BoE's restrictive monetary policy framework has been offset by steady wage growth in the February-April period. Average Earnings Excluding Bonuses, which is a wage inflation measure, grew in line with estimates and the prior release of 6.0%. Also, Average Earnings Including bonuses grew steadily by 5.9%, upwardly revised from 5.7% and higher than the estimates of 5.7%. High wage growth could hamper the BoE's move towards lowering interest rates.

Daily digest market movers: Pound Sterling recovers albeit soft UK Employment

- The Pound Sterling rebounds to near 1.2740 against the US Dollar despite the appeal of the latter remains firm. The US Dollar rises as investors turn cautious ahead of the United States (US) Consumer Price Index (CPI) data for May and the Federal Reserve’s interest rate decision, which are scheduled for Wednesday. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, approaches a monthly high near 105.40.

- Monthly headline inflation is expected to grow at a slower pace of 0.1% from 0.3% in April, with annual figures growing steadily by 3.4%. In the same period, the annual core CPI, which excludes volatile food and energy prices, is expected to have decelerated to 3.5% from the former release of 3.6%, with monthly figures maintaining the current growth rate of 0.3%.

- Steady or higher-than-expected inflation figures would force Fed policymakers to advocate for maintaining the current interest rate framework for a longer period. Soft figures, on the other hand, would reinforce their confidence that the progress in the disinflation process has not stalled.

- The major event for investors will be the Fed’s interest rate decision, in which officials are expected to keep rates on hold for the seventh straight time. Policymakers said they won't lower rates until they get sufficient evidence that inflation will sustainably return to the desired rate of 2%. Investors will keenly focus on Fed Chair Jerome Powell’s press conference and the dot plot to get significant cues about the interest rate outlook.

- Currently, market speculation for Fed rate cuts for the entire year suggests that there will be only one rate cut this year, either in the November or December meeting. Meanwhile, investors’ expectations for the Fed reducing interest rates in the September meeting have diminished significantly.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| GBP | USD | EUR | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | 0.12% | 0.31% | 0.22% | 0.22% | 0.28% | 0.11% | 0.14% | |

| USD | -0.12% | 0.19% | 0.09% | 0.09% | 0.15% | -0.01% | 0.04% | |

| EUR | -0.31% | -0.19% | -0.08% | -0.09% | -0.02% | -0.19% | -0.14% | |

| JPY | -0.22% | -0.09% | 0.08% | -0.00% | 0.04% | -0.13% | -0.07% | |

| CAD | -0.22% | -0.09% | 0.09% | 0.00% | 0.06% | -0.11% | -0.08% | |

| AUD | -0.28% | -0.15% | 0.02% | -0.04% | -0.06% | -0.17% | -0.15% | |

| NZD | -0.11% | 0.00% | 0.19% | 0.13% | 0.11% | 0.17% | 0.04% | |

| CHF | -0.14% | -0.04% | 0.14% | 0.07% | 0.08% | 0.15% | -0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

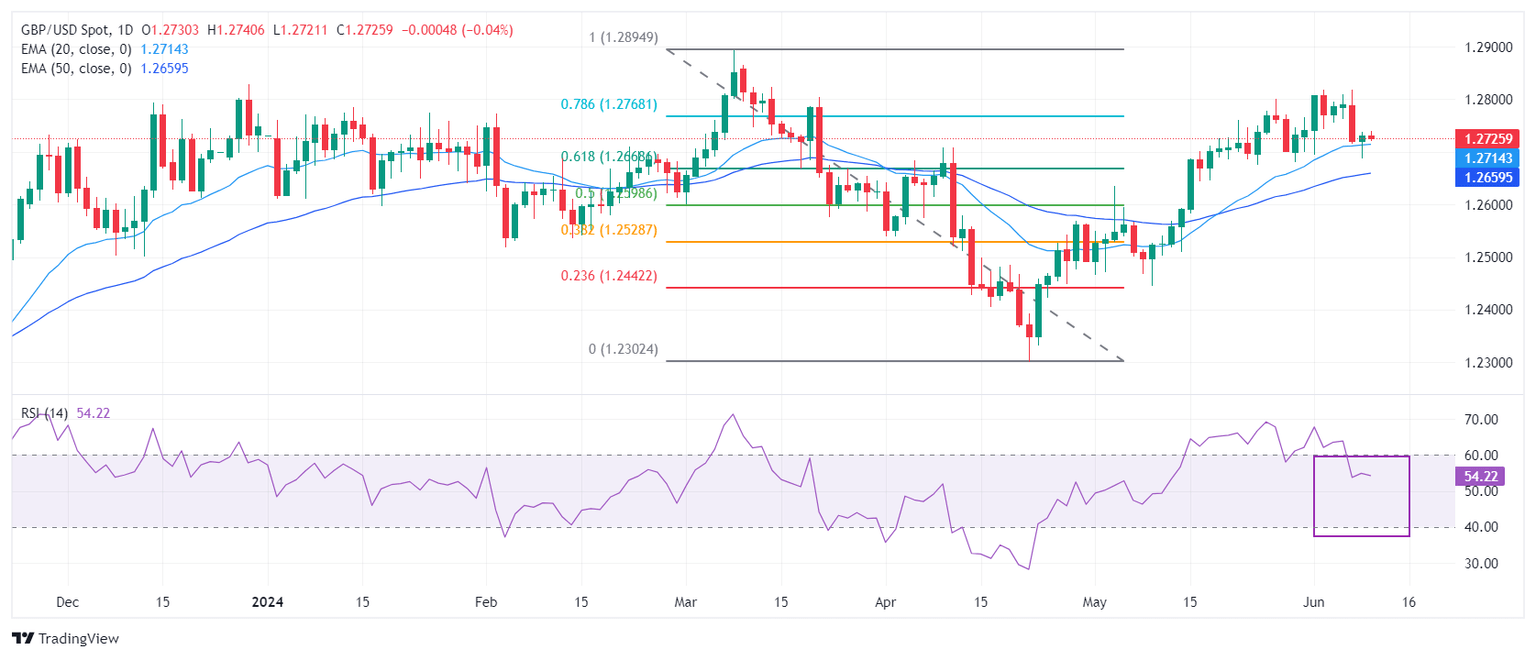

Technical Analysis: Pound Sterling holds key 20-DEMA

The Pound Sterling finds an interim cushion near the round-level support of 1.2700 against the US Dollar. The GBP/USD pair continues to be well-supported by the 20-day Exponential Moving Average (EMA), which trades around 1.2714. Also, the 50-day EMA is loping higher, suggesting that the near-term trend is still upbeat.

The Cable still holds the 61.8% Fibonacci retracement support (plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300) at 1.2665.

However, the 14-period Relative Strength Index (RSI) has shifted into the lower range of 40.00-60.00, suggesting that the momentum is losing strength.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Jun 12, 2024 18:00

Frequency: Irregular

Consensus: 5.5%

Previous: 5.5%

Source: Federal Reserve

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.