Pound Sterling drops to a fresh YTD low

GBP/USD slides to its lowest level since November, eyes 1.2400 ahead of UK jobs data

The GBP/USD pair drifts lower for the third straight day on Tuesday – also marking the fourth day of a negative move in the previous five – and drops to its lowest level since November 17 during the Asian session. Spot prices currently trade around the 1.2420 region as traders now look to the UK monthly employment details for a fresh impetus.

According to the consensus estimates, the number of people claiming unemployment-related benefits are expected to rise to 17.2K from 16.8K previous and the jobless rate is seen edging higher from 3.9% to 4% during the three months to March. This could offer more evidence that the jobs market is cooling and reinforce bets for at least four rate cuts by the Bank of England (BoE) this year, starting in June, which should weigh on the British Pound (GBP) and drag the GBP/USD pair lower. Read more...

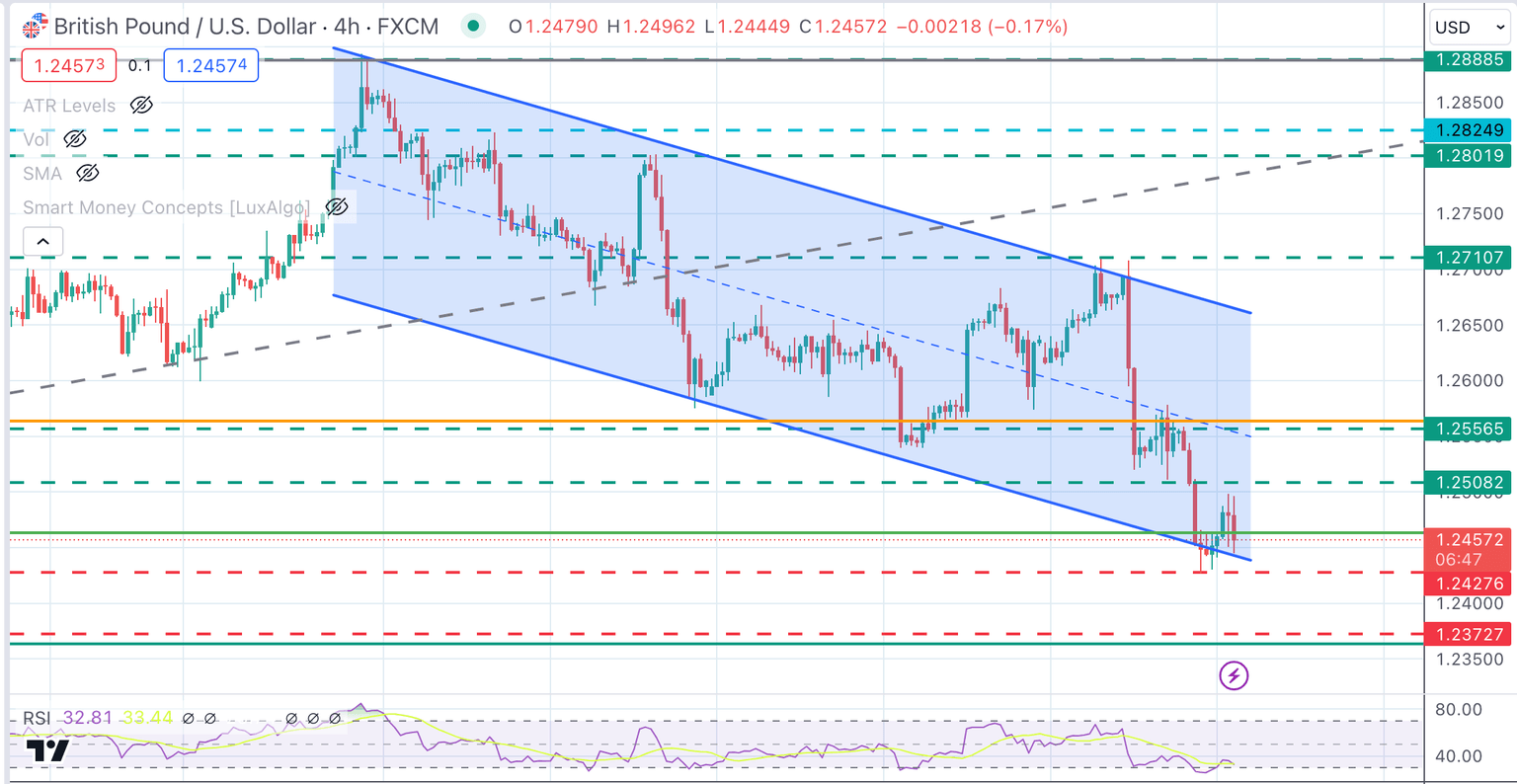

GBP/USD Price Analysis: Pound, rejected at 1.2500 pulls back to retest support area at 1.2430

Sterling’s recovery attempts have failed to find a significant acceptance above the 1.2500 level earlier on Monday. The pair has succumbed to the broad-based US Dollar strength after the release of upbeat US retail sales figures.

US Consumer spending has beaten expectations in MArch adding to the evidence of a strong US economic outlook. Beyond that, growing concerts about the consequences of an escalation in the Middle East conflict are additional support for the safe-haven USD. Read more...

Author

FXStreet Team

FXStreet