Pound Sterling slumps against US Dollar as Fed dovish bets ease

- The Pound Sterling faces pressure against its major peers despite a faster-than-expected increase in UK inflation weighs on BoE rate cut bets for December.

- BoE’s Ramsden supports a less gradual easing approach as he is confident that the disinflation trend is intact.

- The Fed is expected to deliver fewer interest rate cuts ahead due to expectations of a high inflation outlook.

The Pound Sterling (GBP) weakens against most of its peers on Thursday even though traders doubt whether the Bank of England (BoE) will cut interest rates again in the December meeting. Market speculation for BoE rate cuts next month diminished after the release of the United Kingdom (UK) Consumer Price Index (CPI) data for October on Wednesday showed that price pressures accelerated faster than expected.

UK’s headline inflation came in higher than the bank’s target of 2%, the core CPI, which excludes volatile items, accelerated unexpectedly, and the service inflation, which BoE officials closely track, grew at a faster pace of 5%. It seems the headline inflation is on track to where the Monetary Policy Committee (MPC) projected at the start of the month. The MPC forecasted inflation at 2.4% and 2.5% in November and December, respectively.

The inflation data underscores BoE Governor Andrew Bailey’s advice of adopting a gradual policy-easing approach in his commentary at the press conference after the policy decision of cutting interest rates by 25 basis points (bps) to 4.75% on November 7.

On the contrary, BoE Deputy Governor Dave Ramsden said after the inflation data release on Wednesday that he expects the economy to “continue to normalize” with an ongoing trend toward “low and relatively stable inflation,” Bloomberg reported. The comments from Ramsden appeared to be dovish as he said that he would consider a less gradual rate-cut approach if the evidence starts to “point more clearly to further disinflationary pressures.”

Going forward, investors will pay close attention to the Retail Sales data for October and flash S&P Global/CIPS Purchasing Managers Index (PMI) data for November, which will be published on Friday.

Daily digest marker movers: Pound Sterling weakens against US Dollar on Trump trade

- The Pound Sterling slides to near 1.2630 against the US Dollar (USD) in Thursday’s North American session. The GBP/USD pair declines as the US Dollar Index’s (DXY) ticks up, with investors looking for fresh cues about the Federal Reserve (Fed) interest rate path.

- Recently, traders pared Fed rate cut bets for December as investors expect President-elect Donald Trump’s policies on trade and taxes will be inflationary and growth-oriented, a scenario that would force the Fed to follow a more gradual policy-easing approach.

- The Fed's probability of cutting interest rates by 25 bps to the 4.25%-4.50% range in December has come down to 52% from 72% a week ago, according to the CME FedWatch tool. Meanwhile, Fed policymakers have contradictory opinions about the likely Fed interest rate path.

- On Wednesday, Boston Fed Bank President Susan Collins emphasized the need to push the monetary policy gradually towards a neutral range from its current restrictive state as she is confident about inflation remaining on track to the bank’s target of 2%. Meanwhile, Fed Governor Michelle Bowman said, "It's concerning to me that we're recalibrating policy, but we haven't yet achieved our inflation goal."

- On the economic front, US Initial Jobless Claims for the week ending November 15 have come in lower than projected. The number of individuals claiming jobless benefits for the first time was 213K against estimates of 220K.

Technical Analysis: Pound Sterling seeks support near 1.2600

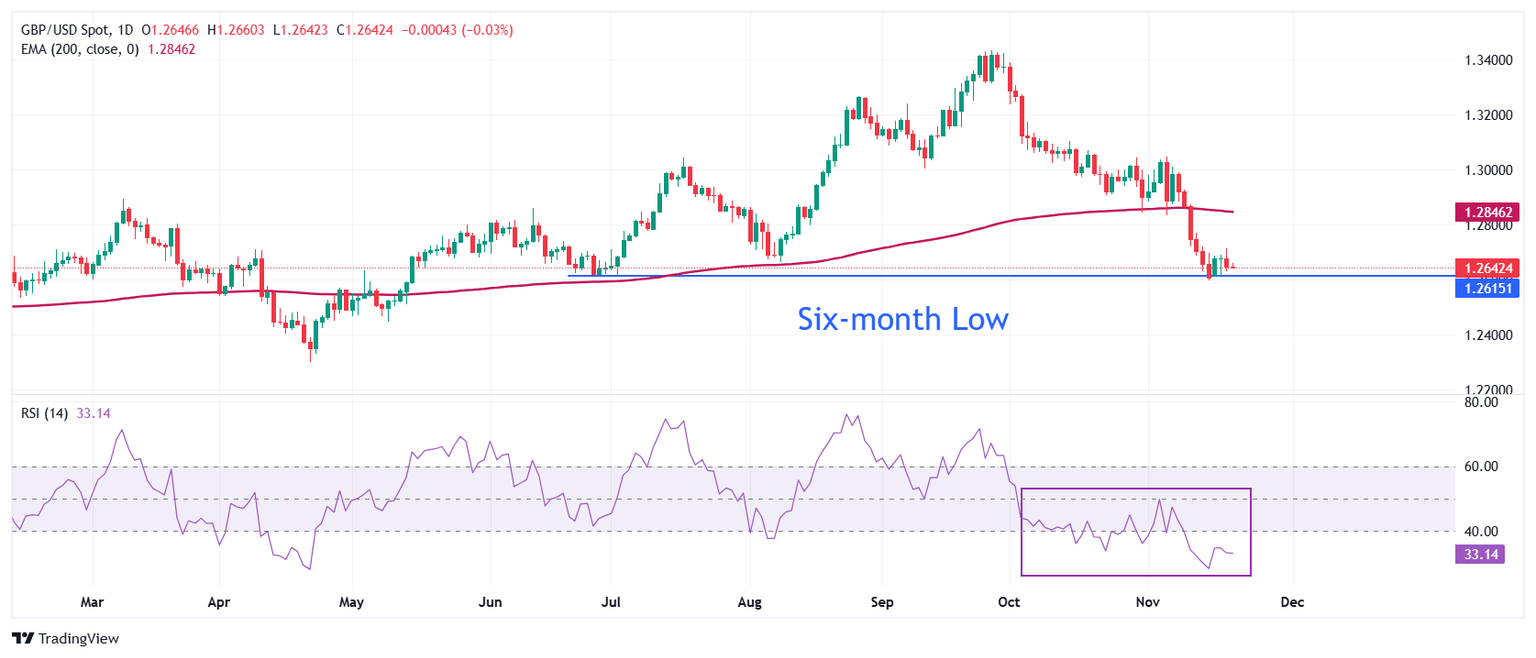

The Pound Sterling starts declines towards the six-month low near 1.2600 against the US Dollar on Thursday. The establishment of the GBP/USD pair below the 200-day Exponential Moving Average (EMA) near 1.2850 suggests that the overall trend is bearish.

The 14-day Relative Strength Index (RSI) remains within the 20.00-40.00 level, indicating a strong bearish momentum.

Looking down, the psychological support of 1.2500 will be a major cushion for Pound Sterling bulls. On the upside, the Cable will face resistance near 200-day EMA.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.