Pound Sterling improves due to risk-on mood amid ongoing UK general elections

- The Pound Sterling strengthens as US Dollar struggles after softer economic data.

- Survation's poll predicts the Labour Party to secure 484 of the 650 seats in parliament.

- The lower US Treasury yields contribute to the pressure on the US Dollar.

The Pound Sterling (GBP) extends its winning streak, which began on June 27. The GBP/USD pair trades around 1.2740 during the Asian session, which could be attributed to the market optimism amid the ongoing UK general elections on Thursday.

Britain appears poised to elect Labour Party leader Keir Starmer as its next prime minister, ousting Rishi Sunak's Conservatives after 14 often turbulent years. A forecast by polling company Survation, as reported by Reuters on Tuesday, predicts the Labour Party will win a record number of seats in the national election.

According to Derek Halpenny, head of FX research at MUFG Bank Ltd., a Labour landslide could be beneficial for the Pound Sterling. A significant majority would provide Labour with a robust mandate for governance, potentially fostering greater political stability.

Read More: How could the UK general election impact the Pound Sterling?

The US Dollar (USD) struggled due to the decline in the US Treasury yields. The softer US data escalated speculations of the Federal Reserve (Fed) to reduce interest rates in 2024. US markets will be closed on Thursday in observance of the Independence Day holiday.

Daily digest market movers: Pound Sterling extends gains amid UK elections

- Survation's central scenario indicates that Keir Starmer's Labour Party is projected to win 484 of the 650 seats in parliament, significantly surpassing the 418 seats won by former leader Tony Blair in his famous 1997 landslide victory, as per Reuters.

- US ISM Services PMI fell sharply to 48.8 in June, marking the steepest decline since April 2020. This figure was well below market expectations of 52.5, following a reading of 53.8 in May.

- The ADP Employment report showed that US private businesses added 150,000 workers to their payrolls in June, the lowest increase in five months. This figure fell short of the expected 160,000 and was below the downwardly revised 157,000 in May.

- Federal Reserve Bank of Chicago President Austan Goolsbee stated on BBC Radio on Wednesday that bringing inflation back to 2% will take time and that more economic data are needed. However, on Tuesday, Fed Chair Jerome Powell said that the central bank is getting back on the disinflationary path, per Reuters.

- The Minutes from the Federal Reserve's June 11-12 monetary policy meeting, released on Wednesday, suggested that Fed officials were in a wait-and-see mode. "Some participants emphasized the Committee’s data-dependent approach, with monetary policy decisions being conditional on the evolution of the economy rather than being on a preset path."

- The Pound Sterling (GBP) outperforms its peers as Bank of England (BoE) policymakers worry about stubborn inflation in the United Kingdom (UK) service sector, which has been refraining from leaning towards policy easing. Meanwhile, inflation in other sectors has declined significantly due to weak demand from domestic and overseas markets.

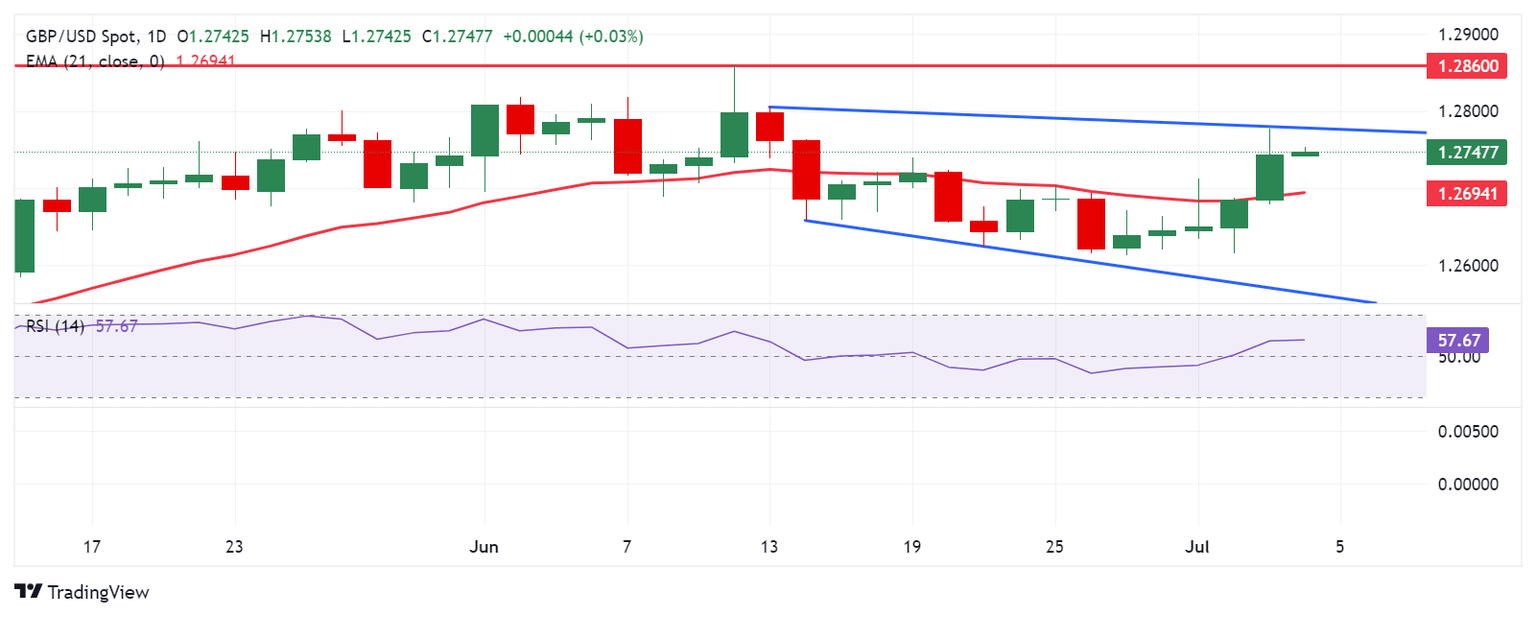

Technical Analysis: Pound Sterling hovers around 1.2750

The GBP/USD pair trades around 1.2750 on Thursday. The analysis of the daily chart shows a bearish bias as the pair consolidates within a descending channel. However, the 14-day Relative Strength Index (RSI) is above the 50 level, suggesting any decline going forward to be mild. Further movement may indicate a clearer directional trend.

The GBP/USD pair could test the upper boundary of the descending channel around the level of 1.2780. A breakthrough above this level could lead the pair to test June’s high of 1.2860.

On the downside, the key support appears at the 21-day Exponential Moving Average (EMA) at the 1.2694 level. A break below this level could exert pressure on the GBP/USD pair to navigate the area near the lower boundary of the descending channel around the level of 1.2570.

GBP/USD: Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.03% | -0.05% | -0.18% | -0.09% | -0.14% | -0.17% | 0.20% | |

| EUR | 0.03% | -0.01% | -0.10% | -0.03% | -0.08% | -0.15% | 0.30% | |

| GBP | 0.05% | 0.00% | -0.12% | -0.04% | -0.08% | -0.15% | 0.28% | |

| JPY | 0.18% | 0.10% | 0.12% | 0.09% | 0.02% | -0.03% | 0.40% | |

| CAD | 0.09% | 0.03% | 0.04% | -0.09% | -0.04% | -0.08% | 0.32% | |

| AUD | 0.14% | 0.08% | 0.08% | -0.02% | 0.04% | -0.04% | 0.38% | |

| NZD | 0.17% | 0.15% | 0.15% | 0.03% | 0.08% | 0.04% | 0.42% | |

| CHF | -0.20% | -0.30% | -0.28% | -0.40% | -0.32% | -0.38% | -0.42% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.