Pound Sterling falls to two-month low against US Dollar

- The Pound Sterling touches 1.2945 against the US Dollar, a fresh two-month low, as the Greenback holds onto recent gains.

- BoE Governor Andrew Bailey's remarks didn't move the GBP/USD pair as he didn't talk about monetary policy in his speech in New York.

- The US Dollar outlook remains upbeat as uncertainty increases ahead of the US presidential election.

The Pound Sterling (GBP) edges down slightly to near 1.2950 against the US Dollar (USD) in Tuesday’s North American session, the lowest level seen in two months. The GBP/USD pair is expected to extend its downside as the US Dollar strives to break above the 11-week high amid uncertainty surrounding the US presidential election. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, clings to gains near 104.00.

A sheer strength in the US Dollar suggests that traders are pricing in former US President Donald Trump’s victory in presidential elections, which are just two weeks away. Trump vowed to hike tariffs and lower taxes in his election promises if he wins. The scenario will undermine the currencies of the US’s close trading partners and keep interest rates escalated. However, the latest national polls have shown a neck-and-neck competition between Trump and US Vice President and Democratic candidate Kamala Harris.

Regarding the interest rate outlook, traders have priced in two rate cuts of 25 bps by the US central bank in November and December. The Fed can afford to avoid a sizeable interest rate cut in November, as earlier expected after a slew of upbeat US economic data for September diminished risks of an economic slowdown.

Daily digest market movers: Pound Sterling posts a fresh two-month low

- In an interview with the Guardian newspaper at the start of the month, BoE Governor Andrew Bailey stressed the need to cut interest rates aggressively if price pressures continue to ease. He said the BoE could become "a bit more activist" and "a bit more aggressive" in its approach to lowering rates if there was further welcome news on inflation. Bailey didn't talk about monetary policy during his speech at the Bloomberg Regulatory Forum in New York.

- Meanwhile, a column written by BoE’s rate-setter Megan Greene, published in the Financial Times on Monday, indicated that the policymaker favored a gradual rate-cut approach, with doubts over whether forward consumption levels will be strong or weak.

- According to market speculation, traders are confident about the BoE cutting interest rates by 25 basis points (bps) to 4.75% in November. For December, traders are also betting heavily for another 25 bps cut, Reuters reported.

- On the economic front, investors will focus on the flash S&P Global/CIPS Purchasing Managers Index (PMI) for October, which will be published on Thursday.

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. The British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.11% | 0.15% | 0.05% | -0.06% | -0.37% | -0.26% | -0.04% | |

| EUR | -0.11% | 0.05% | -0.05% | -0.17% | -0.49% | -0.35% | -0.14% | |

| GBP | -0.15% | -0.05% | -0.12% | -0.20% | -0.53% | -0.41% | -0.18% | |

| JPY | -0.05% | 0.05% | 0.12% | -0.10% | -0.41% | -0.32% | -0.07% | |

| CAD | 0.06% | 0.17% | 0.20% | 0.10% | -0.31% | -0.21% | 0.02% | |

| AUD | 0.37% | 0.49% | 0.53% | 0.41% | 0.31% | 0.11% | 0.33% | |

| NZD | 0.26% | 0.35% | 0.41% | 0.32% | 0.21% | -0.11% | 0.23% | |

| CHF | 0.04% | 0.14% | 0.18% | 0.07% | -0.02% | -0.33% | -0.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

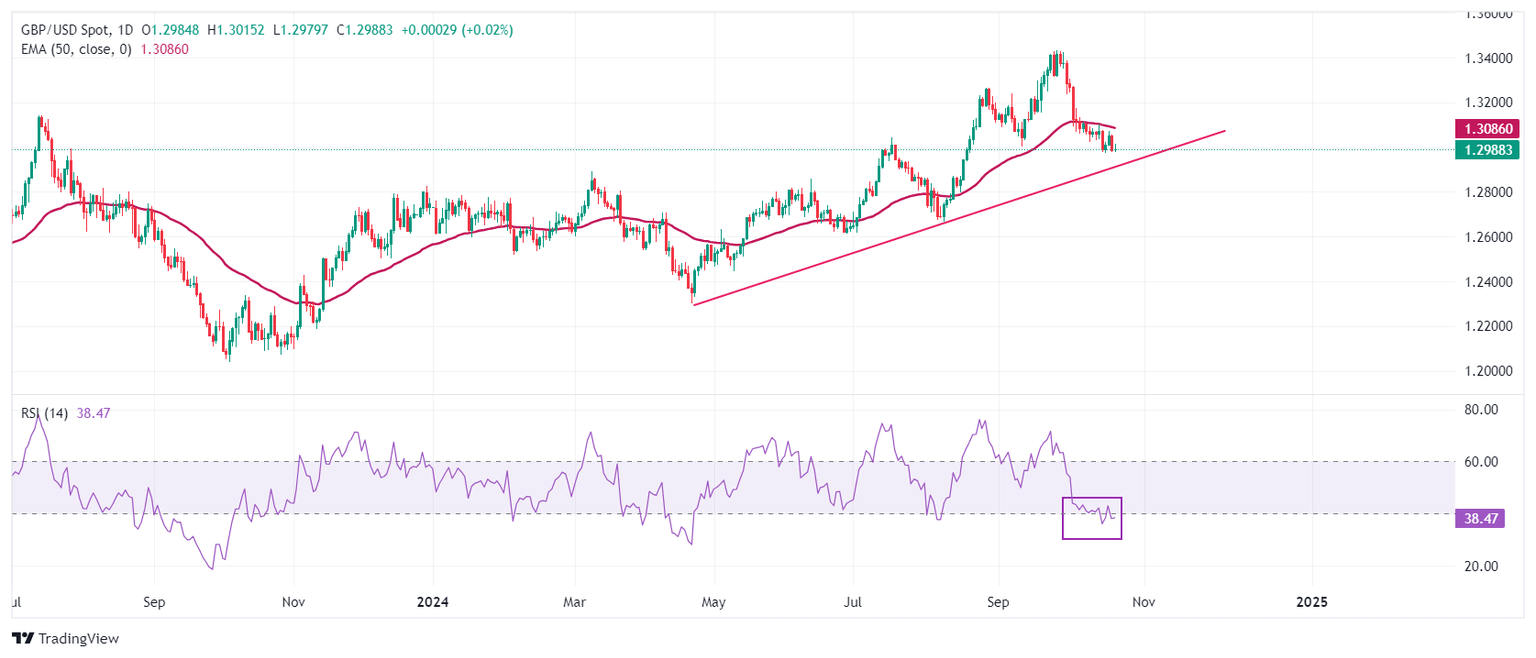

Technical Analysis: Pound Sterling slumps to near 1.2950

The Pound Sterling slides below the psychological support of 1.3000 in North American trading hours. The outlook of the GBP/USD pair remains bearish as it hovers below the 50-day Exponential Moving Average (EMA), which trades around 1.3090.

The 14-day Relative Strength Index (RSI) hovers near 40.00. A breakdown through the same will strengthen the bearish momentum.

Looking down, the upward-sloping trendline drawn from the April 22 low of 1.2300 will be a major support zone for Pound Sterling bulls near 1.2920. On the upside, the Cable will face resistance near the 20-day EMA around 1.3110.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.