Pound Sterling edges lower against USD as Trump's agenda threatens global economic growth

- The Pound Sterling ticks lower against the US Dollar above 1.2400 amid fears that Trump's tariffs could threaten the global growth outlook.

- President Trump’s tariff threats on BRICS and its North American peers have increased USD’s safe-haven appeal.

- Investors expect the BoE to resume the interest rate-cut cycle on Thursday.

The Pound Sterling (GBP) ticks lower against the US Dollar (USD) in Friday’s North American session but holds the key support of 1.2400. The GBP/USD pair remains subdued as the US Dollar’s safe-haven demand has strengthened after United States (US) President Donald Trump reiterated his intentions to impose 25% tariffs on Canada and Mexico from Saturday and 100% on BRICS if they try to replace the US Dollar with a new currency in international trade.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, posts a fresh weekly high of 108.36.

On his social media platform, TruthSocial, Trump said, "We are going to require a commitment from these seemingly hostile countries that they will neither create a new BRICS currency nor back any other currency to replace the mighty US Dollar, or they will face 100% tariffs." He added that there is no chance that “BRICS will replace the US Dollar in International trade” or anywhere else, and any country that tries should say, “Hello to Tariffs, and goodbye to America!"

Market participants believe that President Trump's higher tariffs would be inflationary for the US economy, which could force the Federal Reserve (Fed) to keep interest rates at their current levels for longer. On Wednesday, the Fed announced a pause in the easing policy cycle and kept borrowing rates unchanged in the range of 4.25%-4.50%.

Fed Chair Jerome Powell said that monetary policy adjustments will become appropriate when central bank officials see “real progress on inflation or at least some weakness in the labor market.”

Meanwhile, the US Personal Consumption Expenditures Price Index (PCE) data for December has shown that price pressures rose expectedly. The core PCE inflation, the Fed’s preferred inflation gauge, rose at a faster pace of 0.2%, as expected, month-on-month from 0.1% in November. On year, the underlying inflation data rose in line with estimates and the prior release of 2.8%.

Daily digest market movers: Pound Sterling remains under pressure on BoE dovish bets

- The Pound Sterling is under pressure against its major peers on Friday, with investors focusing on the Bank of England’s (BoE) monetary policy decision next Thursday. Traders are confident that the BoE will resume the policy-easing cycle and reduce interest rates by 25 basis points (bps) to 4.5%.

- The BoE’s monetary policy guidance could be dovish, as recent inflation indicators have shown signs of deceleration, although wage growth remains accelerating.

- Financial market participants are pricing in three interest rate cuts from the BoE this year amid faltering labor demand and weakening business confidence. This is due to higher employer contributions to National Insurance (NI) announced by Chancellor of the Exchequer Rachel Reeves in the Autumn budget.

- However, Reeves strives to cool dissatisfaction among business owners by adopting significant measures to boost growth. In her speech at Oxfordshire on Wednesday, Reeves vowed to support the expansion of London's Heathrow Airport and to remove "stifling and unpredictable" regulations to boost productivity. She was also confident about building better trade relations with the US under Donald Trump's leadership.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.31% | 0.30% | 0.39% | 0.25% | 0.00% | -0.07% | 0.09% | |

| EUR | -0.31% | -0.02% | 0.06% | -0.06% | -0.30% | -0.38% | -0.24% | |

| GBP | -0.30% | 0.02% | 0.06% | -0.04% | -0.30% | -0.37% | -0.23% | |

| JPY | -0.39% | -0.06% | -0.06% | -0.13% | -0.38% | -0.46% | -0.31% | |

| CAD | -0.25% | 0.06% | 0.04% | 0.13% | -0.25% | -0.32% | -0.18% | |

| AUD | -0.00% | 0.30% | 0.30% | 0.38% | 0.25% | -0.08% | 0.06% | |

| NZD | 0.07% | 0.38% | 0.37% | 0.46% | 0.32% | 0.08% | 0.14% | |

| CHF | -0.09% | 0.24% | 0.23% | 0.31% | 0.18% | -0.06% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

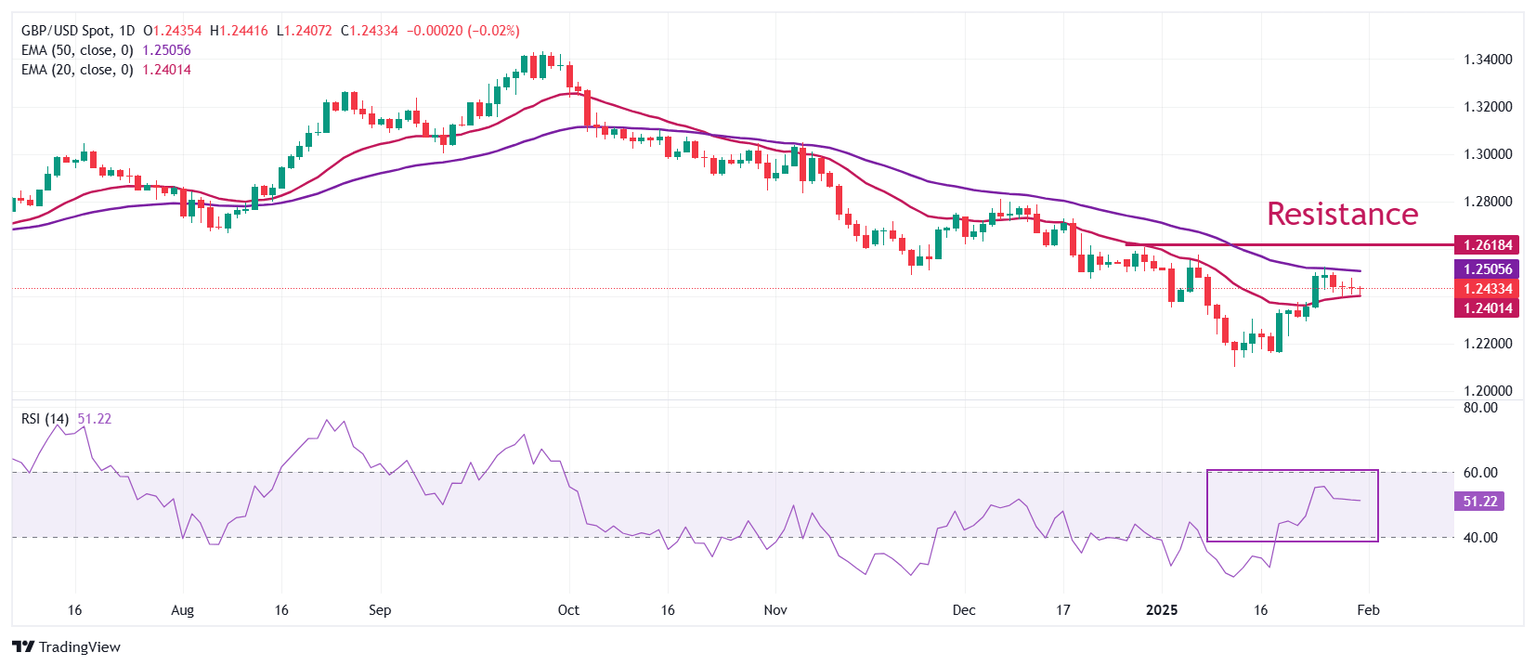

Technical Analysis: Pound Sterling holds ground above 20-day EMA

The Pound Sterling has held the key support of 1.2400 against the US Dollar since Monday. The near-term outlook for the GBP/USD pair remains firm as it holds the 20-day Exponential Moving Average (EMA), which trades around 1.2400. However, the 50-day EMA near 1.2510 remains a major barrier for the Sterling bulls.

The 14-day Relative Strength Index (RSI) oscillates in the 20.00-40.00 range, suggesting a sideways trend.

Looking down, the January 13 low of 1.2100 and the October 2023 low of 1.2050 will act as key support zones for the pair. On the upside, the December 30 high of 1.2607 will act as key resistance.

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri Jan 31, 2025 13:30

Frequency: Monthly

Actual: 2.8%

Consensus: 2.8%

Previous: 2.8%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.