Polestar Stock News and Forecast: PSNY shares plumet 12% on growing operating loss

- PSNY shed roughly 12% on Thursday and holds near its YTD low.

- Polestar stock fall in premarket Thursday as delivery data is reissued.

- PSNY stock could see a catalyst from the SUV launch in October.

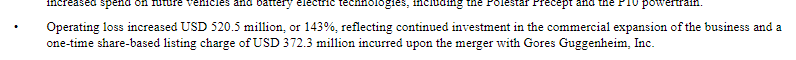

Update: PSNY stock fell like a house of cards and extended this week’s downtrend on Thursday, plummeting 11.89% on the day to settle at $6.89. The stock price of Polestar, however, recovered from all-time lows of $6.74. Despite the upbeat revenue reported by the Swedish electric performance car brand, concerns over growing losses in the company smashed its stock price. Polestar reported revenue of USD 1.0 billion, up 95%, for the first half of 2022 but operating loss increased by USD 520.5 million, or 143%. The late rebound in Wall Street did help the stock price find some floor but it was not enough as bears retained control below the $7 mark.

PoleStar (PSNY) stock managed to outperform on Wednesday when it closed nearly 2% higher after the main indices all closed in the red. That gain may be shortlived, however, as the stock is already losing ground in Thursday's premarket.

Also read: Tesla Stock Deep Dive: Price target at $400 on China headwinds, margin compression, lower deliveries

PSNY stock news

Polestar released financial results for the first six months of 2022 on Thursday. The good news is that guidance for full-year deliveries of 50,000 vehicles was maintained, but investors appear to be focusing on the loss growing in 2022 versus last year as the company ramps up its expansion.

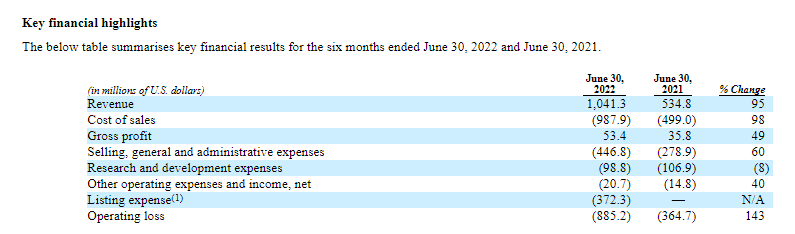

Source: PSNY SEC filings

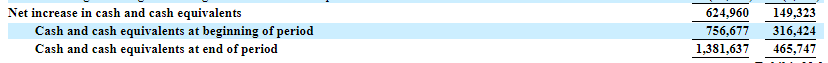

Already, Polestar gross margins have dropped from over 6% to nearer 5% based on our calculations using the data above. The company's cash position has continued to grow, though.

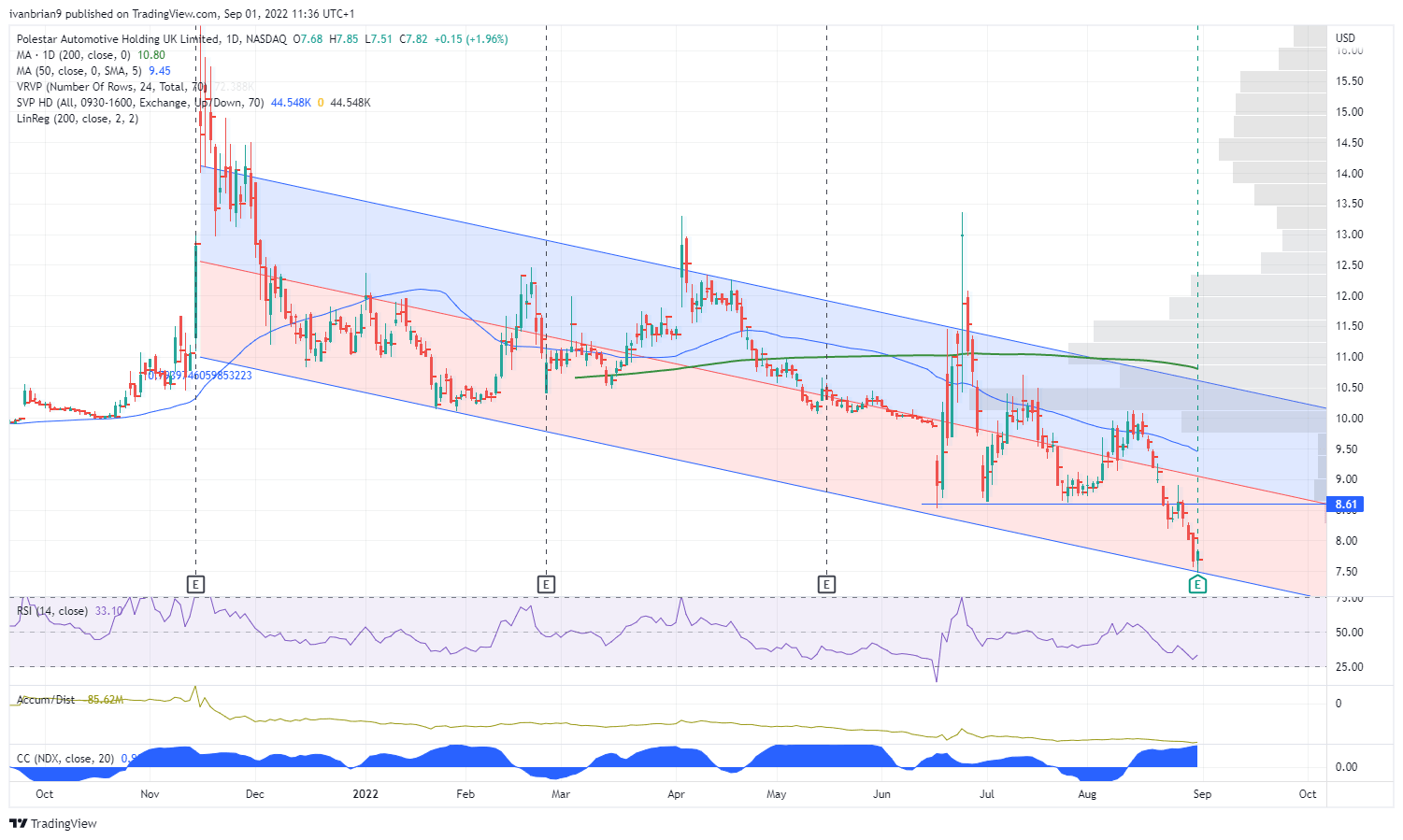

PSNY stock forecast

This is still a very early stage for Polestar stock, so financial statements can be less predictive. Restating guidance is a positive although the company did say it will be at the back end of the year due to China issues. Also, the cash position is beneficial. Margins look to be under pressure based on our crude, back-of-the-envelope assessment, but this is a common theme for manufacturers right now.

I am not especially keen on technical analysis of something so volatile or early stage, but the linear regression is flagging that this may be oversold. We can see it has worked well as an indicator in the past. PSNY stock is down in the premarket, perhaps in reaction to the news above.

A tweet from the well-followed Twitter account may be the more likely reason for the fall. We cannot verify how accurate this tweet and the information it contains is. We are also unsure if this affects Polestar directly. The companies do share manufacturing, but we are not certain of the exact specific sites shared.

VOLVO CARS TO SHUT PLANT IN CHINA'S CHENGDU DUE COVID RESTRICTIONS -SWEDISH NEWS AGENCY TT

— *Walter Bloomberg (@DeItaone) September 1, 2022

PSNY daily chart

Previous updates

Update: PSNY stock extended its slump on Thursday, shedding a whopping 11.89% to end the day at $6.89 per share. It posted a fresh yearly low of $6.72, and additional pain is on the docket ahead of the weekly close. Several fundamental factors undermined the market mood, including China announcing yet another coronavirus lockdown involving 21 million people and persistent tensions between the EU and Russia. On the other hand, US data showed America's growth remains resilient, despite fears of a downturn amid the Fed's aggressive monetary policy tightening stance.

The Dow Jones Industrial Average managed to add 0.46% or 146 points, but the S&P 500 closed 0.198% lower. The Nasdaq Composite settled at 11,785, down 0.26% or 31 points.

Update: PSNY stock lost over 10% at the start of Thursday trading after the company released results for the first half of the year that showed losses jumping from $365 million to $885 million YoY. This should have been expected due to Polestar ramping up production for its newest models and expanding its sales division that includes new showrooms, but apparently Mr. Market was not prepared. PSNY shares are down to $7 for the first time since merging with the Gore Guggenheim SPAC and trading under the PSNY ticker. Revenue rose from $535 million to $1.04 billion over the same period, but the one-time listing expense cost the company $372 million.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.