Polestar (PSNY) stock falls sharply as news flow dries up

- PSNY stock fell nearly 7% on Friday as momentum and news flow dries up.

- Tesla recovering did not help PSNY shares.

- Polestar announced strong delivery growth last week, PSNY stock continues to edge high despite heavy resistance above $10.

Polestar stock has struggled to hold any gains made last week and has not benefitted from huge gains seen in sector leader Tesla (TSLA). Polestar fell sharply on Friday to close at $8.91, a loss of 6.8%.

Also read: Tesla Stock Deep Dive: Price target at $400 on China headwinds, margin compression, lower deliveries

Polestar: The story so far

Polestar and Volvo have a long and storied history going back over 30 years. The story evolved from a racing relationship between the two brands into its current guise where the Swedish automaker and its parent Geely are the major shareholders in Polestar. The relationship between Polestar and Volvo began as a high-performance modified version of Volvo cars under the name Flash/Polestar racing.

Volvo acquired Polestar in 2015 and led to the current iteration of the company, where the electric vehicle company was brought to the equity market by Gores Guggenheim via a Special Purpose Acquisition Company (SPAC) deal under the ticker GGPI, which then transformed into PSNY upon completion of the SPAC deal.

Polestar 3 model due soon

Polestar 3 is an SUV model due for release shortly and is integral to the next stage in PSNY's development. SUVs are currently the highest margin vehicle type for all auto manufacturers. The Swedish EV automaker initially launched a hybrid model – the Polestar 1 – before moving to all-electric with the Polestar 2, a sedan model.

Polestar can leverage the existing Volvo network which gives it considerable manufacturing advantages. It will use Volvo's manufacturing factories in China and South Carolina in the US to make the new vehicle. The Polestar 3 shown in the picture below shares various design cues with Volvo and shares the sleek Scandinavian look and feel of Volvo cars.

Polestar 3

PSNY or TSLA: Who is better?

PSNY was relatively unknown in the US until earlier this year when it launched a cheeky Superbowl ad taking a dig at both Tesla and Volkswagen. Visibility is increasing steadily but TSLA remains well ahead of all auto manufacturers due to its large head start and total commitment to the EV space. As for design, well that is a personal matter but price-wise the Polestar 2 currently starts at $40,900 and was recently named the "Best Premium Electric Car of the Year" by Autotrader UK.

Tesla also has a host of awards to its name. The biggest advantage TSLA has – over not just Polestar but all EV newcomers – is brand recognition and strong customer loyalty. The company led by Elon Musk has worked hard to create a unique identity and is one of the most recognized brands in the world across all sectors, not just cars. Polestar by comparison has a long way to go to catch up.

Electric vehicle delivery news

TSLA stock recently has moved sharply higher on the back of strong delivery numbers despite headwinds from Shanghai and supply chain issues. But not to be left behind PSNY stock also was boosted by a strong delivery number earlier this month. Polestar delivered 21,200 cars in the first half of this year, an increase of 125% yearly. Sounds impressive but compared to Tesla's number of over 250,000 for the last quarter we can see how far behind Polestar is. Polestar does have ambitious plans to deliver 300,000 units by 2025.

PSNY stock forecast

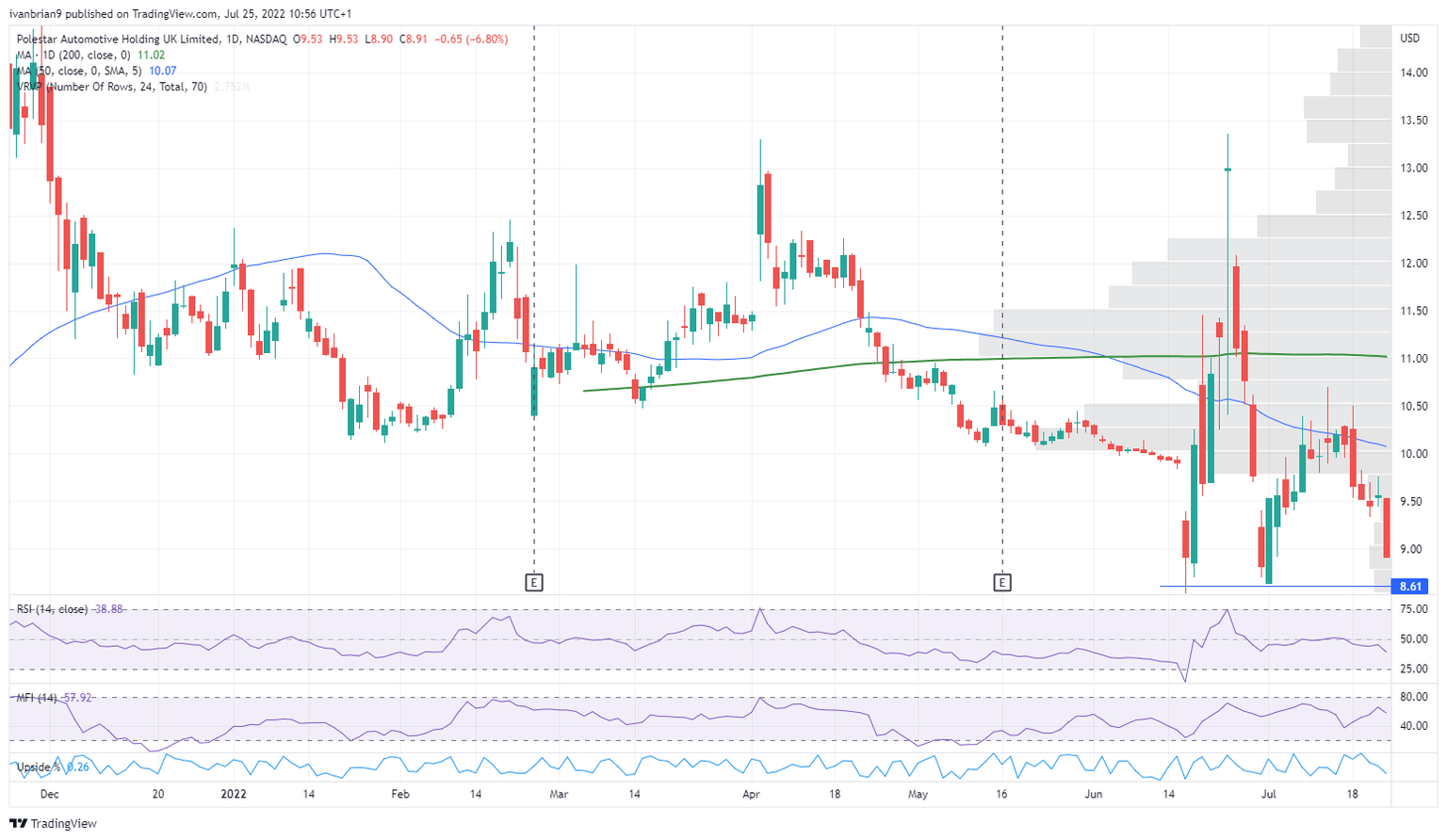

PSNY stock was always likely to suffer once newsflow dried up, as we expected and explained in some of our earlier articles. This is a momentum-driven name and, despite the ongoing rally in equity markets last week and strong moves in the EV sector thanks to TSLA, Polestar lost over 20% on the week. Expect a continued decline in the face of a lack of newsflow. $8.61 remains the key support. So far, that price level has worked well as a double bottom for PSNY share price but the more a level is tested the weaker it becomes, so this needs to be watched carefully.

PSNY stock, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.