Plug Power Stock Price and Forecast: When does PLUG report earnings?

- Plug Power is due to report earnings after the close on Tuesday.

- PLUG is a well-followed retail favourite stock with resulting volatility swings.

- PLUG stock rose over 6% on Monday in advance of the results.

Will the imminent release of earnings from Plug Power (symbol PLUG) be another case of "buy the rumor, sell the fact". PLUG shares have certainly made their move on Monday with a strong 6.7% gain. It is important to see if this can be added to on Tuesday before earnings come out after the close. PLUG is a green energy stock and in the right sector currently, as increased attention on climate change sees inflows to clean energy and green stocks. President Biden's stimulus bill is a benefit and so too is the ongoing climate conference COP26 in Glasgow, Scotland.

Here is a bit of background on PLUG for those not familiar with the name. "With proven hydrogen and fuel cell products, Plug Power replaces lead-acid batteries to power electric industrial vehicles, such as the lift trucks customers use in their distribution centers. Extending its reach into the on-road electric vehicle market, Plug Power’s ProGen platform of modular fuel cell engines empowers OEMs and system integrators to rapidly adopt hydrogen fuel cell technology," according to the company website.

PLUG Power (PLUG) stock news

The US finally got the infrastructure bill across the line on Monday, and this sent many industrial and clean energy stocks higher. The bill is the largest clean energy bill ever in the US with $150 billion for clean energy advancement.

PLUG reports earnings after the close on Tuesday. Earnings per share (EPS) is expected to be -$0.09. Revenue is expected to rise to $143.93 million versus revenue for last year at $125.6 million.

PLUG Power (PLUG) stock forecast

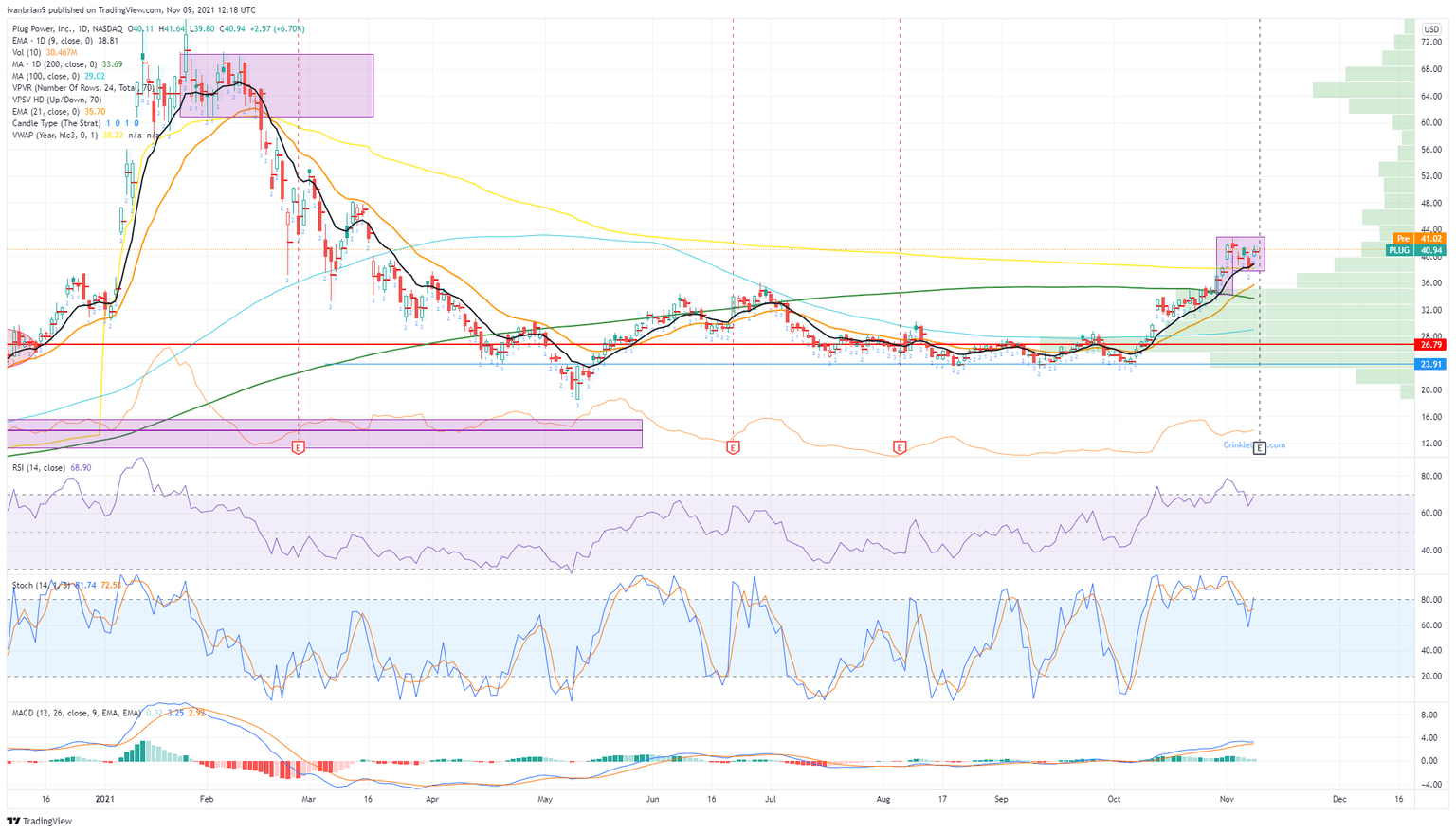

PLUG shares have been trending nicely and have taken out some key levels. The 200-day at $33.69 and the yearly VWAP at $38.22 are now behind us, and PLUG is being guided higher by the 9-day moving average. The extended target is a move back to the consolidation zone from early January and February of this year at $61 to $68, which we have highlighted in the PLUG chart below. Strong support zones are at $33.69 and $28 with some very high volume.

A flag formation is in evidence, and this is a continuation of that pattern. Holding above the lower level of the flag at $38 keeps the bullish possibility intact. This $38 level also neatly aligns with the 9-day moving average. Above we look for gains, below look at the strong suppport zones mentioned, but always use a stop.

PLUG daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.