- Palantir shares 1% rally on Thursday broke resistance but retraced.

- PLTR still has the backing of Cathie Wood's ARK funds.

- Palantir shares broke above 100-day moving average in a bullish move.

Update 2: PLTR shares held gains on Thursday, closing 1% higher at $22.86. The shares had been higher earlier in the session, but the broader market turned lower with the Nasdaq ending over 1% down. Given this, PLTR staged an impressive performance. However, this has left the technical picture still unclear. PLTR is stuck at the 100-day moving average resistance at $22.91.

Update: PLTR shares rallied again on Thursday, breaking above the 100-day moving average in the process. PLTR has a triangle formation that it needs to break out of to accelerate the move upward. PLTR shares are trading at $23.06 at the time of writing for a near 2% gain.

Shares in Palantir outperformed the market yesterday with a 4% gain as the Nasdaq closed up just close to 1%. Palantir is a high beta stock, which means it is basically more volatile than the underlying index. So it can generate outsized returns but also outsized losses. PLTR shares are currently slightly ahead in Thursday's pre-market at $22.70.

Stay up to speed with hot stocks' news!

Palantir Technologies shares have been one of the 2021 meme stock performers. Lately, the shares have been more stable. This has allowed some more technical analysis to identify key levels.

Palantir has a number of fundamental catalysts going for it. A strong government client list, ARK Invest making regular block purchases so far in 2021, and Goldman Sachs turning bullish after the latest set of PLTR results are some of the major pieces of good news.

PLTR shares have struggled to recapture the earlier rise seen in 2021, but perhaps this is not a bad thing for the long-term investor. PLTR shares had moved too high and stretched the valuation metrics too much. Now back toward the mid to low $20s, it is a much more interesting proposition.

Palantir launched on the stock market at the end of September 2020 at a price of $7.25 a share. PLTR was co-founded by legendary Silicon Valley investor Peter Thiel. The firm is a data mining and analytics technology company. It helps companies integrate and analyse their various diverse data sets to help make sense of complicated data. Palantir streamlines decision-making based on data analysis. The company helps with search functions and is heavily involved in the security industry, with links to law enforcement agencies such as the FBI, CIA and Department of Defense.

PLTR stock forecast

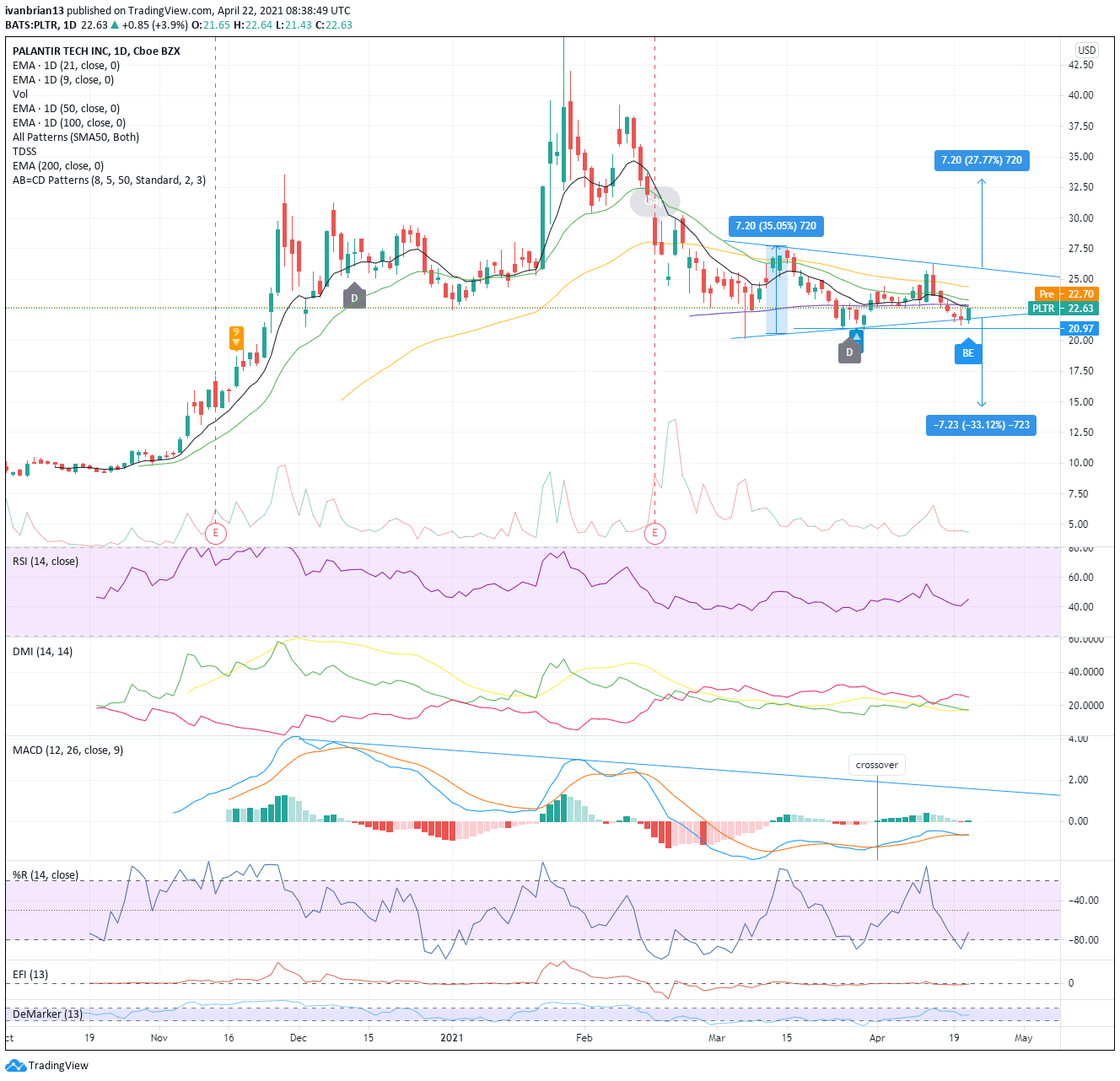

Palantir shares have been in a triangle formation since early March with declining volume and volatility. Eventually a catalyst will result in a breakout of this range. Usually, the breakout can be sharp.

Currently, PLTR is just holding onto the bullish formation. The spike low from March 5 was sharply rejected and since then PLTR has stalled at higher lows. PLTR shares looked at breaking out to the lower end of the triangle formation but rejected this move as buyers stepped in. This is perfectly evidenced by Cathie Wood releasing her fund purchases for Tuesday for ARK funds. ARK purchased 1 million shares of PLTR on Tuesday, in effect defending the lower price range of the triangle. Thursday's price move lends further credence to the bullish argument with a large bullish engulfing candle.

The first target to reach is the 9 and 100-day moving averages. These are nearly identical now at $22.80 and $22.91 for the 100-day. Ideally, the 9-day would break above the 100-day showing short-term bullish momentum.

Further resistance is provided by the 21-day moving average at $23.32 and the 50-day at $24.39. Once these levels are broken, a test of the upper triangle is inevitable, currently at $25.90. A break here gives a target of $33.15. The size of the entry to a triangle determines the size of the breakout. This move would also have the neat symmetry of filling the gap created by earnings on February 16.

A break to the downside of the triangle will have a $14.80 target. The area of main concern to bulls should be the Moving Average Convergence Divergence (MACD) indicator, which is showing the possibility of a crossover sell signal. The MACD has been working well for PLTR, trending lower in tandem with price.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hits two-week tops near 1.0500 on poor US Retail Sales

The selling pressure continues to hurt the US Dollar and now encourages EUR/USD to advance to new two-week peaks in levels just shy of the 1.0500 barrier in the wake of disappointing results from US Retail Sales.

GBP/USD surpasses 1.2600 on weaker US Dollar

GBP/USD extends its march north and reclaims the 1.2600 hurdle for the first time since December on the back of the increasing downward bias in the Greenback, particularly exacerbated following disheartening US results.

Gold maintains the bid tone near $2,940

The continuation of the offered stance in the Greenback coupled with declining US yields across the board underpin the extra rebound in Gold prices, which trade at shouting distance from their record highs.

Weekly wrap: XRP, Solana and Dogecoin lead altcoin gains on Friday

XRP, Solana (SOL) and Dogecoin (DOGE) gained 5.91%, 2.88% and 3.36% respectively on Friday. While Bitcoin (BTC) hovers around the $97,000 level, the three altcoins pave the way for recovery and rally in altcoins ranking within the top 50 cryptocurrencies by market capitalization on CoinGecko.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.