- NYSE:PLTR ended flat on Friday after plummeting during intraday trading.

- Palantir has the eye of Ark Invest as the fund continues to load up on the data analytics giant.

- Palantir’s stock may be at the mercy of institutional hedge funds in the short term.

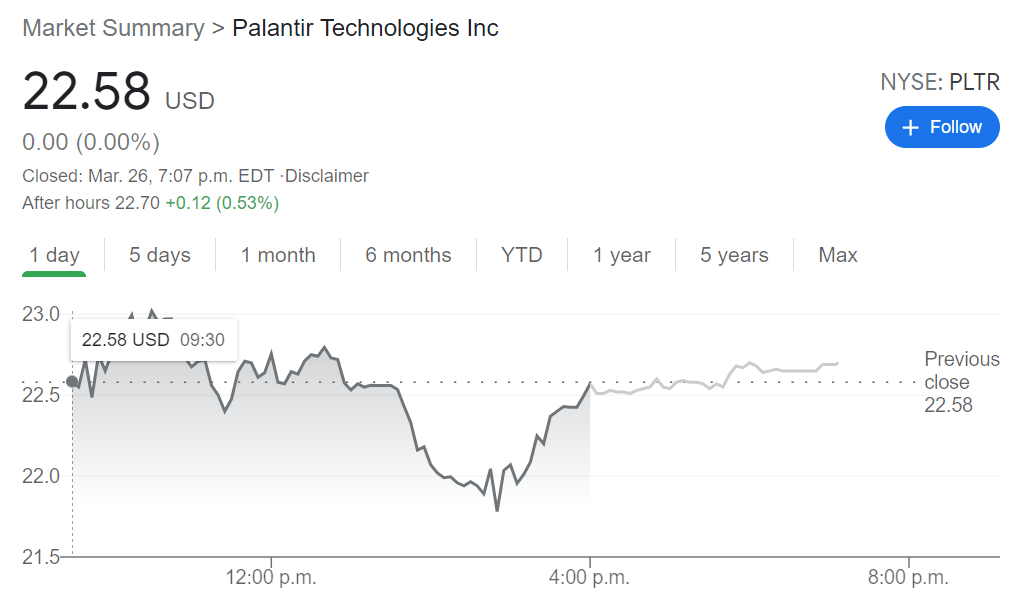

NYSE:PLTR avoided another disastrous week on the markets as it continues to be beaten down during the recent tech sector correction. On Friday Palantir sank during intraday trading, but much like the rest of the S&P 500, rallied into the closing bell. Overall, Palantir ended the trading session unchanged at $22.58 but has been able to garner some support in after hours trading. The data analytics company is now down nearly 50% off of its all-time highs of $45.00 set in late January, and continues to struggle following its IPO lockup expiry where executives unloaded millions of shares.

Stay up to speed with hot stocks' news!

One of the leading funds that retail and institutional investors follow is Ark Invest, and during Palantir’s downward trend, the investment group has been loading up on its shares. On Thursday, lead investor Cathie Wood once again added nearly a million more of Palantir’s shares to several of Ark’s ETFs. Like Wood, Palantir CEO Alex Karp has also been quoted as saying that the stock is for long-term investors and not for short-term traders. Investors who add some Palantir at these price levels may be getting a massive bargain compared to a few years down the road.

PLTR Stock forecast

Part of the volatility surrounding Palantir is its popularity amongst retail investors, particularly those who are a part of the great Reddit movement against Wall Street. Cathie Wood has also received some criticism and backlash from other institutional investors of late, so investors could expect these headwinds to continue to have an effect on Palantir’s stock. Things could be choppy, at least until Palantir’s next quarterly earnings call near the end of May.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.