- Palantir shares ended Friday up 2.6%.

- PLTR has seen ARK Invest purchase more shares.

- PLTR, one of the retail meme stocks of 2021, down 50% from 2021 highs!

Update April 14: Palantir Technologies Inc (NYSE: PLTR) shares have soared by 8.91% on Tuesday, hitting $25.42, the highest since mid-March. According to Wednesday's premarket data, investors in the secretive data analytics firm are set to benefit from another upswing to $25.50. The move comes amid a broad market rally, after US inflation figures remained benign, prompting a sigh of relief in markets. Technically, this may be the big breakout bulls have been waiting for.

Palantir shares rallied on Thursday to close up 2% as the broad market, and the Nasdaq in particular, led the way. PLTR shares closed at $23.41 for a 2.2% gain.

Stay up to speed with hot stocks' news!

Palantir launched on the stock market at the end of September 2020 at a price of $7.25 a share. PLTR was co-founded by legendary Silicon Valley investor Peter Thiel. The firm is a data mining and analytics technology company. It helps companies integrate and analyse their various diverse data sets to help make sense of complicated data. Palantir streamlines decision-making based on data analysis. The company helps with search functions and is heavily involved in the security industry, with links to law enforcement agencies such as the FBI, CIA, and Department of Defense.

What is the PLTR price target?

Palantir has been the subject of much discussion and speculation this year as it captured the attention of the growing band of retail traders. PLTR rose to nearly $45, having been in the $10 to $15 range during the October to November 2020 stretch.

Analysts though have largely been unimpressed with the frenzy and stayed with longer-term views. The Refinitiv average price target currently is $27, a 15% upside from the current share price. PLTR is not that well covered with only 7 analysts covering the stock. Two analysts rate it as a buy or strong buy, three are neutral and three rate PLTR as a sell or strong sell.

Goldman Sachs was one of the more noted upgrades after PLTR released its Q4 2020 results. Goldman increased their price target from $13 to $34 and upgraded their rating from neutral to buy. Goldman was particularly impressed with the strong growth rate and guided future growth rates of near 30%.

Cathie Wood's ARK Invest bought another one million shares on Wednesday, adding to earlier block purchases of PLTR. On Monday, Palantir announced it had been selected by the National Nuclear Security Administration for a five-year, $89.9 million contract. Just another government contract to add to its growing list.

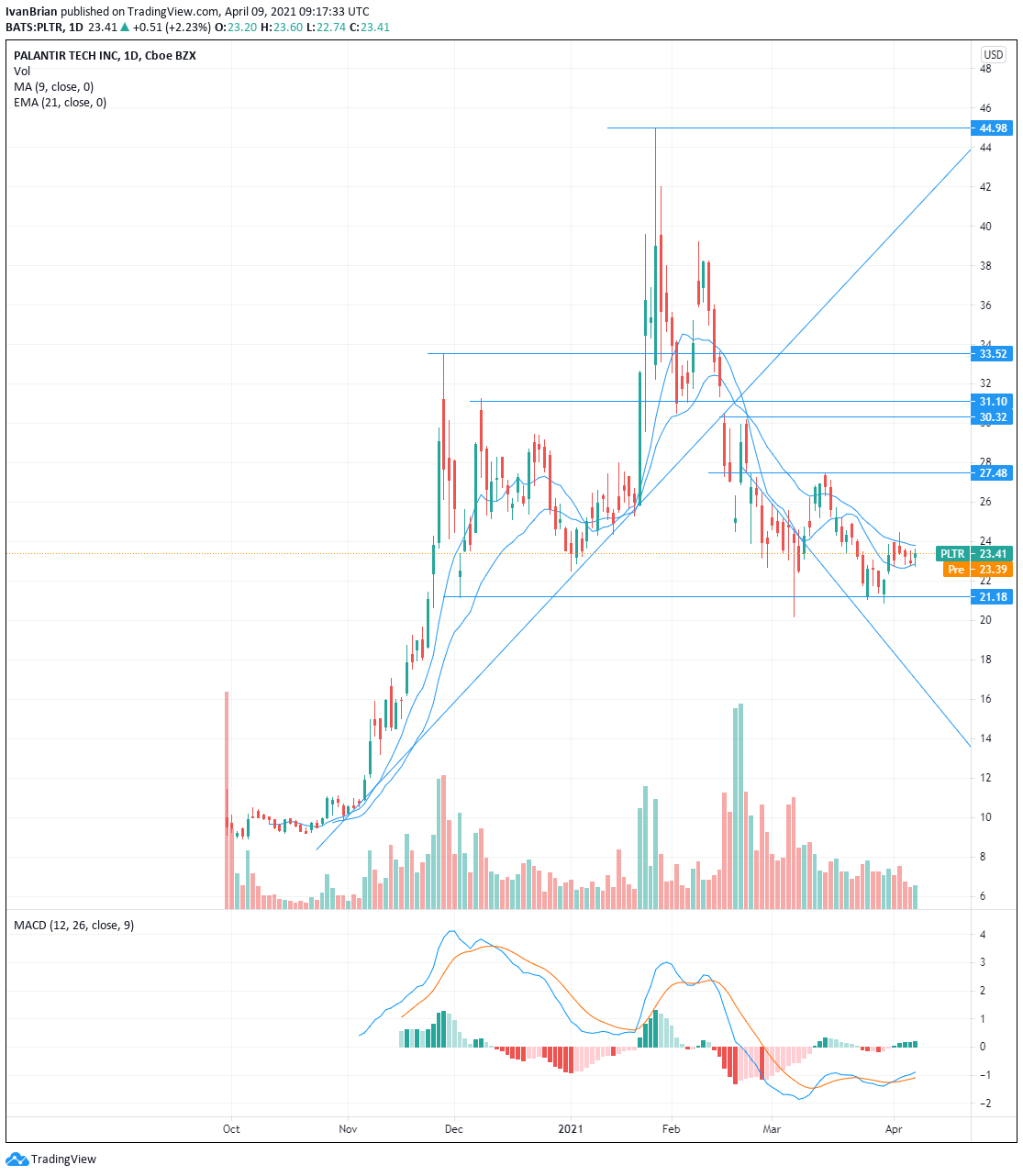

Palantir technical analysis

Technically, the stretched resistance to take out and resume a longer-term bullish trend is at $27.47, the mid-March high. Before that, the 21-day moving average resistance was tested at $23.80. The MACD has crossed over, giving a buy signal, and a move above recent highs near the 21-day resistance would be a nice confirmation.

The 9-day moving average is acting nicely as support and needs to continue doing so as a break is obviously short-term negative.

Given broader market bullishness, the Cathie Wood catalyst and a new government client, a bullish trade with a tight stop just below the 9-day moving average could work for short-term traders.

Support at $21.18 really has to hold to keep any chance of bullishness.

Previous updates

Update April 12: Palantir Technologies (NYSE: PLTR) has closed Friday's trading session at $24.04, an increase of 2.69% and is set to extend its gains to $24.15, according to Monday's pre-market trade. One of the upside drivers of Alex Karp's firm has been buying by ARK, Cathie Woods' investment house. Nevertheless, the Denver-based company is vulnerable to the ebb and flow between value and growth stocks, an ongoing change in the market mood.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds losses below 1.0500 ahead of US data

EUR/USD remains on the back foot below 1.0500 in the European session on Tuesday. A negative shift in risk sentiment revives the haven demand for the US Dollar, while the mixed sentiment data from Germany hurts the Euro, weighing down on the pair. Focus shifts to top-tier US data.

GBP/USD recovers toward 1.2700 after UK jobs data

GBP/USD recovers toward 1.2700 in the European morning on Tuesday. The data from the UK showed that the ILO Unemployment Rate held steady at 4.3% in the three months to October, while the annual wage inflation climbed to 5.2%, helping Pound Sterling hold its ground.

Gold price remains confined in a range ahead of the crucial Fed decision on Wednesday

Gold price struggles to gain any meaningful traction and remains confined in a narrow range. Expectations for a less dovish Fed and elevated US bond yields cap the non-yielding XAU/USD. Geopolitical risks lend support to the safe-haven precious metal ahead of the FOMC meeting.

Ripple reveals official launch for RLUSD, XRP eyes new all-time high at $4.75

Ripple confirmed in a press release on Monday that its RLUSD stablecoin will officially launch on Tuesday across exchanges, including MoonPay, Uphold, CoinMENA, Bitso and ArchaxEx. Bullish sentiments surrounding the launch could help XRP overcome the $2.58 and $2.92 resistance levels.

Will the Fed cut interest rates again and why is the dot plot important Premium

The Fed is expected to cut interest rates on Wednesday for the third consecutive meeting. Every time the Fed decides on rates, it is a crucial event as it directly affects families and businesses in the United States. Moreover, the Fed’s last meeting of the year will also be important because it will provide the outlook for what it expects to do in 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.