- PLTR fell by 4.77% on Monday alongside a broader market sell off.

- Palantir stock recovers on Tuesday and is up 2% from the open.

- Palantir may be in danger of losing one of its lucrative partnerships.

Update: Palantir stock is recovering some ground on Tuesday as a global stock market recovery is underway. At the time of writing the stock is up 2% just from the opening bell. The stock still has a long way to go to recover from recent losses. Palantir has suffered more than most as it is a very high growth stock and so affected by higher bond yields.

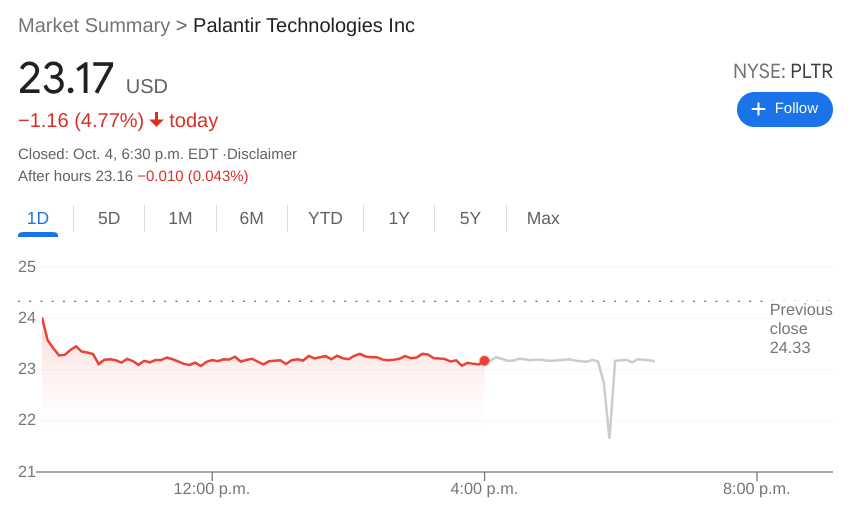

NYSE:PLTR investors woke up to a sea of red to start the week as the broader technology sectors sold off in reaction to the 10-year treasury bond yield rising once again. On Monday, shares of PLTR fell by 4.77% and closed the tumultuous trading session at $23.17. Palantir has hit some rough waters as of late as the stock has now lost over 14.0% in the past week and 13.0% during the past month. The NASDAQ was the big loser on Monday as the tech-heavy exchange dipped for the sixth time in the past seven sessions, while the Dow Jones shed a further 323 basis points and the S&P 500 dropped by 1.3%.

Stay up to speed with hot stocks' news!

Some good news for the data analytics company as Palantir reported it has signed back on for another round of cloud-based data support for the NIH and NCATS. Both health-related agencies are continuing their collaboration with Palantir in the field of COVID-19 research and analysis. Palantir was first awarded the contract in April of 2020 at the start of the project, and it seems as though the U.S. government is intending on the company to see the project through to the finish.

PLTR stock forecast

Now for some bad news for Palantir investors that broke late last week. The company is in danger of losing one of its most lucrative and infamous contracts with ICE or the U.S. Immigrations and Customs Enforcement. This was one of the first contracts that brought Palantir to the mainstream attention with many people against the way its platform was being used. Now, it seems that ICE is preparing to replace Palantir with its own in-house system.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.