- PLTR shares rise 2% straight on opening on Wednesday.

- ARK Invest still buying and PLTR invests in Lilium IPO.

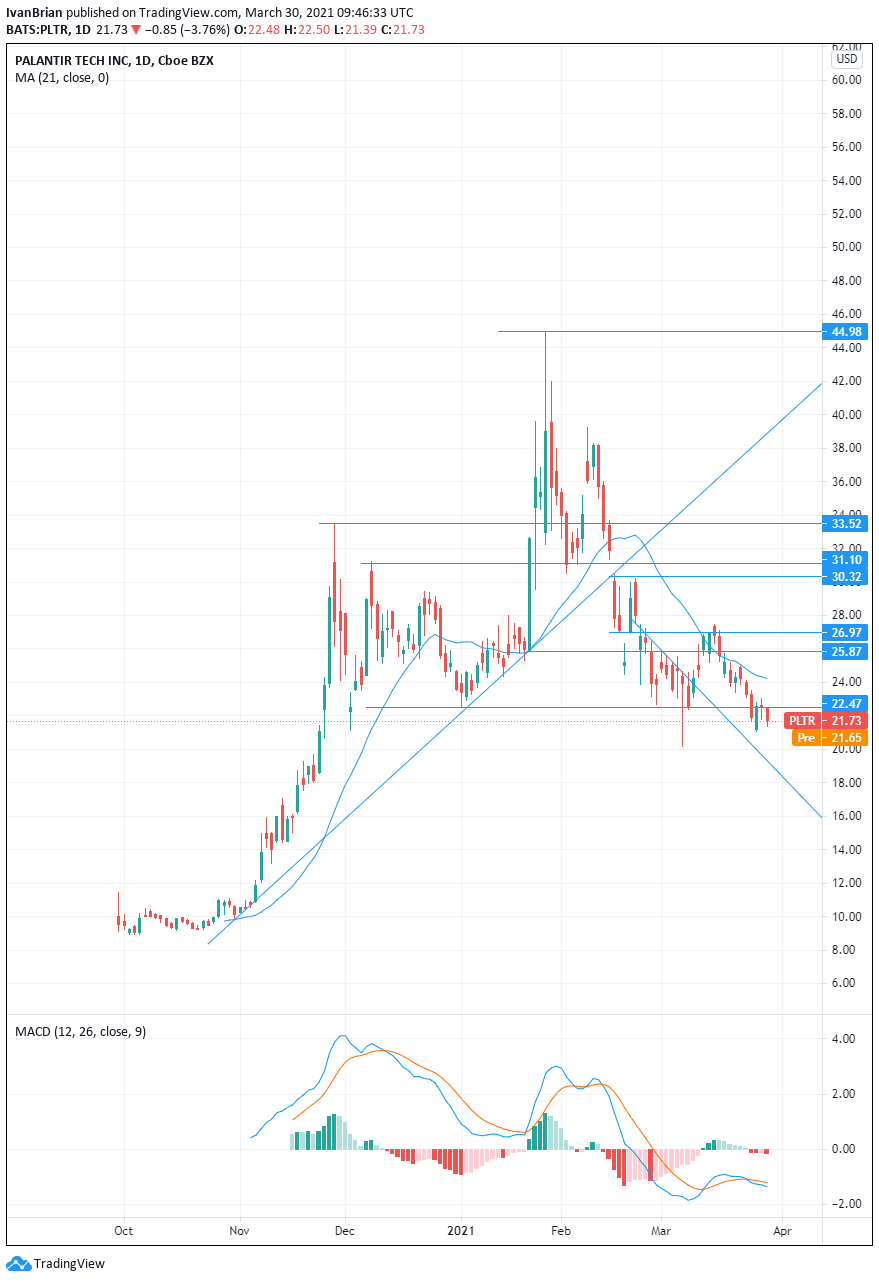

- Palantir chart support at $20.18, look out below!

Update April 1: Palantir Technologies Inc (NYSE: PLTR) is experiencing some calm after storming higher on Wednesday and ahead of the long weekend. Shares of the secretive data analytics company are down some 0.39% to $23.20, holding onto most of its recent gains. It is essential to note that markets are still digesting President Joe Biden's massive spending and tax program.

Palantir (PLTR) shares just cannot hold any gains of late with the stock suffering another fall on Monday. Admittedly, Monday was a tough day for a lot of tech stocks with nervousness spreading across the sector following news of the Archego debacle. Archego had positions in so-called TMT stocks (tech, media and telecoms).

Palantir ended Monday down nearly 4% at $21.73.

Palantir Technologies launched on the stock market at the end of September 2020 at a price of $7.25 a share. The firm was co-founded by legendary Silicon Valley investor Peter Thiel. PLTR is a data mining and analytics technology company. It helps companies integrate and analyse their various diverse data sets to help make sense of complicated data.

Palantir streamlines decision-making based on data analysis. The company helps with search functions and is heavily involved in the security industry. PLTR has links to law enforcement agencies such as the FBI, CIA, police and Department of Defense.

PLTR price prediction

Palantir shares have had a pretty decent correction from retail, fizz-induced highs back in January. Back then PLTR traded up to $45 as the r/WallStreetBets forum on Reddit and other social media posts backed the company.

Since then, however, shares have lost 50% of their value to trade at under $22 now. So why the sudden loss of value?

Well, the price had been pushed too far in the first place on the back of the overly bullish retail sentiment. This was the case with a lot of stocks in January as the GameStop effect spread. It should be noted that back in November 2020, so only five months ago, Palantir shares were trading close to $10.

Palantir also released results that showed a surprising net loss. Analysts had expected EPS of $0.02, while Palantir reported EPS of $0.06. but the GAAP EPS number actually was a loss of $0.08. Revenue did beat expectations and PLTR unveiled an impressive outlook with Q1 growth expected to be 45% and YoY growth of 30%.

Post results, the shares dropped, but Goldman Sachs gave the shares some succor by issuing a strongly bullish note emphasising the strong predicated growth rate.

Insiders have been selling Palantir as they had been locked up post results. This looks to be stopping or at least slowing, and ARK Invest has been buying large blocks of stock.

Palantir technical analysis

The background has to be taken into context though when making any investment. Tech stocks have been suffering due to rising yields, and Palantir cannot avoid this. At current levels, the stock is a more attractive proposition with prices near $20. This is the bottom of the range since December, ignoring the break out in January. A break of $20 brings $12 support as the next possibility, so any purchases at the $20 level should use a stop around $18 to protect against such a move. Any bullish move will lead to resistance at $26.97 and then $30.32.

Overall, given the strong growth rates, government client list and recent new contracts, a long position at current levels appears to offer slightly more risk-reward.

Longer-term traders need to take the overall market sentiment into consideration and continued focus on PLTR fundamentals, growth rates, new customer announcements, etc. This is a high growth stock with a high P/E above 100. These stocks are generally the ones to suffer most if the overall market sentiment turns negative.

Previous updates

Update April 1: Palantir Technologies (NYSE: PLTR) has risen by 5.67% on Wednesday to close at $23.29. Shares of the somewhat secretive data analytics company jumped in response to developments in the UK. The National Health Service (NHS) defended its contract with Palantir and rejected claims made by campaigners at Open Democracy. While the NHS vowed to be more transparent, Open Democracy dropped its lawsuit, providing relief for Alex Karp's company. Thursday's premarket trading is pointing to stability as investors await the Easter holiday.

Update 2 March 31: Palantir shares finally catch some bids on Wednesday. PLTR shares are up 2% just after the open on Wednesday. Shares in Palantir have struggled for positive momentum of late. This despite ARK Invest buying more shares and Palantir taking an investment in German start up Lilium which is going public via SPAC. The last trade is $22.65, a gain of nearly 3% now.

Update: PLTR shares just cannot catch a break, with losses continuing on Tuesday straight at the bell. Palantir shares are sitting at $21 dollar dangerously near key support at $20.18, the low from March 5. A break of this level would bring $17.06 into view. On Tuesday it was announced that Lilium is to IPO via a reverse merger with SPAC QELL. Palantir is to take a stake in Lilium. QELL shares are up 2% at the time of writing. See more.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.