PLTR Stock Forecast: Palantir shares retreats after leaping on ARK buying, Lilium IPO, UK legal relief

- PLTR shares rise 2% straight on opening on Wednesday.

- ARK Invest still buying and PLTR invests in Lilium IPO.

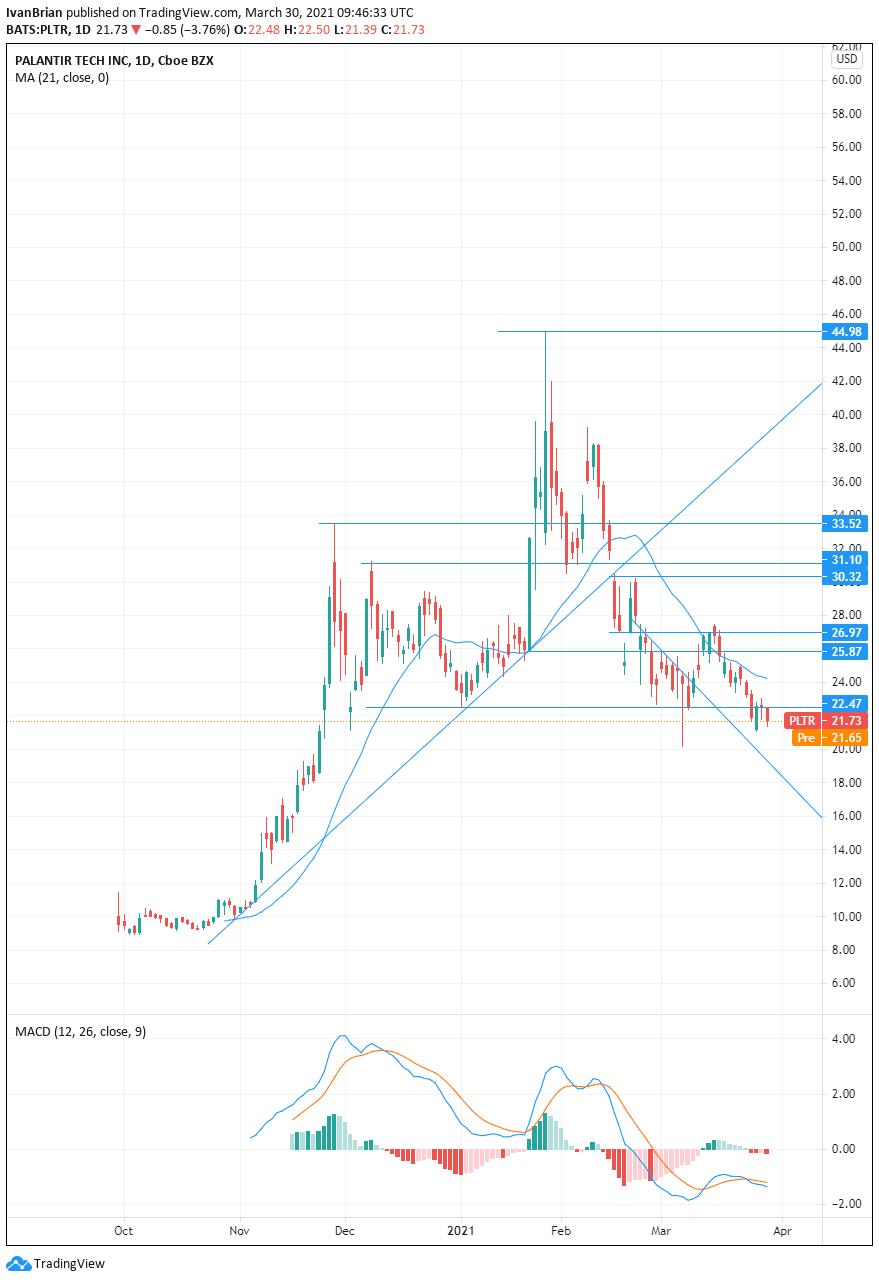

- Palantir chart support at $20.18, look out below!

Update April 1: After surging on Wednesday, investors are taking some profits off the table. Palantir Technologies (NYSE: PLTR) is changing hands at $23.20 at the time of writing, a minor retreat from the highs recorded earlier. The slide comes despite an increase in broader stock markets and seems like a natural correction. See the reasons for its rise below.

Palantir (PLTR) shares just cannot hold any gains of late with the stock suffering another fall on Monday. Admittedly, Monday was a tough day for a lot of tech stocks with nervousness spreading across the sector following news of the Archegos debacle. Archegos was a family investment office that had positions in so-called TMT stocks (tech, media and telecoms).

Palantir ended Monday down nearly 4% at $21.73.

German air shuttle startup Lilium has just filed for a US IPO via a SPAC deal with Qell Acquisition Corp (QELL). Palantir will take a stake in Lilium.

Stay up to speed with hot stocks' news!

Palantir Technologies launched on the stock market at the end of September 2020 at a price of $7.25 a share. The firm was co-founded by legendary Silicon Valley investor Peter Thiel. PLTR is a data mining and analytics technology company. It helps companies integrate and analyse their various diverse data sets to help make sense of complicated data.

Palantir streamlines decision-making based on data analysis. The company helps with search functions and is heavily involved in the security industry. PLTR has links to law enforcement agencies such as the FBI, CIA, police and Department of Defense.

Who is Lilium merging with?

Palantir has taken a stake in German air shuttle company Lilium via a private placement, according to Reuters. Lilium is scheduled to go public in the US via a SPAC deal. The deal is to be via a reverse merger with Qell Acquisition Corp (QELL) in a deal valuing the business at $3.3 billion.

Lilium uses battery-powered aircraft that can take off and land vertically, eliminating the need for runway space and increasing the flexibility of use.

"In Qell, we have found a partner who shares our ambition for sustainable mobility and brings tremendous experience in running mobility and hardware businesses," Daniel Wiegand, CEO and co-founder of Lilium, said in a statement.

Lilium has a five-seater prototype aircraft and also now plans for a seven-seater airplane. The seven-seater will be the mainstay of the business and the first to go into production. Lilium has received certification CR1AO1 from the EU Aviation Safety Agency in 2020.

Qell stock news

Qell Acquisition Corp (QELL) is a SPAC started by Barry Engle. Barry Engle was a former president of General Motors North America. Qell shares are trading at $10.50 in Tuesday's pre-market, up from Monday's close at $9.92.

The new combined company, post-merger, will have Barry Engle on its board along with Tom Enders, former CEO of Airbus.

Previous updates

Update, April 1: Palantir Technologies Inc (NYSE: PLTR) has shot up by 5.67% on Wednesday amid several positive developments. Apart from the buying from ARK and the Lilium IPO moves, investors were relieved to hear that a legal threat in the UK is now off the table. Campaigners at Open Democracy seem to have settled for a promise for more transparency from the National Health Service (NHS), regarding further contracts from Palantir. However, activists demanding to know more about how Palantir handles sensitive patient data dropped their lawsuit, allowing some calm. PLTR's ties with the CIA were under scrutiny.

Update 2 March 31: Palantir shares finally catch some bids on Wednesday. PLTR shares are up 2% just after the open on Wednesday. Shares in Palantir have struggled for positive momentum of late. This despite ARK Invest buying more shares and Palantir taking an investment in German start up Lilium which is going public via SPAC. The last trade is $22.65, a gain of nearly 3% now.

Update March 31: Palantir Technologies Inc (NYSE: PLTR) has ended Tuesday's session at $22.04, up some 1.43%. Shares of the secretive data analytics firm have been on a recovery path, edging higher as tech stocks are looking for a direction. President Joe Biden is set to unveil a multi-trillion infrastructure spending program later in the day. It is essential to note that markets will likely be jittery on the last day of the quarter, as money managers adjust their portfolios.

Update March 30: PLTR shares just cannot catch a break, with losses continuing on Tuesday straight at the bell. Palantir shares are sitting at $21 dollar dangerously near key support at $20.18, the low from March 5. A break of this level would bring $17.06 into view. On Tuesday it was announced that Lilium is to IPO via a reverse merger with SPAC QELL. Palantir is to take a stake in Lilium. QELL shares are up 2% at the time of writing.

Reuters inadvertently issued the story on German aviation startup Lilium ahead of its official publication time, the story has now been widely covered.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.