PLTR News: Palantir Technologies pulls back as markets take a breather following recent rally

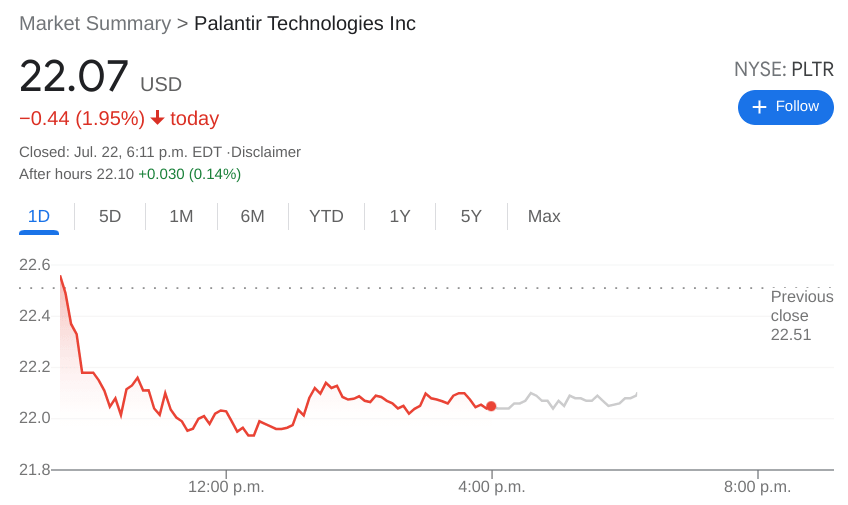

- NYSE:PLTR dipped by 2.00% on Thursday ending its recent three day winning streak.

- Palantir unveils a video in which it works with the Ferrari racing team.

- Palantir is set to present at the CNBC Auto Digital Solutions Expo.

NYSE:PLTR saw its three day winning streak snapped on Thursday, as the broader markets paused after its recent rally. Shares of Palantir fell by 2.00% to close Thursday’s trading session at $22.07. The 17 million shares that traded hands was the lowest the stock has seen in months, especially compared to the recent daily trading average of 52 million shares. The markets had a choppy session on Thursday, following an unexpected rise in the weekly jobless rates, although it was more or less brushed off by analysts as an anomaly.

Stay up to speed with hot stocks' news!

Earlier this week Palantir released footage of how its Foundry platform is helping the Ferrari F1 racing team analyze its own race data which influences its in-race decisions. The platform allows Ferrari to access over 1.5 trillion data points which include things like lap times and vehicle speed. The data analysis allows Ferrari to make split second decisions mid-race, and provides them with an edge over its competition.

PLTR stock forecast

Palantir is also set to present at the CNBC Auto Digital Solutions Expo, and it was revealed that one of their presentations will be about supply chain logistics for automakers. Palantir will be discussing how various automakers around the world use the Foundry Platform as a connected supply chain, and already has panthers like French automotive supply company Faurecia in its portfolio. Palantir also invested in vehicle data startup WeJo, which is a relationship that is looking to further the connected vehicle data industry.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet