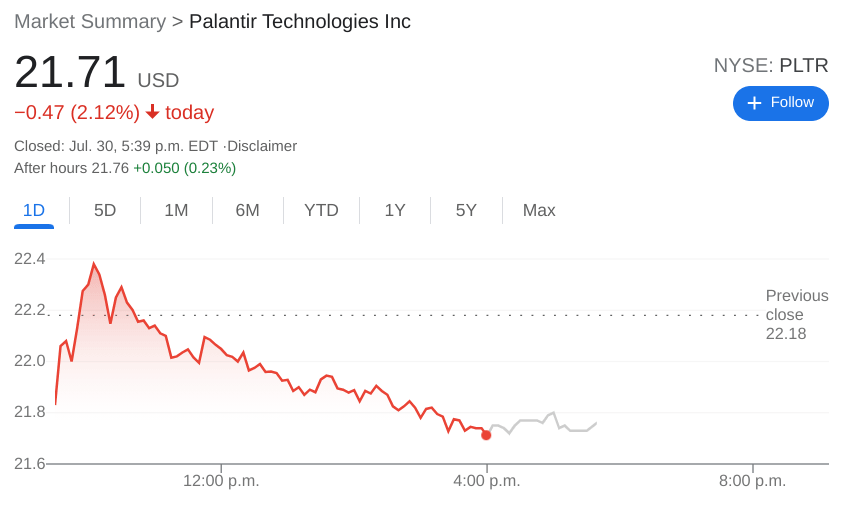

PLTR News: Palantir Technologies falls as the stock sheds 12% during July

- NYSE:PLTR declined to close the week as the stock fell by 2.12%.

- Palantir’s involvement in the UK government has its share of critics.

- Lilium is set to merge with its SPAC in the third quarter of 2021.

NYSE:PLTR closed out the month of July in the red, as the popular data analytics company declined by a total of 12% during the month. On Friday, shares of Palantir fell by 2.12% to close the trading session at $21.71. The markets were dragged down by the eCommerce giant Amazon (NASDAQ:AMZN) which tumbled 7.6% as the company missed revenue estimates for the second quarter. All three major indices closed the day in the red, although the S&P 500 managed to eke out its sixth straight positive month. Palantir was not able to hold its 8 day exponential moving average, and sees a declining RSI, which is generally an indication that the general trend is still bearish.

Stay up to speed with hot stocks' news!

Palantir is still working on its reputation in the court of public opinion, and it’s recent contracts with the UK government have not done much to improve this. NHS employees have openly criticized Palantir’s Foundry platform which allegedly impedes their ability to access certain datasets. After being awarded nearly £100 million over the years, UK citizens have spoken out against the company, causing the government to re-evaluate further contract extensions.

PLTR stock forecast

One of Palantir’s recent SPAC PIPE investments is Lilium, is a vertical take off, or eVTOL company based out of Germany. The company is merging with Qell Acquisiiton Corp (NASDAQ:QELL) and announced it would be completing the merger at some time in the third quarter of 2021. Palantir is an early investor in Lilium, alongside Chinese tech conglomerate Tencent, and Lilium has already been approved to begin using Palantir’s Foundry platform for its data analytics.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet