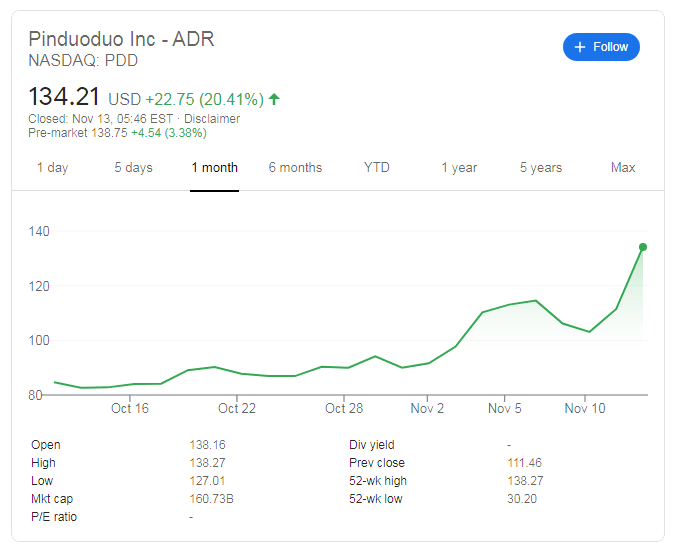

Pinduoduo Inc ADR (PDD Stock) rally set to extend amid impressive earnings growth

- NASDAQ: PDD is set to extend its gains on Friday after surging by over 20% on Thursday.

- Pinduoduo Inc has beat revenue estimates and surprised with a profit.

- The interactive e-commerce platform may also be benefiting from Alibaba's Singles' Day sales.

Several of China's tech behemoths are well-known worldwide – yet those are still not giants have more potential to rise. Pinduoduo Inc is an e-commerce giant based in Shanghai, which offers a more interactive marketplace.

The firm – founded only in 2015 by Colin Huang Zheng – has a unique model, which facilitates users to create buying clubs based on family members and friends. Group purchases offer savings and also create peer pressure on others to consume on the interactive platform.

Pinduoduo reported encouraging earnings figures for the third quarter. Average monthly users jumped by 50% to 643.4 million, reflecting increase in inactivity. Despite China's emergence from the coronavirus crisis, online shopping remains robust. Revenue leaped by 89% to $2.09 billion, exceeding analysts' estimates of $1.86 billion.

CEO Lei Chen said "This quarter we continued to invest in user engagement, which resulted in the strong growth of MAUs and active buyers,"

PDD Stock Forecast

The company's reports coincided with "Singles' Day" – a shopping festivity that was invented by Alibaba, a major rival. Expenditure tends to rise on November 11 due to the event – and impacts other firms, not only the one that founded it. That may explain part of the recent increase.

NASDAQ: PDD soared by over 20% to close at $134.21 on Thursday. It is already worth more than four times the 52-week low of $30.20 and is on course to hit new highs. Friday's premarket trading is pointing to another rise of over 3% to $138.71.

Support awaits at $103.90, which was a low point ahead of the earnings report.

What you need to know about the dollar in the post-vaccine announcement world

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.