- Donald Trump pauses his "reciprocal" tariffs for 90 days.

- Dow Jones pharma stocks reverse higher on tariff pause.

- Trump raises his tariffs on Chinese goods to 125%.

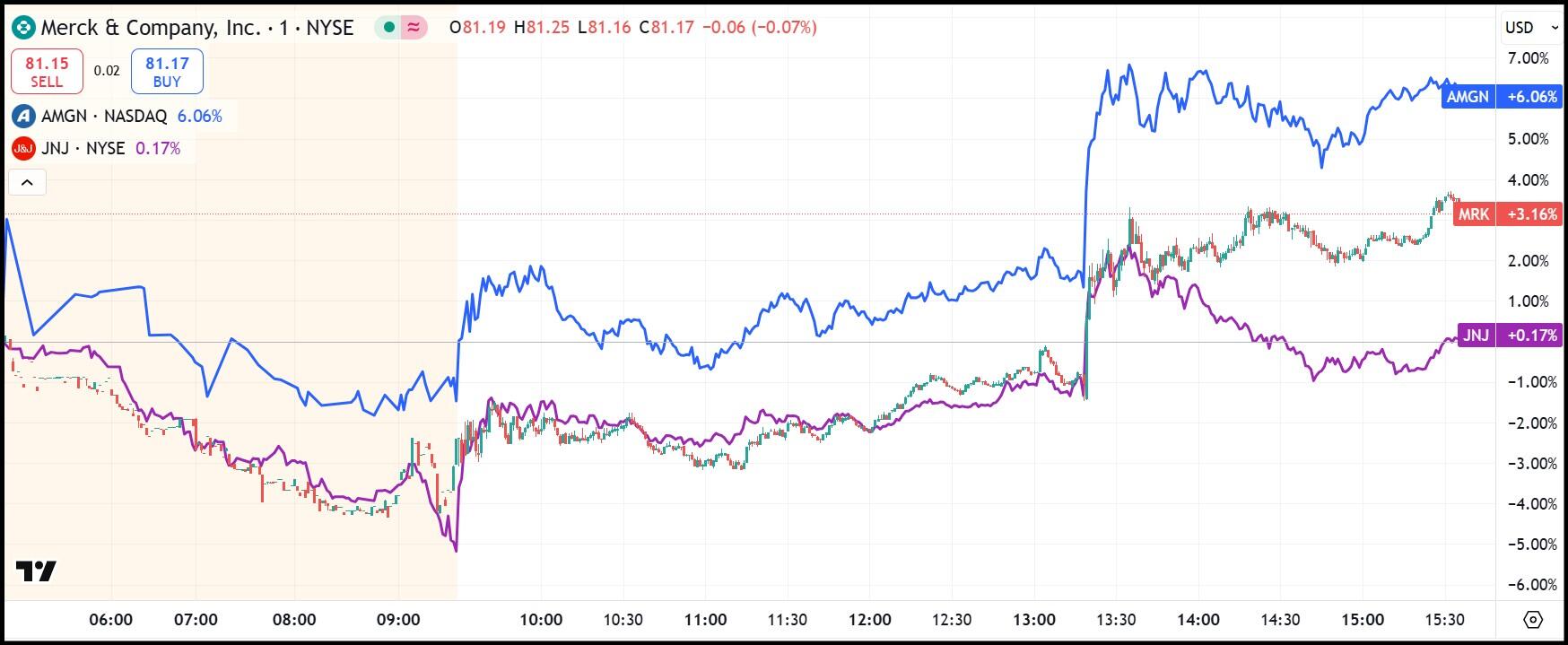

- MRK, AMGN and JNJ all recover from intraday lows.

US President Donald Trump’s sudden, shocking 90-day pause on his so-called “reciprocal” tariffs (they were not reciprocal) has helped pharmaceutical stocks recover on Wednesday.

After trading significantly lower Wednesday morning on expectations that Trump would ditch the pharma exemption for tariffs, pharma stocks exploded higher as the exemption is no longer necessary now that the higher bilateral tariffs have been delayed.

Trump instead has signaled that he will stick with the across-the-board 10% base tariff for the time being. This sent the NASDAQ Composite skyrocketing 10% and the Dow Jones Industrial Average (DJIA) up 7%.

Pharma stocks recover: Amgen, Johnson & Johnson, Merck

US President Donald Trump told a private gathering of Republican House members late Tuesday evening that he was considering removing the tariff exemption for the pharmaceutical industry. According to The Wall Street Journal, Trump said, “We’re going to tariff our pharmaceuticals, and once we do that they’re going to come rushing back into our country because we’re the big market.”

This reporting abruptly hurt pharma stocks at first, including Dow Jones Industrial Average (DJIA) components Johnson & Johnson (JNJ), Merck (MRK) and Amgen (AMGN).

However, Trump’s post on his Truth Social platform on Wednesday afternoon changed all that. Suddenly, investors have 90 days to plan around the future tariffs and some might expect that the much higher tariffs never see the light of day.

After trading down 2% to 3% early Wednesday, all three reversed course following the tariff delay. Only JNJ stock is still trading in the red at the time of writing, albeit well off the session lows. JNJ traded down to $141.50 earlier before reversing to above $148.00.

When Trump announced 25% tariffs on South Korea, 24% tariffs on Japan, 17% tariffs on Israel, 20% tariffs on the European Union, and 26% tariffs on India last week, pharma stocks breathed a sigh of relief that they were exempt alongside semiconductors and a few other industries. But Trump’s interest in removing their exemption might mean that when the 90-day pause is up in July, the companies will be hit with tariffs when trying to bring their foreign-produced products into the US market.

Trump also raised his tariffs from 104% on Chinese goods to 125%, effective immediately, in response to China's raising its own tariffs on US goods to 84%.

Trump would prefer if the pharmaceutical industry reshored production. However, many US pharma companies house their production units in low-tax nations like Switzerland and Ireland so that they can report their US sales in the foreign locales and skirt US corporate taxes. Reshoring production due to tariffs would then be less attractive since they would have to pay these US tax rates on their US profits.

Bernstein analyst Courtney Breen estimates that Trump’s paused tariff rates would add about $46 billion in import costs alone for the industry.

MRK (candlesticks), AMGN (blue), JNJ (purple) stock performance for April 9, 2025 (1-minute candles)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold sits at fresh record high above $3,300 as US Dollar wilts on trade woes

Gold price remains within a striking distance of new record highs above $3,300 on Wednesday. Persistent worries about the escalating US-China trade war and US recession fears revive brroad US Dollar downtrend, boosting the traditional safe-haven Gold ahead of Fed Powell's speech.

EUR/USD holds firm above 1.1350 amid renewed US Dollar weakness

EUR/USD is storngly bid above 1.1350 in European trading on Wednesday. The pair draws support from a fresh round of selling in the US Dollar amid persistent fears over US-China trade war and a lack of progress on EU-US trade talks. US consumer data and Powell speech are in focus.

GBP/USD hangs close to fresh 2025-high above 1.3250 after UK CPI data

GBP/USD holds its six-day winning streak and stays close to its highest level since October above 1.3250 in the European session on Wednesday. The data from the UK showed that the annual CPI inflation softened to 2.6% in March from 2.8% in February but had little impact on Pound Sterling.

BoC set to leave interest rate unchanged amid rising inflation and US trade war

All the attention is expected to be on the Bank of Canada this Wednesday as market experts widely anticipate the central bank to maintain its interest rate at 2.75%, halting seven consecutive interest rate cuts.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.