Pan American Silver Corporation (ticker: PAAS) is engaged in the production and sale of silver, gold, zinc, lead and copper. It also has other related activities, including exploration, extraction, processing, refining and reclamation. The company operates 10 mining sites, including La Colorada, Dolores, Huaron, Morococha, San Vicente, Manantial Espejo, Shahuindo, La Arena, Timmins and Escobal. In the charts below, we look at the technical outlook of the company.

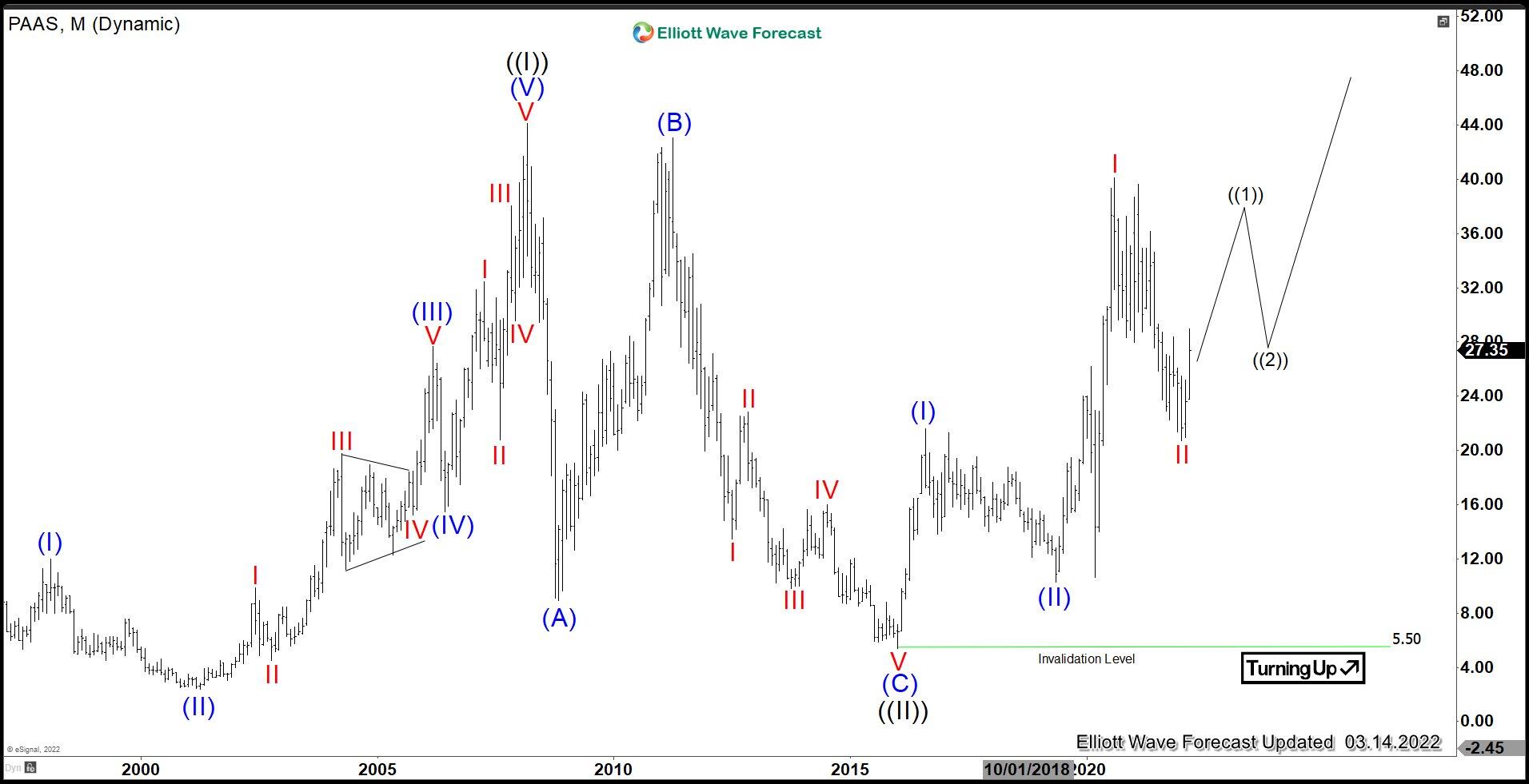

PAAS monthly Elliott Wave chart

The monthly chart of PAAS above shows the rally from January 2016 low is in progress as a nesting 5 waves impulse. Up from January 2016 low, wave (I) ended at 21.59 and pullback in wave (II) ended at 10.26. The stock then extends higher in wave (III) which subdivides in another 5 waves in lesser degree. Up from wave (II), wave I ended at 40.11 and dips in wave II ended at 20.73. Expect the stock to continue higher in the months to come in wave III of (III).

PAAS daily Elliott Wave chart

Daily Elliott Wave chart above shows the stock ended correction to cycle from May 2019 low in wave II pullback at 20.75. Structure of wave II unfolded in a double three Elliott Wave structure where wave ((W)) ended at 28.33, rally in wave ((X)) ended at 39.62, and wave ((Y)) of II completed at 20.75. While pullback stays above wave II low, expect the stock to extend higher.

PAAS 4 hour Elliott Wave chart

The 4 hour chart of PAAS above shows the rally from January 29, 2022 low is in progress as a 5 waves impulse Elliott Wave structure. Up from wave II, wave 1 ended at 25.98 and pullback in wave 2 ended at 22.43. Stock then extends higher in wave 3 towards 28.95, and pullback in wave 4 ended at 25.56. Expect the stock to extend higher to end wave 5 of (1), then it should pullback in larger degree 3 waves to correct cycle from January 29 low in wave (2) before the rally resumes.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

Gold retreats after setting new record-high above $3,000

Gold corrects lower and trades below $3,000 after setting a new record-high above this level earlier in the day. Rising US Treasury bond yields and the upbeat market mood seems to be limiting XAU/USD's upside for the time being.

EUR/USD advances toward 1.0900 on renewed USD weakness

EUR/USD gains traction and rises toward 1.0900 in the European session on Friday. The improving risk mood makes it difficult for the US Dollar (USD) to find demand and helps the pair push higher. Markets await US consumer sentiment data for March.

GBP/USD rebounds from session lows, stays near 1.2950

GBP/USD recovers toward 1.2950 after falling below 1.2920 with the immediate reaction to the disappointing macroeconomic data releases from the UK in the early European session. The renewed USD weakness amid a positive shift seen in risk sentiment helps the pair hold its ground.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Brexit revisited: Why closer UK-EU ties won’t lessen Britain’s squeezed public finances

The UK government desperately needs higher economic growth as it grapples with spending cuts and potential tax rises later this year. A reset of UK-EU economic ties would help, and sweeping changes are becoming more likely.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.