Pan American Silver Corp. (PAAS) is a Canadian mining company headquartered in Vancouver, British Columbia. It focuses on the exploration, development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines across the Americas. Below is the long term Elliott Wave technical update of the stock.

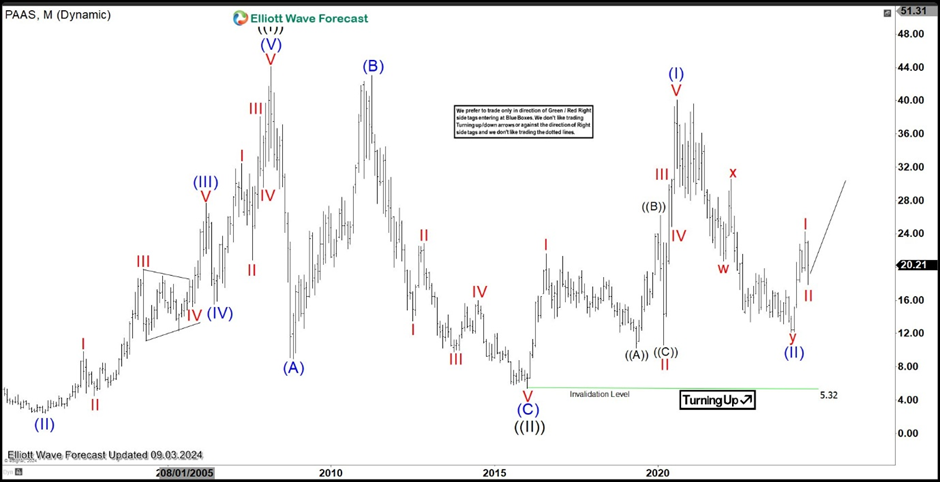

PAAS monthly Elliott Wave chart

Monthly Elliott Wave chart of Pan American Silver (PAAS) above shows the stock has ended Grand Super Cycle wave ((II) correction at 5.32. It has since turned higher in wave ((III)) as an impulse. Up from wave ((II)), wave (I) ended at 40.11 and pullback in wave (II) ended at 12.16. As far as pivot at 5.32 low stays intact, expect the stock to extend higher.

Daily Elliott Wave Chart of PAAS above shows that the stock ended wave (II) at 12.18. Up from there, wave (III) is in progress as a 5 waves impulse. Up from wave (II), wave I ended at 24.27 and pullback in wave II is proposed complete at 17.86. The stock still needs to break above wave I peak at 24.27 to rule out a double correction. As far as pivot at 12.18 low stays intact, expect pullback to find buyers in 3, 7, or 11 swing for further upside.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

EUR/USD stays in daily range near 1.1050 after US data

EUR/USD trades in a narrow channel at around 1.1050 in the second half of the day on Tuesday. The data from the US showed that the ISM Manufacturing PMI recovered slightly to 47.2 in August, failing to provide an additional boost to the USD.

GBP/USD closes in on 1.3100 following US PMI data

GBP/USD stays under bearish pressure on Tuesday and closes in on 1.3100. Although the US Dollar struggles to benefit from the ISM Manufacturing PMI data for August, the risk-averse market atmosphere doesn't allow the pair to stage a rebound.

Gold extends correction, trades below $2,480

Gold continues to stretch lower on Tuesday and trades at its weakest level in nearly two weeks below $2,480. Although the US Treasury bond yields decline toward 3.8%, XAU/USD struggles to find a foothold amid persistent US Dollar resilience.

Crypto Today: Bitcoin, Ethereum lag, XRP back above $0.56 with major announcements in Korea, Japan

Bitcoin trades at $59,000, Ethereum hovers around $2,500, both note a slight decline in price on Tuesday. XRP tests $0.57 resistance, adds more than 0.5% to its value on the day.

Week ahead: US labour data and the BoC rate announcement in focus

With US Federal Reserve Chair Jerome Powell’s recent speech at the Jackson Hole Symposium confirming that it is time to begin easing policy as well as underlining the importance of the jobs market, this week’s jobs data may help determine how the Fed approaches its easing cycle.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.