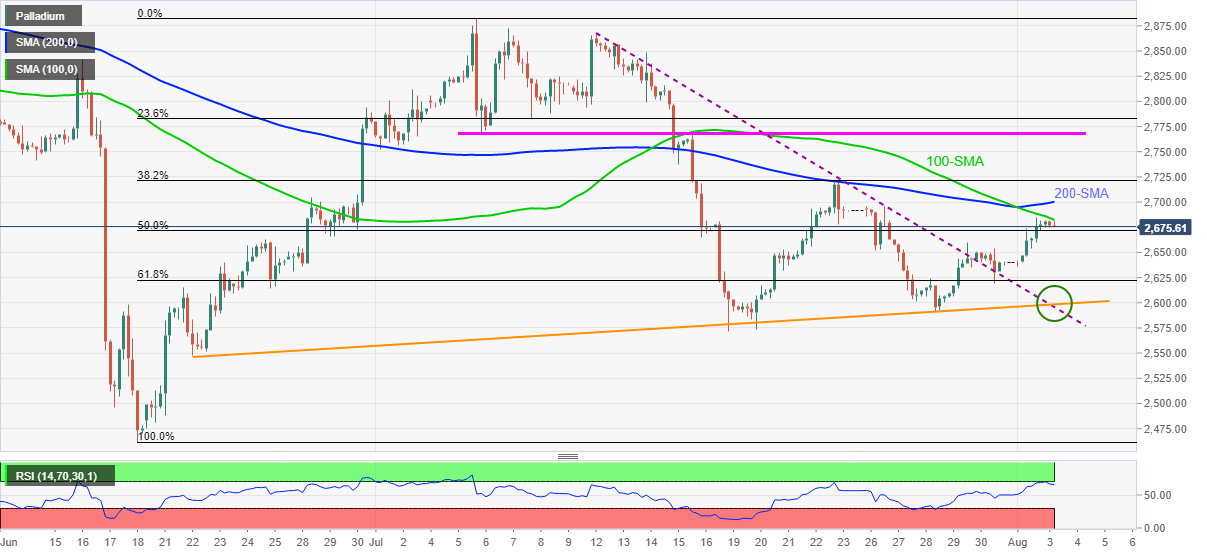

Palladium Price Analysis: Key SMAs probe XPD/USD bulls below $2,700

- Palladium stays mildly bid, up for the second day after crossing three-week-old falling trend line.

- 100 and 200-DMA guard immediate upside amid overbought RSI conditions.

- 61.8% Fibonacci retracement offers immediate support, late July tops add to the upside filters.

Palladium (XPD/USD) stays mildly bid around $2,680, up 0.10% intraday, as European traders brace for Tuesday’s bell. In doing so, the precious metal rises for the second consecutive day after crossing a downward sloping trend line from July 12.

However, the key Simple Moving Averages (SMAs) restrict the quote’s immediate upside amid overbought RSI conditions.

Hence, a pullback towards 50% Fibonacci retracement level of June 18 to July 06 upside, near $2,670, becomes imminent. However, any further weakness will be challenged by a 61.8% Fibonacci retracement level of $2,622.

If at all the XPD/USD prices remain weak past $2,622, a convergence of the previous resistance line and an ascending support line from late June, near the $2,600 threshold, will be crucial to watch for the bears.

Alternatively, 100-SMA and 200-SMA, respectively around $2,685 and $2,700, guard the quote’s immediate upside ahead of late July’s high near $2,725.

In a case where the palladium buyers remain dominant past $2,725, a horizontal line comprising July 06 low and July 16 high, near $2,770, should be watched closely.

Palladium: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.