Palantir Technologies Stock Price and Forecast: PLTR remains strong despite pullback

- Palantir stock falls nearly 2% on Monday.

- PLTR still strong after the recent earnings report.

- Palantir is winning new customers and booking strong revenue.

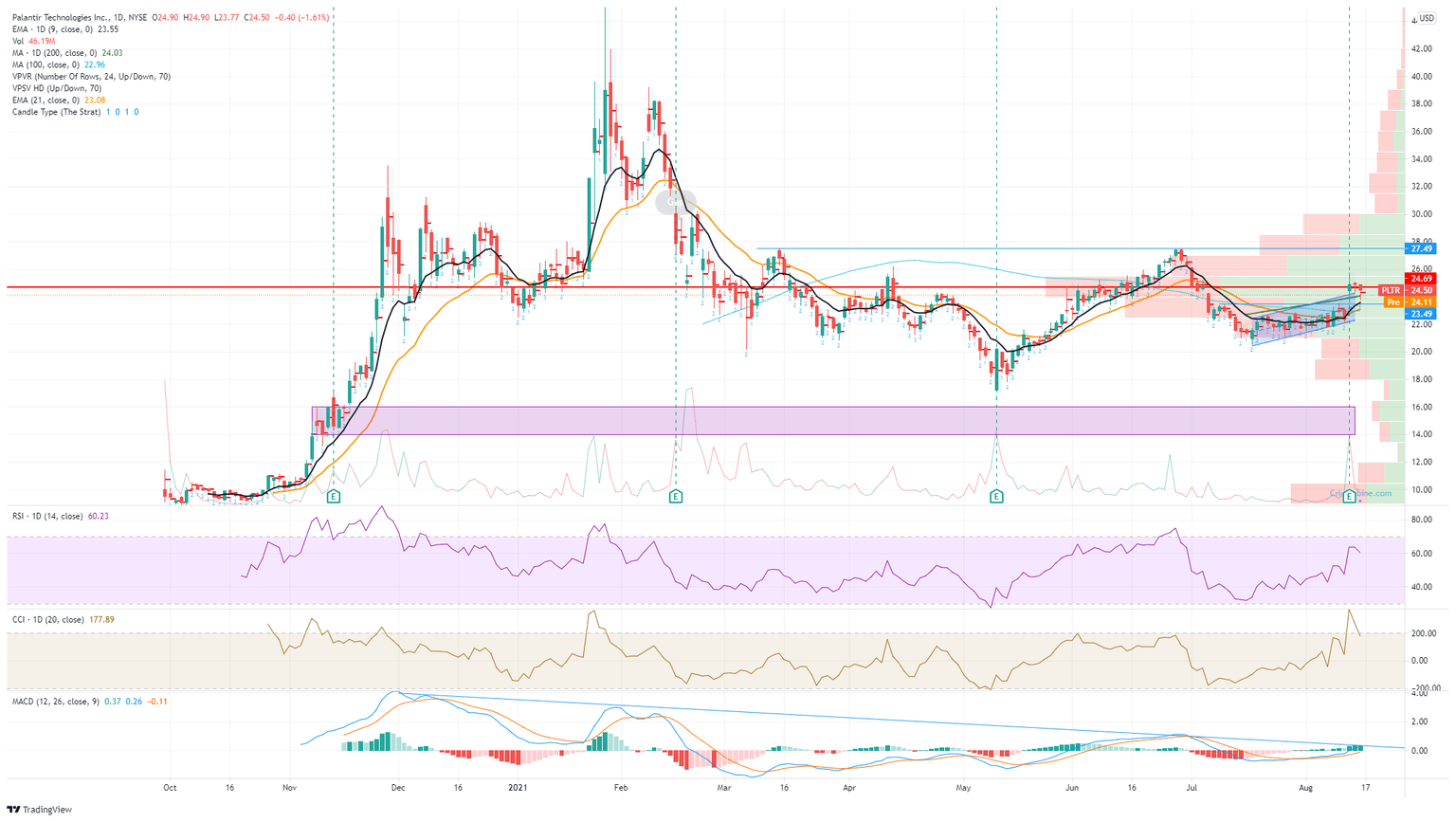

Palantir shares gave up some recent gains on Monday, but the stock still remains strong after last week's very strong earnings numbers. Palantir stock closed lower by 1.6% on Monday to finish at $24.50. We had cautioned on Monday that the explosive move up after results would probably settle down and consolidate as Palantir entered a high volume area. Volume generally means more price acceptance and so more stability in price. This is exactly what happened and no surprise, given the point of control since the company launched on the stock market is at $24.69. The point of control is the price at which there has been the highest amount of volume. Palantir has had some pretty wild swings after having caught the attention of WallStreetBets in the past, but it is a fully-fledged Wall Street favourite now after a series of solid results and a management team full of well-known names..

Now let us just recap those results. They were solid with a beat on EPS and revenue, but it was the outlook that was really the stunning feature. Revenue grew by 50% in the quarter, and then Palantir guided its estimates up for revenue in Q3. The real eye-catcher was the doubling in free cash flow guidance from $150 million to $300 million. Palantir said it had closed 62 new deals worth $1 million or more and added 20 new customers in the quarter. It also said it had booked $900 million in total contract value. Palantir shares rose over 11% on the day of results last week: Thursday, August 12.

Palantir key statistics

| Market Cap | $46.7 billion |

| Enterprise Value | $40.49 billion |

| Price/Earnings (P/E) | 135 |

|

Price/Book | 26 |

| Price/Sales | 36 |

| Gross Margin | 0.7 |

| Net Margin | -1.02 |

| EBITDA | |

| 52 week low | $45 |

| 52 week high | $8.90 |

| Average Wall Street rating and price target |

HOLD $24.61 |

Palantir stock forecast

The results helped Palantir break out of the small trend channel it had been in since July and tracked the stock up to a high volume area around the point of control as mentioned. This is likely to cap further gains, making them slow and steady and marking a period of consolidation. Holding above the 9-day moving average at $23.55 is key as this also marks the high from July and is where PLTR stock exploded through after results. This level really needs to hold for short-term bulls. If it does hold, there should be a gradual rise to test the big resistance at $27.49. This is where things can get interesting. Above $27.49 volume thins out quite dramatically, meaning a break should see a price acceleration with little in the way of resistance from price or volume. This would allow Palantir to finally target filling the gap from back in February, ironically also an earnings release. $31.34 fills the gap.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.